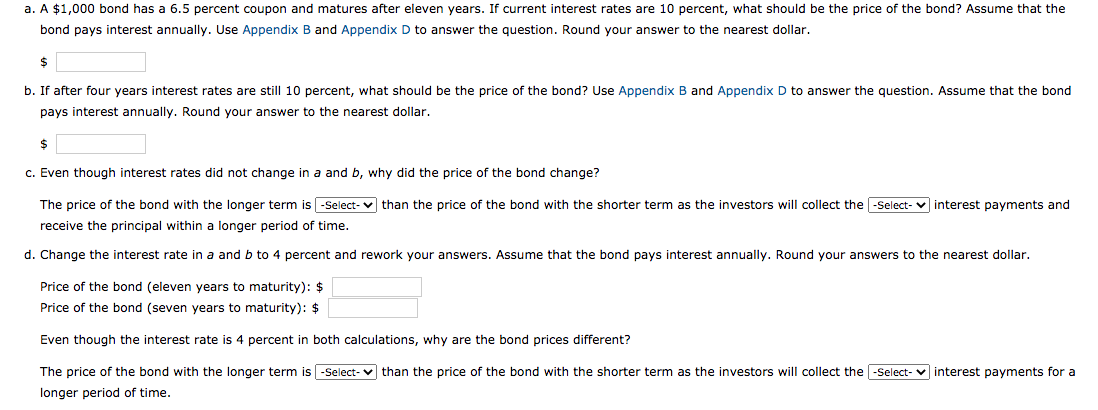

no0 Dond nas a 6.5 percent even years rcurrent interest rates are 10 price bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar. b. If after four years interest rates are still 10 percent, what should be the price of the bond? Use Appendix B and Appendix D to answer the question. Assume that the bond pays interest annually. Round your answer to the nearest dollar. c. Even though interest rates did not change in a and b, why did the price of the bond change? The price of the bond with the longer term is -Select- v than the price of the bond with the shorter term as the investors will collect the -Select- v interest payments and receive the principal within a longer period of time. d. Change the interest rate in a and b to 4 percent and rework your answers. Assume that the bond pays interest annually. Round your answers to the nearest dollar. Price of the bond (eleven years to maturity): $ Price of the bond (seven years to maturity): $ Even though the interest rate is 4 percent in both calculations, why are the bond prices different? The price of the bond with the longer term is -Select- v than the price of the bond with the shorter term as the investors will collect the -Select- interest payments for a longer period of time.

no0 Dond nas a 6.5 percent even years rcurrent interest rates are 10 price bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar. b. If after four years interest rates are still 10 percent, what should be the price of the bond? Use Appendix B and Appendix D to answer the question. Assume that the bond pays interest annually. Round your answer to the nearest dollar. c. Even though interest rates did not change in a and b, why did the price of the bond change? The price of the bond with the longer term is -Select- v than the price of the bond with the shorter term as the investors will collect the -Select- v interest payments and receive the principal within a longer period of time. d. Change the interest rate in a and b to 4 percent and rework your answers. Assume that the bond pays interest annually. Round your answers to the nearest dollar. Price of the bond (eleven years to maturity): $ Price of the bond (seven years to maturity): $ Even though the interest rate is 4 percent in both calculations, why are the bond prices different? The price of the bond with the longer term is -Select- v than the price of the bond with the shorter term as the investors will collect the -Select- interest payments for a longer period of time.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.2E

Related questions

Question

Transcribed Image Text:no0 Dond nas a 6.5 percent

even years

rcurrent interest rates are 10

price

bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar.

b. If after four years interest rates are still 10 percent, what should be the price of the bond? Use Appendix B and Appendix D to answer the question. Assume that the bond

pays interest annually. Round your answer to the nearest dollar.

c. Even though interest rates did not change in a and b, why did the price of the bond change?

The price of the bond with the longer term is -Select- v than the price of the bond with the shorter term as the investors will collect the -Select- v interest payments and

receive the principal within a longer period of time.

d. Change the interest rate in a and b to 4 percent and rework your answers. Assume that the bond pays interest annually. Round your answers to the nearest dollar.

Price of the bond (eleven years to maturity): $

Price of the bond (seven years to maturity): $

Even though the interest rate is 4 percent in both calculations, why are the bond prices different?

The price of the bond with the longer term is -Select- v than the price of the bond with the shorter term as the investors will collect the -Select-

interest payments for a

longer period of time.

Expert Solution

Step 1

Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for you. To get remaining sub-part solved please repost the complete question and mention the sub-parts to be solved.

Step 2

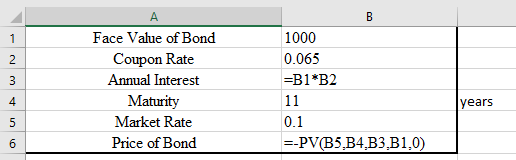

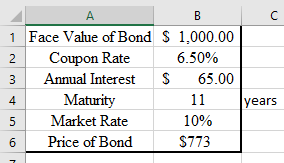

a.

Calculate value of Bond as below:

Resultant table:

Hence, price is $773.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning