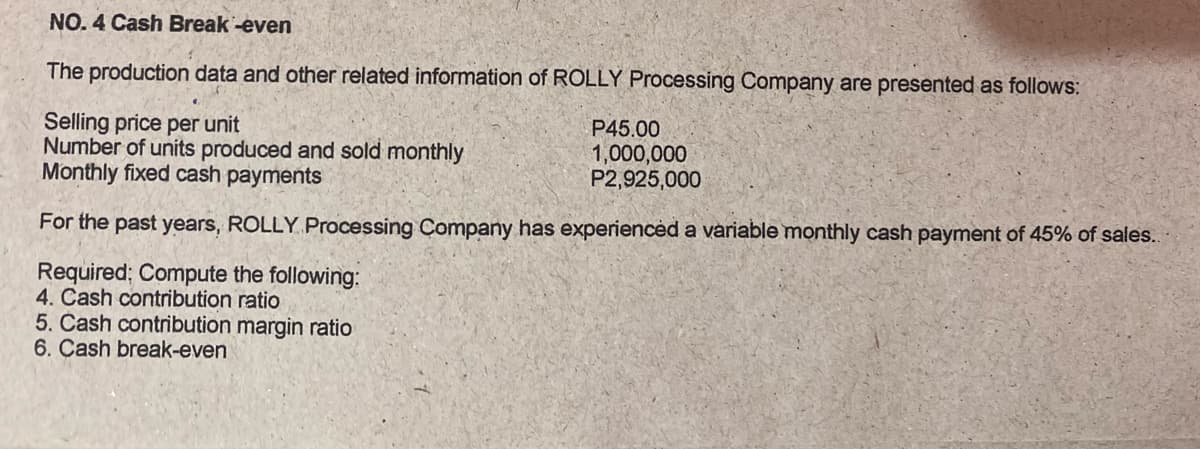

NO. 4 Cash Break-even The production data and other related information of ROLLY Processing Company are presented as follows: Selling price per unit Number of units produced and sold monthly Monthly fixed cash payments P45.00 1,000,000 P2,925,000 For the past years, ROLLY Processing Company has experiencėd a variable monthly cash payment of 45% of sales. Required; Compute the following: 4. Cash contribution ratio 5. Cash contribution margin ratio 6. Cash break-even

NO. 4 Cash Break-even The production data and other related information of ROLLY Processing Company are presented as follows: Selling price per unit Number of units produced and sold monthly Monthly fixed cash payments P45.00 1,000,000 P2,925,000 For the past years, ROLLY Processing Company has experiencėd a variable monthly cash payment of 45% of sales. Required; Compute the following: 4. Cash contribution ratio 5. Cash contribution margin ratio 6. Cash break-even

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter6: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 11E

Related questions

Question

Please answer the first picture, the second picture is the example.

Transcribed Image Text:NO. 4 Cash Break -even

The production data and other related information of ROLLY Processing Company are presented as follows:

Selling price per unit

Number of units produced and sold monthly

Monthly fixed cash payments

P45.00

1,000,000

P2,925,000

For the past years, ROLLY Processing Company has experiencėd a variable monthly cash payment of 45% of sales.

Required; Compute the following:

4. Cash contribution ratio

5. Čash contribution margin ratio

6. Çash break-even

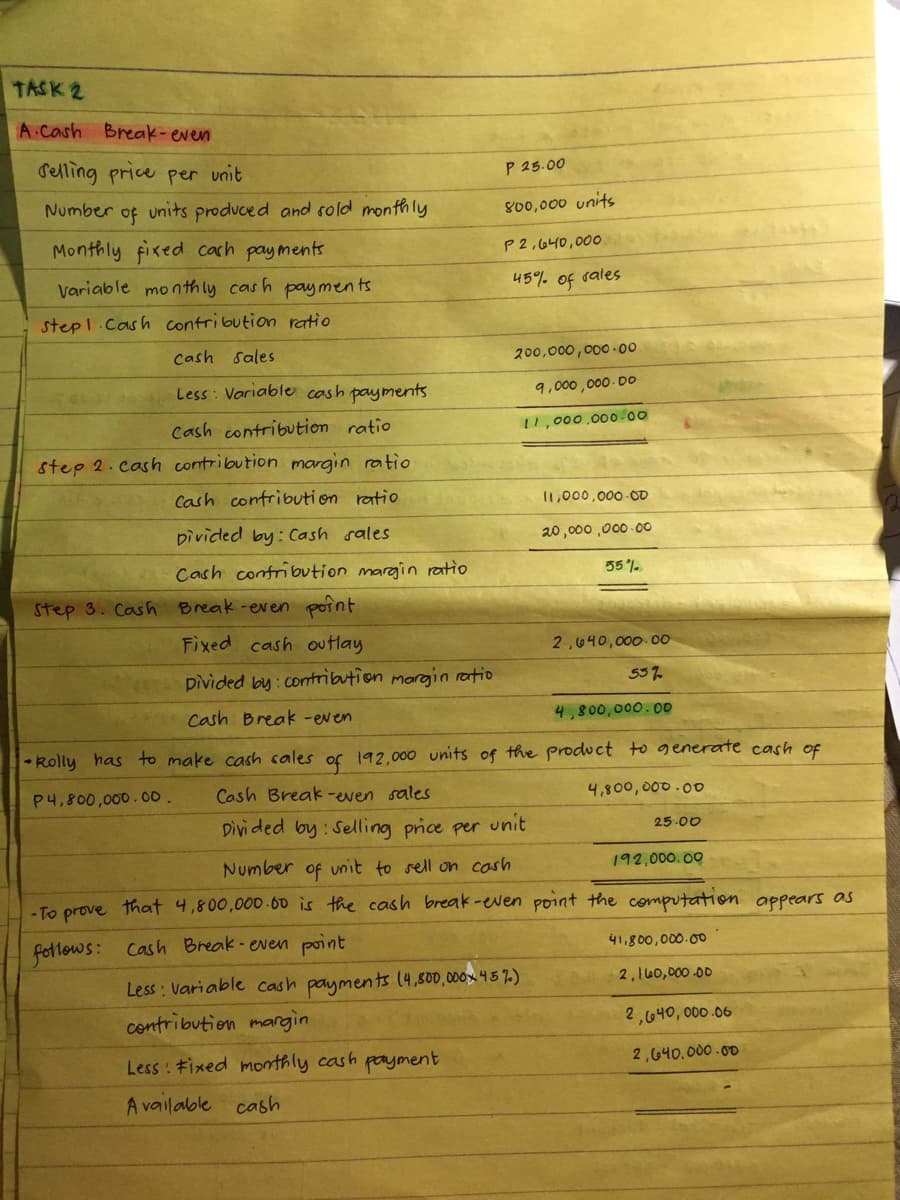

Transcribed Image Text:TASK 2

A.Cash Break-even

Selling price per unit

P 25.00

Number

of

units produced and sold monthly

800,000 units

Monthly fixed cach payments

P2,640,000

Variable month ly cash payments

45% of rales

step I.Cash contribution ratio

Cash sales

200,000, 000 -00

Less : Variable cash payments

9,000,000 - DO

Cash contribution ratio

11,000,00.00

step 2. cash contribution margin ratio

Cash confributi on ratio

11,000,000-00

pìvided by: Cash sales

20,000 ,000 00

Cash contribution margin ratio

55 %-

Step 3. Cash Break-even point

Fixed cash outlay

2,640,000 00

pivided by: contribution margin rantio

557

Cash Break -even

4,800,000.00

- Rolly has to make cash cales of 192,000 units of the product to generate cash of

P4,800,000. 00.

Cash Break-even sales

4,800,000.00

Divi ded by: Selling price per unit

25.00

Number of unit to sell on cash

192,000. 00

- To prove that 4,800,000.60 is the cash break-even point the computation appears as

fotlows: Cash Break-even point

41,800,000.00

Less : Variable cash payments l(4,800,000x 457)

contribution margin

2, 140,000 -00

2,640, 000.06

Less : #ixed monthly cash poyment

2,640.000.00

A vailable cash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning