Number Per Unit $ 75.00 Date Transaction of Units Total Jan. 1 Inventory 7,500 $ 562,500 10 Purchase 22,500 85.00 1,912,500 28 Sale 11,250 150.00 1,687,500 30 Sale 3,750 150.00 562,500 Feb. 5 Sale 1,500 150.00 225,000 10 Purchase 54,000 87.50 4,725,000 16 Sale 27,000 160.00 4,320,000 28 Sale 25.500 160.00 4,080,000 Mar. 5 Purchase 45,000 89.50 4,027,500 14 Sale 30,000 160.00 4,800,000 25 Purchase 7,500 90.00 675,000 30 Sale 26,250 160.00 4,200,000

Number Per Unit $ 75.00 Date Transaction of Units Total Jan. 1 Inventory 7,500 $ 562,500 10 Purchase 22,500 85.00 1,912,500 28 Sale 11,250 150.00 1,687,500 30 Sale 3,750 150.00 562,500 Feb. 5 Sale 1,500 150.00 225,000 10 Purchase 54,000 87.50 4,725,000 16 Sale 27,000 160.00 4,320,000 28 Sale 25.500 160.00 4,080,000 Mar. 5 Purchase 45,000 89.50 4,027,500 14 Sale 30,000 160.00 4,800,000 25 Purchase 7,500 90.00 675,000 30 Sale 26,250 160.00 4,200,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 16MCQ: ( Appendix 6B) Refer to the information for Morgan Inc. above. If Morgan uses a periodic inventory...

Related questions

Topic Video

Question

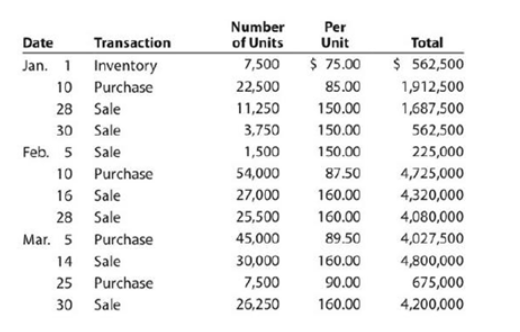

FIFO perpetual inventory

The beginning inventory at Midnight Supplies and data on purchases

and sales for a three-month period ending March 31, are as attached:

Instructions

1. Record the inventory, purchases, and cost of merchandise sold

data in a perpetual inventory record similar to the one illustrated

in Exhibit 3, using the first-in, first-out method.

2. Determine the total sales and the total cost of merchandise sold

for the period.

merchandise sold accounts. Assume that all sales were on account.

3. Determine the gross profit from sales for the period.

Transcribed Image Text:Number

Per

Unit

$ 75.00

Date

Transaction

of Units

Total

Jan. 1 Inventory

7,500

$ 562,500

10 Purchase

22,500

85.00

1,912,500

28 Sale

11,250

150.00

1,687,500

30 Sale

3,750

150.00

562,500

Feb. 5 Sale

1,500

150.00

225,000

10 Purchase

54,000

87.50

4,725,000

16 Sale

27,000

160.00

4,320,000

28 Sale

25.500

160.00

4,080,000

Mar. 5 Purchase

45,000

89.50

4,027,500

14 Sale

30,000

160.00

4,800,000

25 Purchase

7,500

90.00

675,000

30

Sale

26,250

160.00

4,200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning