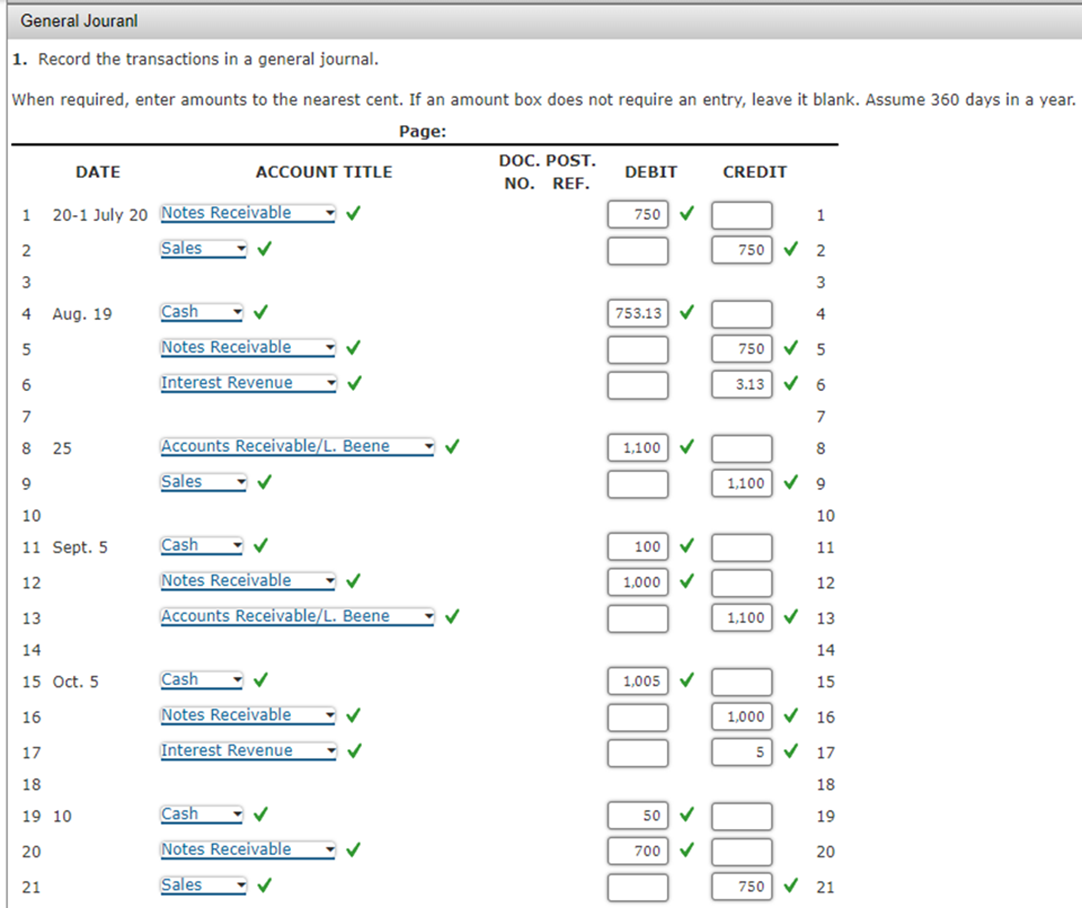

Notes Receivable Entries 1. Record the transactions in a general journal. When required, enter amounts to the nearest cent. If an amount box does not require an entry, leave it blank. Assume 360 days in a year. J. K. Pratt Co. had the following transactions: 20-1 July 20 Received a $750, 30-day, 5% note from J. Akita in payment for sale of merchandise. Aug. 19 J. Akita paid note issued July 20 plus interest. 25 Sold merchandise on account to L. Beene, $1,100. Sept. 5 L. Beene paid $100 and gave a $1,000, 30-day, 6% note to extend time for payment. Oct. 5 L. Beene paid note issued September 5, plus interest. 10 Sold merchandise to R. Harris for $750: $50 plus a $700, 30-day, 6% note. Nov. 9 R. Harris paid $200 plus interest on note issued October 10 and extended the note ($500) for 30 days. Dec. 9 R. Harris paid note extended on November 9, plus interest. 10 Sold merchandise on account to B. Kraus, $1,500. 15 B. Kraus paid $150 on merchandise purchased on account, and gave a $1,350, 30-day, 7% note to extend time for payment. 20-2 Jan. 14 B. Kraus's note of December 15 is dishonored. Feb. 13 Collected B. Kraus’s dishonored note, plus interest at 7% on the maturity value.

Notes Receivable Entries 1. Record the transactions in a general journal. When required, enter amounts to the nearest cent. If an amount box does not require an entry, leave it blank. Assume 360 days in a year. J. K. Pratt Co. had the following transactions: 20-1 July 20 Received a $750, 30-day, 5% note from J. Akita in payment for sale of merchandise. Aug. 19 J. Akita paid note issued July 20 plus interest. 25 Sold merchandise on account to L. Beene, $1,100. Sept. 5 L. Beene paid $100 and gave a $1,000, 30-day, 6% note to extend time for payment. Oct. 5 L. Beene paid note issued September 5, plus interest. 10 Sold merchandise to R. Harris for $750: $50 plus a $700, 30-day, 6% note. Nov. 9 R. Harris paid $200 plus interest on note issued October 10 and extended the note ($500) for 30 days. Dec. 9 R. Harris paid note extended on November 9, plus interest. 10 Sold merchandise on account to B. Kraus, $1,500. 15 B. Kraus paid $150 on merchandise purchased on account, and gave a $1,350, 30-day, 7% note to extend time for payment. 20-2 Jan. 14 B. Kraus's note of December 15 is dishonored. Feb. 13 Collected B. Kraus’s dishonored note, plus interest at 7% on the maturity value.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter16: Financial Statements And Closing Entries For A Corporation

Section: Chapter Questions

Problem 5AP

Related questions

Question

Notes Receivable Entries

1. Record the transactions in a general journal.

When required, enter amounts to the nearest cent. If an amount box does not require an entry, leave it blank. Assume 360 days in a year.

J. K. Pratt Co. had the following transactions:

| 20-1 | |

| July 20 | Received a $750, 30-day, 5% note from J. Akita in payment for sale of merchandise. |

| Aug. 19 | J. Akita paid note issued July 20 plus interest. |

| 25 | Sold merchandise on account to L. Beene, $1,100. |

| Sept. 5 | L. Beene paid $100 and gave a $1,000, 30-day, 6% note to extend time for payment. |

| Oct. 5 | L. Beene paid note issued September 5, plus interest. |

| 10 | Sold merchandise to R. Harris for $750: $50 plus a $700, 30-day, 6% note. |

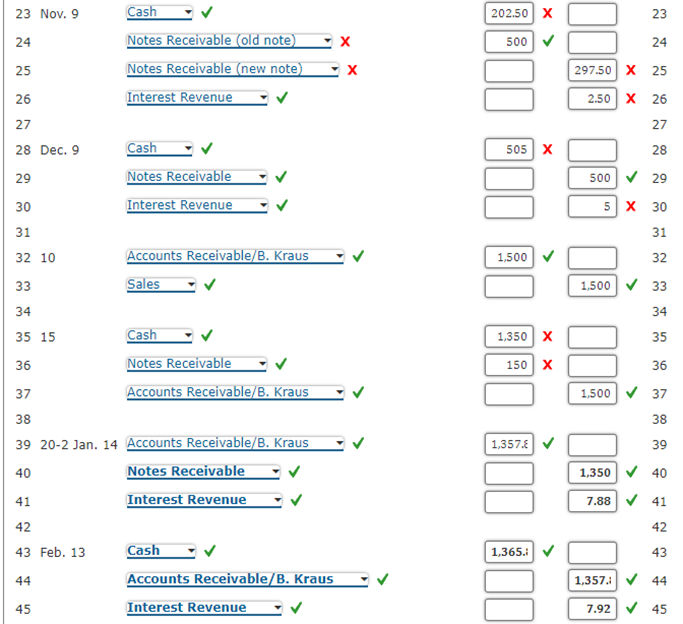

| Nov. 9 | R. Harris paid $200 plus interest on note issued October 10 and extended the note ($500) for 30 days. |

| Dec. 9 | R. Harris paid note extended on November 9, plus interest. |

| 10 | Sold merchandise on account to B. Kraus, $1,500. |

| 15 | B. Kraus paid $150 on merchandise purchased on account, and gave a $1,350, 30-day, 7% note to extend time for payment. |

| 20-2 | |

| Jan. 14 | B. Kraus's note of December 15 is dishonored. |

| Feb. 13 | Collected B. Kraus’s dishonored note, plus interest at 7% on the maturity value. |

Transcribed Image Text:General Jouranl

1. Record the transactions in a general journal.

When required, enter amounts to the nearest cent. If an amount box does not require an entry, leave it blank. Assume 360 days in a year.

Page:

1

2

3

4

5

6

。

7

8 25

20

DATE

21

20-1 July 20 Notes Receivable

Sales

✓

Aug. 19

9

10

11 Sept. 5

12

13

14

15 Oct. 5

16

17

18

19 10

ACCOUNT TITLE

Cash

Notes Receivable

Interest Revenue

Accounts Receivable/L. Beene

Sales

✓

Cash

✓

Notes Receivable

✓

Accounts Receivable/L. Beene

Cash

Notes Receivable

✓

Interest Revenue

Cash

Notes Receivable

Sales

DOC. POST.

NO. REF.

DEBIT

750 ✓

753.13 ✔

00 000 000 000

✓

✓

✓

1,005 ✔

✓

✓

CREDIT

1

750 ✔ 2

3

4

750 ✔ 5

3.136

1,100 9

10

11

12

1,100 ✔ 13

14

15

1,000✔ 16

5 ✓

17

18

19

20

750 21

Transcribed Image Text:23 Nov. 9

24

25

26

27

28 Dec. 9

29

30

31

32 10

Cash

Notes Receivable (old note)

Notes Receivable (new note)

Interest Revenue

41

42

43 Feb. 13

44

45

Cash

Notes Receivable

Interest Revenue

Accounts Receivable/B. Kraus

Sales

33

34

35 15

36

37

38

39 20-2 Jan. 14 Accounts Receivable/B. Kraus

40

Notes Receivable

Cash

Notes Receivable

Accounts Receivable/B. Kraus

Interest Revenue

Cash

Accounts Receivable/B. Kraus

Interest Revenue

X

X

202.50 X

500

505 X

1,500

< x

1,350 X

150 X

1,357.

1,365.:

297.50 X

2.50 X

23

25

26

27

28

29

5 X 30

31

32

1,500✔ 33

34

35

36

1,500 ✓ 37

38

39

1,350 40

7.88 ✔ 41

42

43

1,357.✔✔ 44

7.92 ✔ 45

500✔

24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning