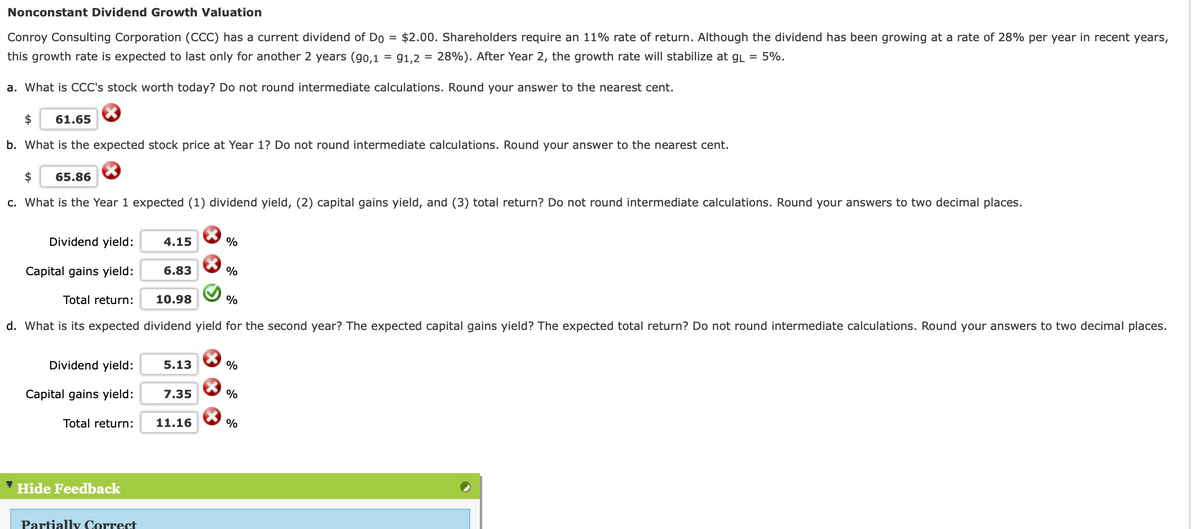

Nonconstant Dividend Growth Valuation Conroy Consulting Corporation (CCC) has a current dividend of Do = $2.00. Shareholders require an 11% rate of return. Although the dividend has been growing at a rate of 28% per year in recent years, this growth rate is expected to last only for another 2 years (g0,1 = 91,2 = 28%). After Year 2, the growth rate will stabilize at gL = 5%. a. What is CCC's stock worth today? Do not round intermediate calculations. Round your answer to the nearest cent. 61.65 b. What is the expected stock price at Year 1? Do not round intermediate calculations. Round your answer to the nearest cent. 24 65.86 c. What is the Year 1 expected (1) dividend yield, (2) capital gains yield, and (3) total return? Do not round intermediate calculations. Round your answers to two decimal places. Dividend yield: 4.15 Capital gains yield: 6.83 Total return: 10.98 d. What is its expected dividend yield for the second year? The expected capital gains yield? The expected total return? Do not round intermediate calculations. Round your answers to two decimal places. Dividend yield: 5.13 % Capital gains yield: 7.35 % Total return: 11.16 %

Nonconstant Dividend Growth Valuation Conroy Consulting Corporation (CCC) has a current dividend of Do = $2.00. Shareholders require an 11% rate of return. Although the dividend has been growing at a rate of 28% per year in recent years, this growth rate is expected to last only for another 2 years (g0,1 = 91,2 = 28%). After Year 2, the growth rate will stabilize at gL = 5%. a. What is CCC's stock worth today? Do not round intermediate calculations. Round your answer to the nearest cent. 61.65 b. What is the expected stock price at Year 1? Do not round intermediate calculations. Round your answer to the nearest cent. 24 65.86 c. What is the Year 1 expected (1) dividend yield, (2) capital gains yield, and (3) total return? Do not round intermediate calculations. Round your answers to two decimal places. Dividend yield: 4.15 Capital gains yield: 6.83 Total return: 10.98 d. What is its expected dividend yield for the second year? The expected capital gains yield? The expected total return? Do not round intermediate calculations. Round your answers to two decimal places. Dividend yield: 5.13 % Capital gains yield: 7.35 % Total return: 11.16 %

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter7: Corporate Valuation And Stock Valuation

Section: Chapter Questions

Problem 24P: Conroy Consulting Corporation (CCC) has a current dividend of D0 = $2.5. Shareholders require a 12%...

Related questions

Question

Transcribed Image Text:Nonconstant Dividend Growth Valuation

Conroy Consulting Corporation (CCC) has a current dividend of Do = $2.00. Shareholders require an 11% rate of return. Although the dividend has been growing at a rate of 28% per year in recent years,

this growth rate is expected to last only for another 2 years (go,1

= g1,2 = 28%). After Year 2, the growth rate will stabilize at gL = 5%.

a. What is CCC's stock worth today? Do not round intermediate calculations. Round your answer to the nearest cent.

$

61.65

b. What is the expected stock price at Year 1? Do not round intermediate calculations. Round your answer to the nearest cent.

$

65.86

c. What is the Year 1 expected (1) dividend yield, (2) capital gains yield, and (3) total return? Do not round intermediate calculations. Round your answers to two decimal places.

Dividend yield:

4.15

Capital gains yield:

6.83

%

Total return:

10.98

%

d. What is its expected dividend yield for the second year? The expected capital gains yield? The expected total return? Do not round intermediate calculations. Round your answers to two decimal places.

Dividend yield:

5.13

%

Capital gains yield:

7.35

%

Total return:

11.16

%

Hide Feedback

Partially Correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning