nses

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter2: Asset And Liability Valuation And Income Recognition

Section: Chapter Questions

Problem 2QE: Asset Valuation and Income Recognition. Asset valuation and recognition of net income closely...

Related questions

Question

The 8b photo, thank you.

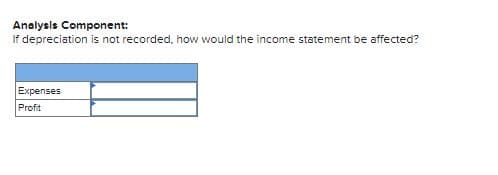

Transcribed Image Text:Analysis Component:

If depreciation is not recorded, how would the income statement be affected?

Expenses

Profit

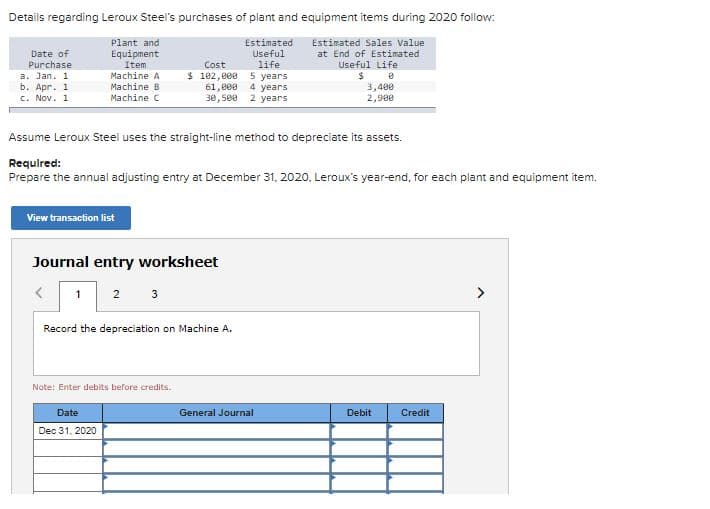

Transcribed Image Text:Details regarding Leroux Steel's purchases of plant and equipment items during 2020 follow:

Plant and

Estimated

Estimated Sales Value

Date of

Purchase

Equipment

Item

Machine A

Useful

at End of Estimated

life

$ 102, 000 5 years

4 years

Cost

Useful Life

a. Jan. 1

b. Apr. 1

c. Nov. 1

Machine B

61,e00

30,500 2 years

3,400

2,900

Machine C

Assume Leroux Steel uses the straight-line method to depreciate its assets.

Requlred:

Prepare the annual adjusting entry at December 31, 2020, Leroux's year-end, for each plant and equipment item.

View transaction list

Journal entry worksheet

2

3

>

Record the depreciation on Machine A.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Dec 31, 2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning