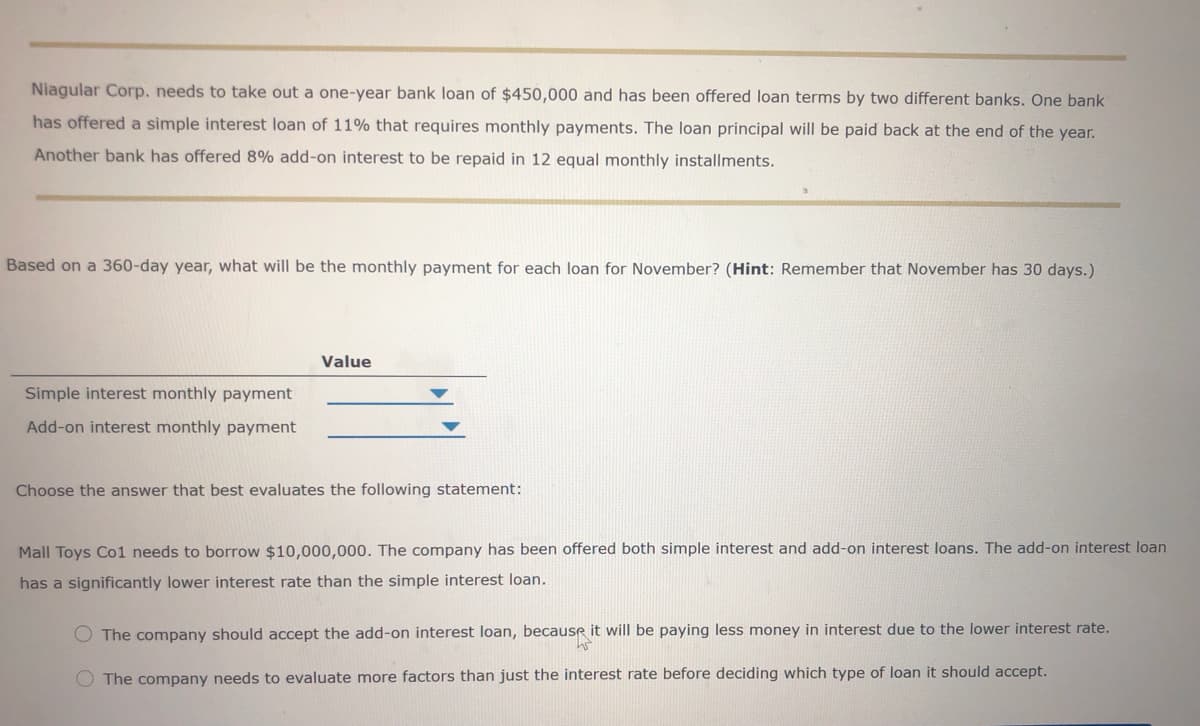

Niagular Corp. needs to take out a one-year bank loan of $450,000 and has been offered loan terms by two different banks. One bank has offered a simple interest loan of 11% that requires monthly payments. The loan principal will be paid back at the end of the year. Another bank has offered 8% add-on interest to be repaid in 12 equal monthly installments. Based on a 360-day year, what will be the monthly payment for each loan for November? (Hint: Remember that November has 30 days.)

Niagular Corp. needs to take out a one-year bank loan of $450,000 and has been offered loan terms by two different banks. One bank has offered a simple interest loan of 11% that requires monthly payments. The loan principal will be paid back at the end of the year. Another bank has offered 8% add-on interest to be repaid in 12 equal monthly installments. Based on a 360-day year, what will be the monthly payment for each loan for November? (Hint: Remember that November has 30 days.)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 3P: Del Hawley, owner of Hawleys Hardware, is negotiating with First City Bank for a 1-year loan of...

Related questions

Concept explainers

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

Question

Transcribed Image Text:Niagular Corp. needs to take out a one-year bank loan of $450,000 and has been offered loan terms by two different banks. One bank

has offered a simple interest loan of 11% that requires monthly payments. The loan principal will be paid back at the end of the year.

Another bank has offered 8% add-on interest to be repaid in 12 equal monthly installments.

Based on a 360-day year, what will be the monthly payment for each loan for November? (Hint: Remember that November has 30 days.)

Value

Simple interest monthly payment

Add-on interest monthly payment

Choose the answer that best evaluates the following statement:

Mall Toys Co1 needs to borrow $10,000,000. The company has been offered both simple interest and add-on interest loans. The add-on interest loan

has a significantly lower interest rate than the simple interest loan.

O The company should accept the add-on interest loan, because it will be paying less money in interest due to the lower interest rate.

O The company needs to evaluate more factors than just the interest rate before deciding which type of loan it should accept.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT