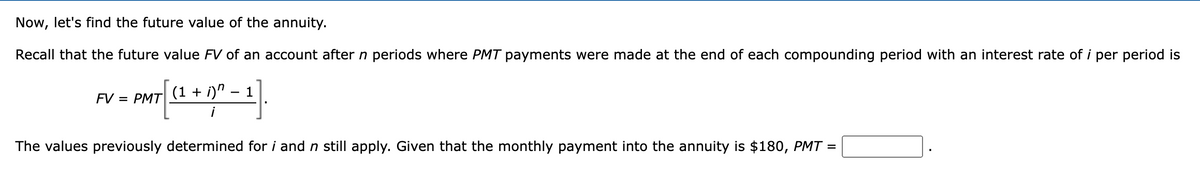

Now, let's find the future value of the annuity. Recall that the future value FV of an account after n periods where PMT payments were made at the end of each compounding period with an interest rate of i per period is FV = PMT (1 + i)" - 1 i The values previously determined for i and n still apply. Given that the monthly payment into the annuity is $180, PMT=

Now, let's find the future value of the annuity. Recall that the future value FV of an account after n periods where PMT payments were made at the end of each compounding period with an interest rate of i per period is FV = PMT (1 + i)" - 1 i The values previously determined for i and n still apply. Given that the monthly payment into the annuity is $180, PMT=

Chapter9: Sequences, Probability And Counting Theory

Section9.4: Series And Their Notations

Problem 56SE: To get the best loan rates available, the Riches want to save enough money to place 20% down on a...

Related questions

Question

Transcribed Image Text:Now, let's find the future value of the annuity.

Recall that the future value FV of an account after n periods where PMT payments were made at the end of each compounding period with an interest rate of i per period is

FV = PMT (1 + i)^

¡

1

The values previously determined for i and n still apply. Given that the monthly payment into the annuity is $180, PMT =

![Find the amount accumulated FV in the given annuity account. HINT [See Quick Example 1 and Example 1.] (Assume end-of-period deposits and compounding at the same intervals as

deposits.)

Step 1

Note that this question asks us to find the amount accumulated in an annuity with an initial investment. To find the future value of the account, we will find the future value of the $15,000

and the future value of the monthly deposits separately and then find the sum of the two amounts.

Let's begin by finding the future value of the initial $15,000.

Recall that the future value FV of an investment of PV dollars earning compound interest at a rate of i per compounding period for n periods is FV = PV(1 + i)^.

Given that $15,000 was the initial investment, PV = 15000

$180 deposited monthly for 20 years at 3% per year in an account containing $15,000 at the start

If the annual interest rate of 3% per year as a decimal is 0.03, then the monthly interest rate is i =

12

Step 2

We determined that PV = 15,000, i =

If the investment is compounded monthly for 20 years, then the number of periods of compounding is n = 12 · 20 = 240

FV =

=

15000

27311.32

To find the future value FV, to the nearest cent, substitute the known values into the compound interest formula and proceed to simplify. (Round your final answer to the nearest cent.)

FV =

PV(1 + i)^

15,000 1 +

15,000

27,311.32

0.03

12

0.03

0.03

and n = 240. Now, we want to calculate the future value of the initial investment.

"I

12

240

12

Thus, the future value of $15,000 at 3% per year compounded monthly for 20 years is $ 27311.32

240

27,311.32](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fcde950f0-76bf-49b0-beb1-b0472364554b%2F308c7e3f-7942-4129-9108-be25c393a80f%2Fgxacdbq_processed.png&w=3840&q=75)

Transcribed Image Text:Find the amount accumulated FV in the given annuity account. HINT [See Quick Example 1 and Example 1.] (Assume end-of-period deposits and compounding at the same intervals as

deposits.)

Step 1

Note that this question asks us to find the amount accumulated in an annuity with an initial investment. To find the future value of the account, we will find the future value of the $15,000

and the future value of the monthly deposits separately and then find the sum of the two amounts.

Let's begin by finding the future value of the initial $15,000.

Recall that the future value FV of an investment of PV dollars earning compound interest at a rate of i per compounding period for n periods is FV = PV(1 + i)^.

Given that $15,000 was the initial investment, PV = 15000

$180 deposited monthly for 20 years at 3% per year in an account containing $15,000 at the start

If the annual interest rate of 3% per year as a decimal is 0.03, then the monthly interest rate is i =

12

Step 2

We determined that PV = 15,000, i =

If the investment is compounded monthly for 20 years, then the number of periods of compounding is n = 12 · 20 = 240

FV =

=

15000

27311.32

To find the future value FV, to the nearest cent, substitute the known values into the compound interest formula and proceed to simplify. (Round your final answer to the nearest cent.)

FV =

PV(1 + i)^

15,000 1 +

15,000

27,311.32

0.03

12

0.03

0.03

and n = 240. Now, we want to calculate the future value of the initial investment.

"I

12

240

12

Thus, the future value of $15,000 at 3% per year compounded monthly for 20 years is $ 27311.32

240

27,311.32

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you