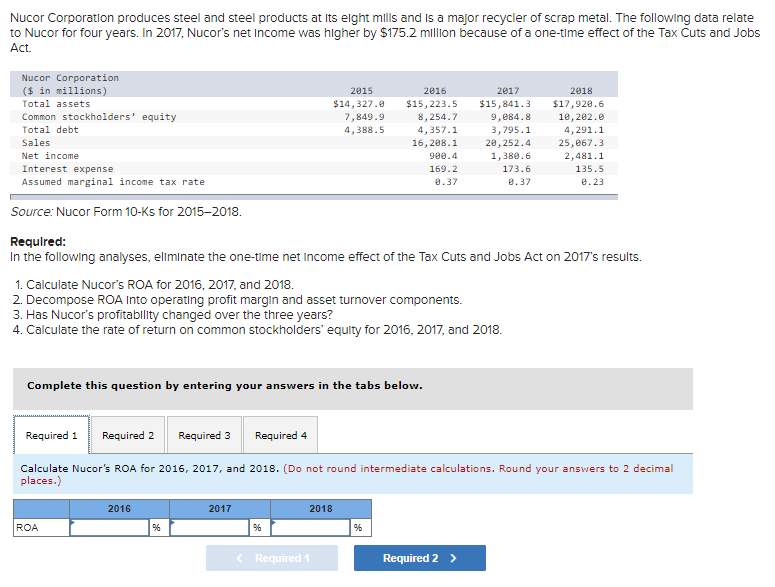

Nucor Corporation produces steel and steel products at its eight mills and is a major recycler of scrap metal. The following data relate to Nucor for four years. In 2017, Nucor's net Income was higher by $175.2 million because of a one-time effect of the Tax Cuts and Jobs Act. Nucor Corporation ($ in millions) Total assets Common stockholders' equity Total debt Sales Net income Interest expense Assumed marginal income tax rate Source: Nucor Form 10-Ks for 2015-2018. Required: In the following analyses, eliminate the one-time net Income effect of the Tax Cuts and Jobs Act on 2017's results. 1. Calculate Nucor's ROA for 2016, 2017, and 2018. 2. Decompose ROA Into operating profit margin and asset turnover components. 3. Has Nucor's profitability changed over the three years? 4. Calculate the rate of return on common stockholders' equity for 2016, 2017, and 2018. Complete this question by entering your answers in the tabs below. ROA Required 2 Required 3 2016 2015 $14,327.0 7,849.9 4,388.5 Required 1 Calculate Nucor's ROA for 2016, 2017, and 2018. (Do not round intermediate calculations. Round your answers to 2 decimal places.) % 2017 Required 4 2017 2016 $15,223.5 $15,841.3 8,254.7 9,084.8 4,357.1 3,795.1 16,208.1 20,252.4 1,380.6 173.6 0.37 96 900.4 169.2 0.37 2018 %6 2018 $17,928.6 10,202.0 4,291.1 25,067.3 2,481.1 135.5 0.23

Nucor Corporation produces steel and steel products at its eight mills and is a major recycler of scrap metal. The following data relate to Nucor for four years. In 2017, Nucor's net Income was higher by $175.2 million because of a one-time effect of the Tax Cuts and Jobs Act. Nucor Corporation ($ in millions) Total assets Common stockholders' equity Total debt Sales Net income Interest expense Assumed marginal income tax rate Source: Nucor Form 10-Ks for 2015-2018. Required: In the following analyses, eliminate the one-time net Income effect of the Tax Cuts and Jobs Act on 2017's results. 1. Calculate Nucor's ROA for 2016, 2017, and 2018. 2. Decompose ROA Into operating profit margin and asset turnover components. 3. Has Nucor's profitability changed over the three years? 4. Calculate the rate of return on common stockholders' equity for 2016, 2017, and 2018. Complete this question by entering your answers in the tabs below. ROA Required 2 Required 3 2016 2015 $14,327.0 7,849.9 4,388.5 Required 1 Calculate Nucor's ROA for 2016, 2017, and 2018. (Do not round intermediate calculations. Round your answers to 2 decimal places.) % 2017 Required 4 2017 2016 $15,223.5 $15,841.3 8,254.7 9,084.8 4,357.1 3,795.1 16,208.1 20,252.4 1,380.6 173.6 0.37 96 900.4 169.2 0.37 2018 %6 2018 $17,928.6 10,202.0 4,291.1 25,067.3 2,481.1 135.5 0.23

Chapter12: Balanced Scorecard And Other Performance Measures

Section: Chapter Questions

Problem 3PA: Macon Mills is a division of Bolin Products. Inc. During the most recent year, Macon had a net...

Related questions

Question

Transcribed Image Text:Nucor Corporation produces steel and steel products at its eight mills and is a major recycler of scrap metal. The following data relate

to Nucor for four years. In 2017, Nucor's net Income was higher by $175.2 million because of a one-time effect of the Tax Cuts and Jobs

Act.

Nucor Corporation

($ in millions)

Total assets

Common stockholders' equity

Total debt

Sales

Net income

Interest expense

Assumed marginal income tax rate

Source: Nucor Form 10-Ks for 2015-2018.

Required:

In the following analyses, eliminate the one-time net Income effect of the Tax Cuts and Jobs Act on 2017's results.

1. Calculate Nucor's ROA for 2016, 2017, and 2018.

2. Decompose ROA Into operating profit margin and asset turnover components.

3. Has Nucor's profitability changed over the three years?

4. Calculate the rate of return on common stockholders' equity for 2016, 2017, and 2018.

Complete this question by entering your answers in the tabs below.

ROA

Required 2 Required 3

2016

Required 1

Calculate Nucor's ROA for 2016, 2017, and 2018. (Do not round intermediate calculations. Round your answers to 2 decimal

places.)

%

2017

2015

$14,327.0

7,849.9

4,388.5

Required 4

96

2017

2016

$15,223.5 $15,841.3

8,254.7

9,084.8

4,357.1

3,795.1

16,208.1

20,252.4

1,380.6

173.6

0.37

2018

< Required 1

900.4

169.2

0.37

96

2018

$17,928.6

10,202.0

4,291.1

25,067.3

2,481.1

135.5

0.23

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT