Note: Take the absolute value of the present value when answering this question. Using the table you just filled out, along with a financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately v (when the interest rate is 8.00%). Based on this, Dmitri should choose option if he seeks to maximize present value. Now assume the interest rate is 9.00%, entered as 9 on your financial calculator. Note: Take the absolute value of the present value when answering this question. Using the table you just filled out, along with your financial calculator, yields a present value for option 2 of approximately v and (when the interest rate is 9.00%). Based on this, Dmitri should choose option a present value for option 3 of approximately if he seeks to maximize present value. Assume the interest rate is 10.00%, entered as 10 on your financial calculator. Note: Take the absolute value of the present value when answering this question.

Note: Take the absolute value of the present value when answering this question. Using the table you just filled out, along with a financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately v (when the interest rate is 8.00%). Based on this, Dmitri should choose option if he seeks to maximize present value. Now assume the interest rate is 9.00%, entered as 9 on your financial calculator. Note: Take the absolute value of the present value when answering this question. Using the table you just filled out, along with your financial calculator, yields a present value for option 2 of approximately v and (when the interest rate is 9.00%). Based on this, Dmitri should choose option a present value for option 3 of approximately if he seeks to maximize present value. Assume the interest rate is 10.00%, entered as 10 on your financial calculator. Note: Take the absolute value of the present value when answering this question.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.20MCE

Related questions

Question

100%

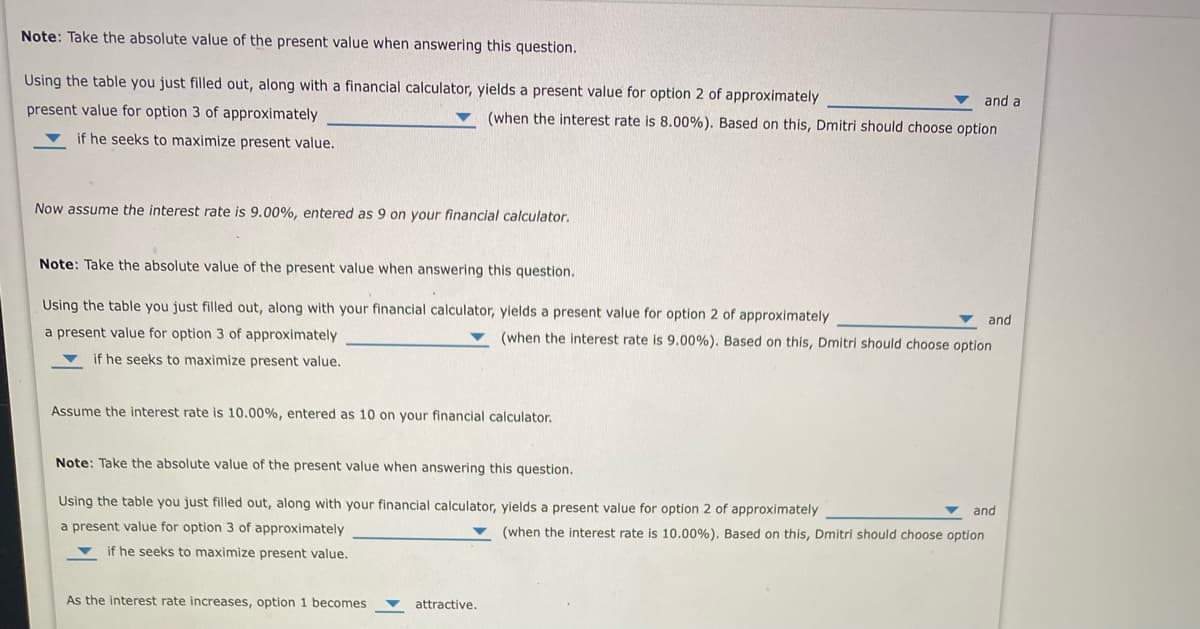

Transcribed Image Text:Note: Take the absolute value of the present value when answering this question.

Using the table you just filled out, along with a financial calculator, yields a present value for option 2 of approximately

and a

present value for option 3 of approximately

(when the interest rate is 8.00%). Based on this, Dmitri should choose option

if he seeks to maximize present value.

Now assume the interest rate is 9.00%, entered as 9 on your financial calculator.

Note: Take the absolute value of the present value when answering this question.

Using the table you just filled out, along with your financial calculator, yields a present value for option 2 of approximately

and

a present value for option 3 of approximately

(when the interest rate is 9.00%). Based on this, Dmitri should choose option

if he seeks to maximize present value.

Assume the interest rate is 10.00%, entered as 10 on your financial calculator.

Note: Take the absolute value of the present value when answering this question.

Using the table you just filled out, along with your financial calculator, yields a present value for option 2 of approximately

and

a present value for option 3 of approximately

(when the interest rate is 10.00%). Based on this, Dmitrí should choose option

v if he seeks to maximize present value.

As the interest rate increases, option 1 becomes

attractive.

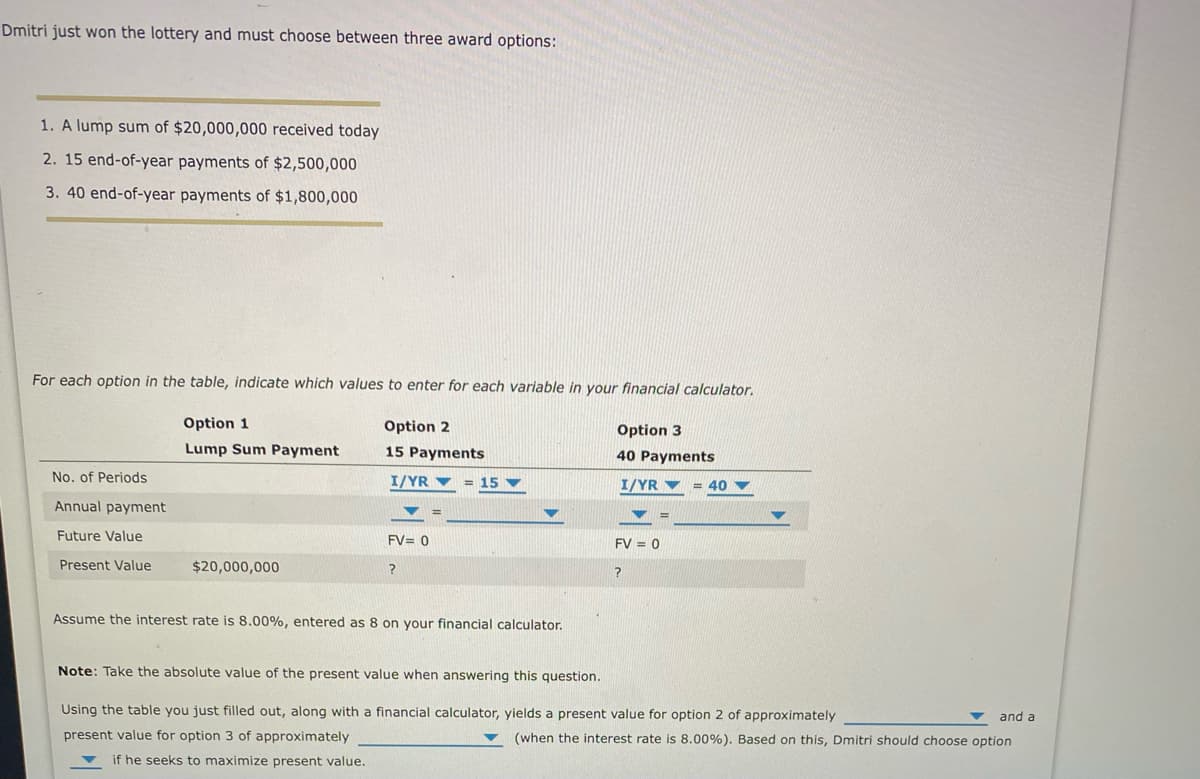

Transcribed Image Text:Dmitri just won the lottery and must choose between three award options:

1. A lump sum of $20,000,000 received today

2. 15 end-of-year payments of $2,500,000

3. 40 end-of-year payments of $1,800,000

For each option in the table, indicate which values to enter for each variable in your financial calculator.

Option 1

Option 2

Option 3

Lump Sum Payment

15 Payments

40 Payments

No. of Periods

I/YR V

= 15 ▼

I/YR V

= 40

Annual payment

%3D

%3D

Future Value

FV= 0

FV = 0

Present Value

$20,000,000

Assume the interest rate is 8.00%, entered as 8 on your financial calculator.

Note: Take the absolute value of the present value when answering this question.

Using the table you just filled out, along with a financial calculator, yields a present value for option 2 of approximately

and a

present value for option 3 of approximately

(when the interest rate is 8.00%). Based on this, Dmitri should choose option

if he seeks to maximize present value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning