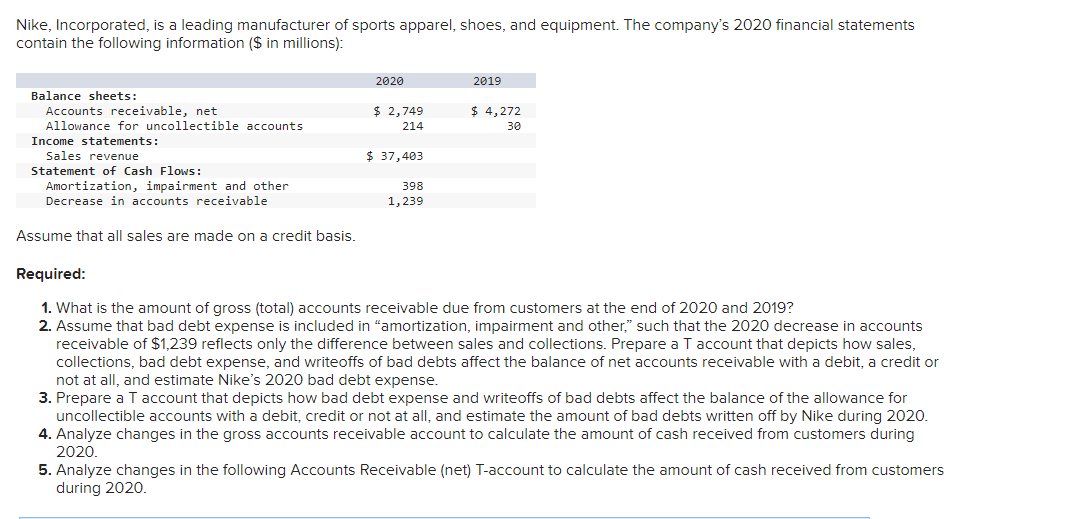

Nike, Incorporated, is a leading manufacturer of sports apparel, shoes, and equipment. The company's 2020 financial statements contain the following information ($ in millions): Balance sheets: Accounts receivable, net Allowance for uncollectible accounts Income statements: Sales revenue Statement of Cash Flows: Amortization, impairment and other Decrease in accounts receivable Assume that all sales are made on credit basis. 2020 $ 2,749 214 $ 37,403 398 1,239 2019 $ 4,272 30 Required: 1. What is the amount of gross (total) accounts receivable due from customers at the end of 2020 and 2019? 2. Assume that bad debt expense is included in "amortization, impairment and other," such that the 2020 decrease in accounts receivable of $1,239 reflects only the difference between sales and collections. Prepare a T account that depicts how sales, collections, bad debt expense, and writeoffs of bad debts affect the balance of net accounts receivable with a debit, a credit or not at all, and estimate Nike's 2020 bad debt expense. 3. Prepare a T account that depicts how bad debt expense and writeoffs of bad debts affect the balance of the allowance for uncollectible accounts with a debit, credit or not at all, and estimate the amount of bad debts written off by Nike during 2020.

Nike, Incorporated, is a leading manufacturer of sports apparel, shoes, and equipment. The company's 2020 financial statements contain the following information ($ in millions): Balance sheets: Accounts receivable, net Allowance for uncollectible accounts Income statements: Sales revenue Statement of Cash Flows: Amortization, impairment and other Decrease in accounts receivable Assume that all sales are made on credit basis. 2020 $ 2,749 214 $ 37,403 398 1,239 2019 $ 4,272 30 Required: 1. What is the amount of gross (total) accounts receivable due from customers at the end of 2020 and 2019? 2. Assume that bad debt expense is included in "amortization, impairment and other," such that the 2020 decrease in accounts receivable of $1,239 reflects only the difference between sales and collections. Prepare a T account that depicts how sales, collections, bad debt expense, and writeoffs of bad debts affect the balance of net accounts receivable with a debit, a credit or not at all, and estimate Nike's 2020 bad debt expense. 3. Prepare a T account that depicts how bad debt expense and writeoffs of bad debts affect the balance of the allowance for uncollectible accounts with a debit, credit or not at all, and estimate the amount of bad debts written off by Nike during 2020.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 11C

Related questions

Question

Transcribed Image Text:Nike, Incorporated, is a leading manufacturer of sports apparel, shoes, and equipment. The company's 2020 financial statements

contain the following information ($ in millions):

Balance sheets:

Accounts receivable, net

Allowance for uncollectible accounts

Income statements:

Sales revenue

Statement of Cash Flows:

Amortization, impairment and other

Decrease in accounts receivable

Assume that all sales are made on a credit basis.

2020

$ 2,749

214

$ 37,403

398

1,239

2019

$ 4,272

30

Required:

1. What is the amount of gross (total) accounts receivable due from customers at the end of 2020 and 2019?

2. Assume that bad debt expense is included in "amortization, impairment and other," such that the 2020 decrease in accounts

receivable of $1,239 reflects only the difference between sales and collections. Prepare a T account that depicts how sales,

collections, bad debt expense, and writeoffs of bad debts affect the balance of net accounts receivable with a debit, a credit or

not at all, and estimate Nike's 2020 bad debt expense.

3. Prepare a T account that depicts how bad debt expense and writeoffs of bad debts affect the balance of the allowance for

uncollectible accounts with a debit, credit or not at all, and estimate the amount of bad debts written off by Nike during 2020.

4. Analyze changes in the gross accounts receivable account to calculate the amount of cash received from customers during

2020.

5. Analyze changes in the following Accounts Receivable (net) T-account to calculate the amount of cash received from customers

during 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub