nnah Company's sales are forecasted to increase from P1,000 in 20X4 to P2.C 20x5. Here is the December 31, 20X4 statement of financial position. Statement of Financial Position (in thousands of pesos) Assets Liabilities and Stockholders' Equiny sh. ccounts receivable.. . P 100 Accounts payable.. 200 Notes payable. ......... IS .*.......

nnah Company's sales are forecasted to increase from P1,000 in 20X4 to P2.C 20x5. Here is the December 31, 20X4 statement of financial position. Statement of Financial Position (in thousands of pesos) Assets Liabilities and Stockholders' Equiny sh. ccounts receivable.. . P 100 Accounts payable.. 200 Notes payable. ......... IS .*.......

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Current Liabilities And Payroll

Section: Chapter Questions

Problem 10.23EX

Related questions

Question

Help me answer this thank you

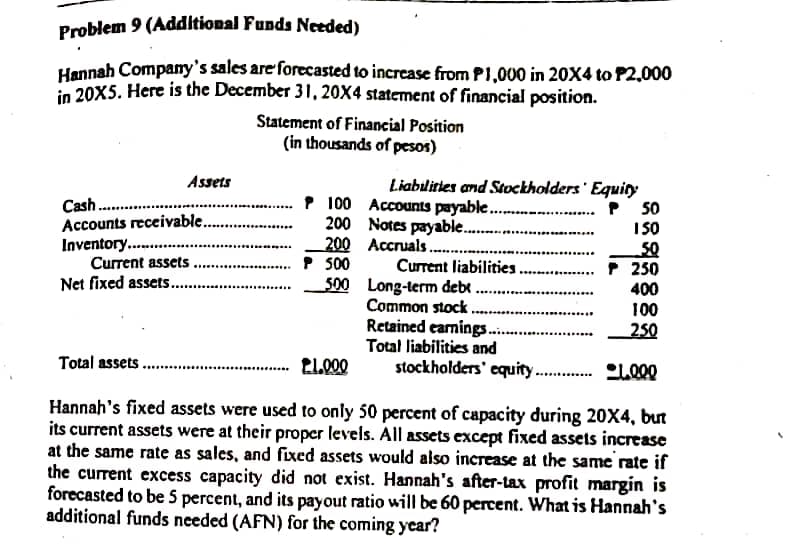

Transcribed Image Text:Problem 9 (Additional Funds Needed)

Hannah Company's sales are forecasted to increase from P1,000 in 20X4 to P2.,000

in 20X5. Here is the December 31, 20X4 statement of financial position.

Statement of Financial Position

(in thousands of pesos)

Assets

Liabulities and Stockholders Equiry

Cash.

Accounts receivable.

Inventory. .

Current assets.

Net fixed assets.

P 100 Accounts payable .

200 Notes payable.

200 Accruals..

P 500

P 50

I SO

Current liabilities

500 Long-term debe

Common stock .

Retained earnings.

Total liabilities and

stockholders' equity.

P 250

400

100

250

Total assets .

2L000

Hannah's fixed assets were used to only 50 percent of capacity during 20X4, bưt

its current assets were at their proper levels. All assets except fixed assets increase

at the same rate as sales, and fixed assets would also increase at the same rate if

the current excess capacity did not exist. Hannah's after-tax profit margin is

forecasted to be 5 percent, and its payout ratio will be 60 percent. What is Hannah's

additional funds needed (AFN) for the coming ycar?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning