Q: XTY Company has total assets turnover ratio of 1.90 and a return on total assets of 7.20%. What is…

A: Asset turnover ratio = 1.90 Return on assets = 7.20%

Q: Iggy Company is considering three capital expenditure projects. Relevant data for the projects are…

A: Here, Depreciation Method is Straight Line Method.

Q: What would you pay for a bond that pays an annual coupon of $45, has a face value of $1,000, matures…

A: Face value of bond (FV) = $1000 Annual coupon amount (C) = $45 Years to maturity (n) = 11 Years…

Q: Net cash flow from operating activities

A: A cash flow cash flow statement that highlights all cash flow a firm gets from ongoing activities as…

Q: Martinez Co. borrowed Ș/1,059 on Mar pearing note. Assuming a 360-day year payment should include a…

A: interest amount = principal * rate = 71059*5%*60/360 = 592.1583 near to $592

Q: 1. You are considering the purchase of an apartment building with the following information:…

A: It is given that: Purchase price - $12,500,000 Year 1 NOI - $1,000,000 Growth – 4% Holding period –…

Q: PROBLEM: 1. What is the current value of the Php 200 payment to be made at the end of each of the…

A:

Q: A. Explain two purposes of WACC in capital budgeting. B. H&H Manufacturing Company is considering…

A: The capital invested in the entity may be in the form of owner's fund as well as borrowed fund. The…

Q: 11.8100 11.2500 X

A: We can also do this by taking frequency 2 also i.e on semi annual coupon payment basis and we have…

Q: Jasmine invested a certain amount in a bank compounded semi-anually. The bank told her that the…

A: First we need to calculate the interest rate. Given, Amount will be doubled in 5 years and it is…

Q: ent unir payment A 24000 18000 12000 6000 good 1 2 4 3.

A: When the present value of unequal cash flows is divided by the present value annuity factor it is…

Q: 1. Given a price-earnings ratio of 12, EPS of P2.18, and payout ratio of 75%, compute for the…

A: Dividend yield refers to a ratio which shows the relationship between the annual dividend and…

Q: uppose you bought stock XYZ December RM8 put options for40 sen. What is the strike price? Suppose…

A: Put option gives the opportunity to sell the stock on expiration but no obligations to do that. Put…

Q: aleb wants to go on a cruise for his Senior Trip. He needs $2500 for the trip. Caleb is currently a…

A: Here we will use the concept of time value of money. The concept of time value of money states that…

Q: Which of the following situations are likely to reduce agency conflicts between stockholders and…

A: Agency conflicts arise due to the conflict between shareholders and managers with respect to the…

Q: 20. Ron and Sandy have purchased their first house. They borrowed $174, 000 for 30 years at an…

A: Solution:- Total monthly payment will be the total payment made towards the monthly mortgage…

Q: . Ron and Sandy have purchased their first house. They borrowed $174, 000 for 30 years at an annual…

A: Loans are to be paid by the monthly payment that carry the payment for the principal amount and…

Q: Q4 Write notes explaining EACH of the following; (i) Rent review (ii) All risks yield…

A: In this question, we will explain all the points given above in the question . 1. Rent review = It…

Q: 240,000 will be deposited in a fund at the beginning of each six months for 5 yrs. Using 11% as the…

A: Here the concept of annuity will apply. This is the case of an annuity due as the payments are made…

Q: unlike depreciation and retained earnings, the interest expense does not have to directly tie on any…

A: Depreciation is shown both under the balance sheet and the income statement. Retained earnings are…

Q: Two companies, X and Y have issued 30 day commercial papers in the money market. Company X’s…

A: Bond valuation involves five components – coupon rate, yield, present value, future value and time…

Q: Consider the following investment in CURRENT DOLLARS The trem (minimum acceptable rate of return), m…

A: Real rate is the rate which excludes the impact of inflation in the economy, while nominal rates are…

Q: You currently have $250,000 in your retirement account. What equal annual amount must you deposit…

A: Equal annual deposits into an account for a fixed number of times is called annuity. The future…

Q: ould it sell for in order to yield a 7.5% nominal return on the investment? O $522,150 O $542,487…

A: Price today is the present value of of coupon payment plus present value of future prices after 9…

Q: What is the APR that they are required to disclose? (Do not round ntermediate calculations and round…

A: Annual Percentage Rate: It is the annual rate charged on the loan amount or earned on the…

Q: Q25. Because of the importance of cash, the statement of cash flows has become the third primary…

A: Financial statements are the company’s performance report which is prepared at the end of the period…

Q: What is Alyssa's equity in the house?

A: Loan Amount: It is the amount given to the borrower from the bank and the bank charges interest on…

Q: B. What are the strength and weaknesses of each of the following capital budgeting technique below?…

A: Capital budgeting techniques are used for assessing the net benefits from projects and the value…

Q: 4. Calculate the NPV at a cost of capital of 9% and the IRR for a project with an initial outlay of…

A: Solution: Net Present Value (NPV) means the net of present value of cash inflows and initial outlay.…

Q: of $10 million. Investment A will generate $2 million per year (starting at the end of the first…

A: IRR is the internal rate of return where net present value is zero that means present value of cash…

Q: he regular financial statements in which every line has been divided by the sales for the year.…

A: For comparison of financial statement of different companies some common form is required to compare…

Q: Use the following information to calculate the change in value that would result if the benchmark…

A: Given :- Current food cost - 29.2% Benchmark food cost - 28.5% Target reduction in cost - 0.7%…

Q: NCC Corporation is considering building a new facility in Texas. To raise money for the capital…

A: Break point is the point and the dollar amount for the purchase of mutual fund shares and bonds , It…

Q: Refer to the table below to answer one question. Interest Rate Option March 2020 Cash 0.00% Checking…

A: Money can be held or can be invested in different investment vehicles or in different types of…

Q: Automatic dividend reinvestment O is a requirement of all mutual fund companies. O compounds share…

A: Automatic dividend reinvestment is the process where the dividends earned are not paid out but…

Q: When all else is equal, interest rate risk is smaller wit

A: interest rate risk increases with longer maturity , decreases with shorter maturity.

Q: current price stock XYZ is RM20. In 3 months, it will be either RM22 or RM18. A 3-month call option…

A: Options are called derivative financial instruments, because the value of options is derived from…

Q: ABC Corporation bought 5 short futures. The contract size is 10,000 shares of Mining Inc. The strike…

A: ABC Corporation bought 5 short futures. It means ABC is a Put Buyer. The put Buyer will exercise…

Q: Suppose that a futures price is currently £30. The risk-free interest rate is 5% per annum…

A: Here, To Find: Bounds for the price =?

Q: 13 Suppose you sold stock XYZ December RM8 call options for 40 sen. The price of XYZ stock on the…

A: Call Options: It is the financial contracts that give the choice purchaser the right however not…

Q: Volkswagen Key Financial Ratios 2016-12 2017-12 2018-12 2019-12 2020-12 TTM Efficiency 101.55 107.25…

A: Efficiency refers to Optimal utilization of available resources (Material, Labor, Machine time,…

Q: a. If interest rates suddenly rise by 1.4 percent, what is the percentage change in price of Bond A…

A: Bond valuation refers to a method which is used to compute the current value or present value (PV)…

Q: The expected market rate of return is 12%, and the risk free rate is 3%. Stock A has a beta of 1.25.…

A: Risk free rate = 0.03 Market rate of return = 0.12 Beta = 1.25 Expected return as per CAPM = ?…

Q: Assume you have secured a loan of $10,000 from a bank which will be paid in one year. The fin bank…

A: Closing Balnace = Opening Balance + Interest @ 0.31% - Monthly Installments

Q: Assume you have secured a loan of $10,000 from a bank which will be paid in one year. The bank has…

A: Interest payable = Opening Balance * Monthly interest rate

Q: Financial Ratios analysis is a part of Group of answer choices Fundamental Analysis Economic…

A: As per Bartleby Honor Code, when multiple questions are asked, the expert is required only to solve…

Q: EPS is computed by dividing net income by the average number of shares outstanding. True False

A: Earnings per share(EPS) refers to an indicator or a financial ratio that shows how much a company is…

Q: Assume you buy a March RM1625 FBM-KLCI call option for RM25 and hold until expiry. What will be your…

A: In the given case, Call option is purchased at a premium of $25 Long call is exercised only if Stock…

Q: esterday, Tom Brady, a professional football player, announced that after his retirement he'll move…

A: Present value of annuities would give the equivalent amount today considering the interest rate and…

Q: The United States has a comparative advantage in -skilled labor. This explains why the U.S. is a net…

A: Skilled labor refers to workers who are highly trained, educated, or experienced and can do more…

17

Step by step

Solved in 2 steps

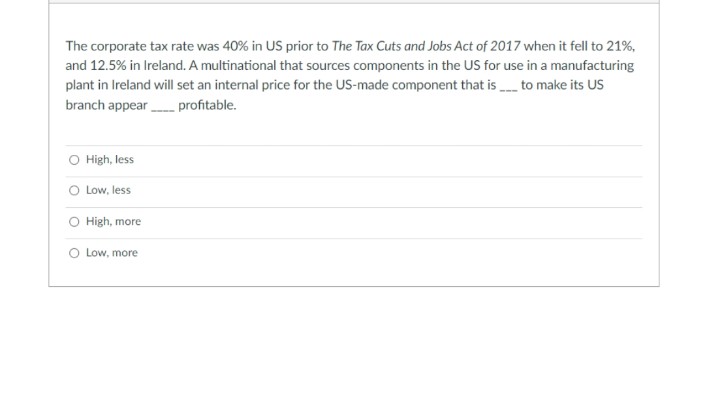

- A company produces jackets for €20 each in Portugal, which has a corporate tax rate of 21%. It then transfers its products to its Irish subsidiary for resale to the Irish public at a sales price of €30 per jacket. The corporate tax rate in Ireland is 12.5%. Calculate the total after-tax profit in the two countries if the company uses a transfer price of €23 and it sells 10,000 jackets. ANSWERS: €84,950 €15,050 €66,500 €8,495 €8,750Given: A company XYZ in the United States is profitable and pays taxes. XYZ produces “widgets”, and in recent years, the cost of producing each widget has been falling because the price of raw materials has been falling. Each year for the past few years, XYZ has produced significantly more widgets each year than it has sold. True or False: XYZ would report lower Net Income on the Income Statement if it used FIFO accounting versus if it used LIFO accounting Explain your answer.Assume the U.S. corporate income tax rate is 40 percentand the Mexican corporate income tax rate is 30 percent.Jacques International Apparel Company has subsidiaries inboth the U.S. and Mexico. Jacques is trying to decide whattransfer price to use for its famous French frock, whichis being transferred from the U.S. subsidiary to theMexican subsidiary. It could ship the frock at the marketprice of $75 or at cost plus 20 percent. The cost of the frockis $40. Which transfer price would minimize Jacques’s taxburden?a. $75.b. $48.c. $90.d. $75 $40 $35.

- XYZ Industries Company operates in Oman and supplies its products to the Omani and local market in addition to the Gulf markets.With the beginning of 2020, the Cocod-19 crisis appeared which affected the economies of all countries around the world. The impact of Cocod-19 on the work of companies varies according to the industrial sector in which the company operates.With the beginning of the year 2021, the government began applying value-added tax ( VAT) , which has a direct impact on the prices of goods and services provided in Oman.Based on what you have studied on the topic of risks and returns in the corporate finance course, answer the following questions: 1- What are the most important types of risks that XYZ Industries Company was exposed to in Oman? (Risks are: default, Inflation, Maturity, Liquidity)2- What are the most important measures that can be taken to reduce these risks?3- What is the potential impact of VAT on the company?KS Inc. produces a product in the United Kingdom at a cost of £0.55 per unit which it then sells in France for €1.25 per unit. If in the currency markets, 1 U.S. dollar = £0.6373 and 1 U.S. dollar = €1.0279, how much profit is realized by KS Inc. on each unit of product sold? * $0.7857 $0.3531 $0.2571 $0.1095 When the supply for money increases and the demand for money reduces, there will be * A fall in the level of prices An increase in the rate of interest A fall in the level of demand A decrease in the rate of interestMMA plc., is a UK-based manufacturer of heavy machine components for the power industry. MMA exports a significant proportion of its products to clients in the US. In order to compete with other US suppliers of heavy machine components, MMA prices its exports in US dollars. It is March 2021 and MMA has just shipped a large consignment worth $50 million to TLP Inc., one of MMA’s major clients in the US. Payment for this shipment is due in 90-days. MMA treasury department is concerned about the recent volatility of the dollar[1]pound exchange rates and has suggested that its exposure to the US dollar should be hedged. The following currency and money market quotes are available today: Spot Rate (bid – ask): US$1.5077/£ - US$1.5379/£ Barclays 90-day forward quote ((bid – ask): US$1.5025/£ - US$1.5432 90-day dollar deposit interest rate: 0.8% per annum 90-day pound deposit interest: 1.2% per annum 90-day US dollar borrowing rate: 1.2% per annum 90-day pound borrowing rate: 1.8% per annum…

- Davao has a potential foreign customer that has offered to buy 1,500 tons at P450 per ton. Assume that all of Davao’s costs would be at the same levels and rates as last year. What net income after taxes would Davao make if it took this order and rejected some business from regular customers so as not to exceed capacity? Without prejudice to your answers to previous questions, and assume that Davao plans to market its product in a new territory. Davao estimates that an advertising and promotion program costing P61,500 annually would need to be undertaken for the next two or three years. In addition, a P25 per ton sales commission over and above the current commission to the sales force in the new territory would be required. How many tons would have to be sold in the new territory to maintain Davao’s current after-tax income of P94,500? If the sales volume is estimated to be 2,100 tons in the next year, and if the prices and costs stay at the same levels and amounts next year, the…BMW, owner of the BMW, Mini, and Rolls-Royce brands, has been a major presence in Europe since 1916. The company still sells 46 percent of its cars in Europe, and growth is highest there. However, China is becoming one of BMW’s most important markets. In 2016, the company sold over 520,000 cars in China, and BMW has turned to the Chinese market as a primary focus for future sales. Despite rising sales revenues, BMW is conscious that its profits are often wiped out by changes in exchange rates. The company has pointed out that it was hit particularly hard by China’s currency devaluation in late 2015. BMW Brilliance Automotive Co. Ltd., BMW’s subsidiary in China, imports about half its components from Europe and elsewhere, and it faced major declines in profit because of the negative effects of unfavorable exchange rates. However, BMW did not want to pass those exchange rate costs on to consumers through price increases. Its rival, Porsche, had done that in the United States at the end…BMW, owner of the BMW, Mini, and Rolls-Royce brands, has been a major presence in Europe since 1916. The company still sells 46 percent of its cars in Europe, and growth is highest there. However, China is becoming one of BMW’s most important markets. In 2016, the company sold over 520,000 cars in China, and BMW has turned to the Chinese market as a primary focus for future sales. Despite rising sales revenues, BMW is conscious that its profits are often wiped out by changes in exchange rates. The company has pointed out that it was hit particularly hard by China’s currency devaluation in late 2015. BMW Brilliance Automotive Co. Ltd., BMW’s subsidiary in China, imports about half its components from Europe and elsewhere, and it faced major declines in profit because of the negative effects of unfavorable exchange rates. However, BMW did not want to pass those exchange rate costs on to consumers through price increases. Its rival, Porsche, had done that in the United States at the end…

- New Life is a multinational distribution company that started operating a Branch in Barbados on 1 January 2023. The company’s Head Office is in the Cayman Islands and is part of a group which earns more than USD 850 million for the year. It employed some of its staff from Barbados and imports good and services from the US, Cayman Islands, and other Caribbean countries. New Life repatriation policy is to transfer 50 % to 70% of its after-tax profits to the Cayman Islands. The company was of the view that for the first year of operation there was a window of no tax obligations. In December 2023, the company realized that their understanding was not correct and therefore engaged UWI Tax Consulting Services Limited to provide tax advisory and tax compliance services. Your Group was assigned this engagement. Required.Advice New Life of the tax matters that needs to be considered when operating in Barbadosincluding any tax benefits or incentives they may consider.A Chinese automobile company is going to use one of its unused manufacturing plants in China to produce 20,000 cars a year. The cars will then be sold in the United States for $40,000 per vehicle. The plant has been fully depreciated. Production and assembly costs in China will be RMB 120,000 per vehicle and selling and administrative costs in the U.S. will be $30 million per year. The company will pay taxes in China at a rate of 35% and will not pay taxes in the U.S. Assume the current exchange rate is 7 RMB/$. It is expected that the plant will operate for 5 years and then cease operations. What are the expected yearly sales, expressed in RMB, assuming the current exchange rate? 5,600,000,000 800,000,000 560,000,000 3,600,000,000 What is the expected yearly net after-tax cash flow, expressed in RMB, assuming the exchange rate stays constant? 5,600,000,000 1,943,500,000 3,170,000,000 2,990,000,000 What is the change in cash flow, in RMB, if the RMB appreciates to 6.5…compeny,whose products are sold in 30 countries worldwide, is an integrated Canadian forest products company. compeny sells the majority of its lumber products in the United States and a significant amount of its pulp products in asia.Demon also has loans from other countries. For example, on June 18, 2018, the company borrowed US$160 million at an annual interest rate of 12%. compeny must repay this loan, and interest, in U.S.dollars One of the challenges global companies face is to make themselves attractive to investors from other currencies. This is difficult to do when different accounting rules in different countries blur the real impact of earnings. For example, in 2018 compenyreported a loss of $2.3 million, using a accounting rules.Had it reported under U.S. accounting rules, its loss would have been $12.1 million. Many companies that want to be more easily compared with U.S and other global competitors have switched to U,S. accounting principles. a National Railway.…