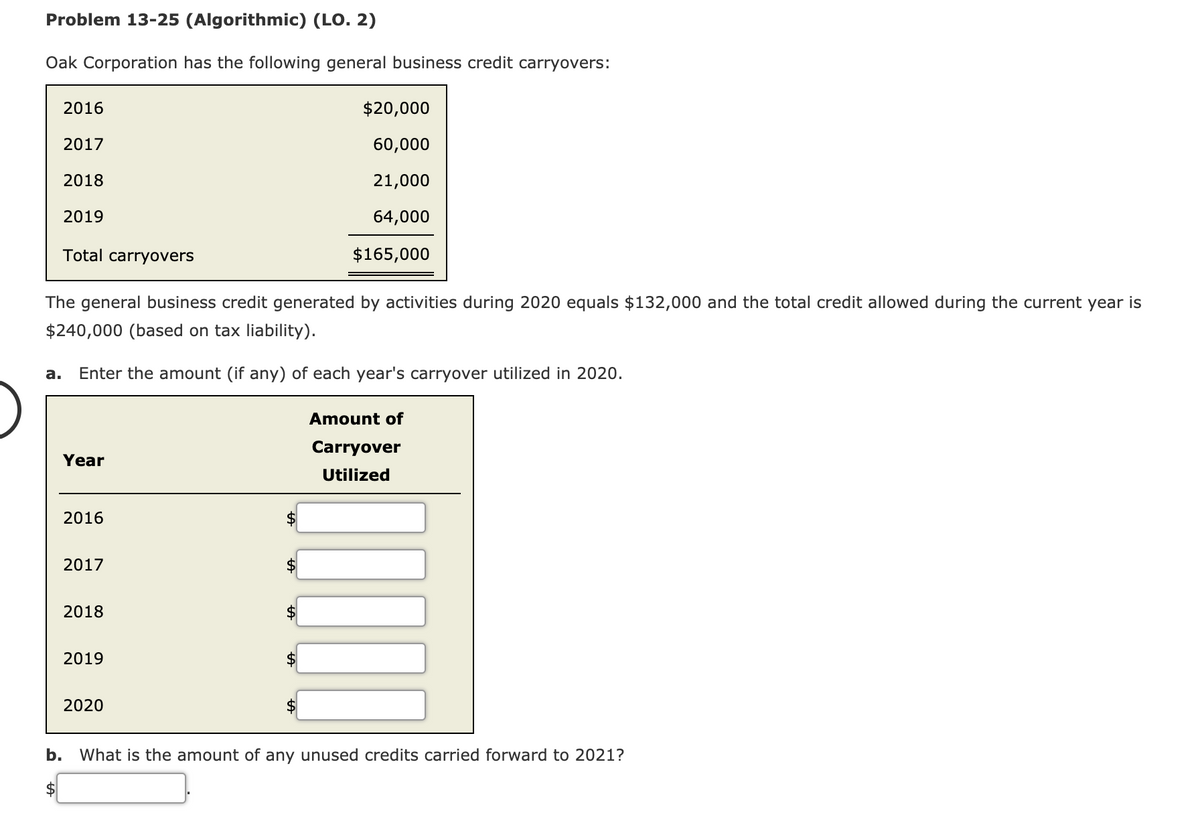

Oak Corporation has the following general business credit carryovers: 2016 $20,000 2017 60,000 2018 21,000 2019 64,000 Total carryovers $165,000 The general business credit generated by activities during 2020 equals $132,000 and the total credit allowed during the current year is $240,000 (based on tax liability). а. Enter the amount (if any) of each year's carryover utilized in 2020. Amount of Carryover Year Utilized 2016 2017 2018 2$ 2019 $ 2020 b. What is the amount of any unused credits carried forward to 2021? $

Oak Corporation has the following general business credit carryovers: 2016 $20,000 2017 60,000 2018 21,000 2019 64,000 Total carryovers $165,000 The general business credit generated by activities during 2020 equals $132,000 and the total credit allowed during the current year is $240,000 (based on tax liability). а. Enter the amount (if any) of each year's carryover utilized in 2020. Amount of Carryover Year Utilized 2016 2017 2018 2$ 2019 $ 2020 b. What is the amount of any unused credits carried forward to 2021? $

Chapter13: Tax Credits And Payment Procedures

Section: Chapter Questions

Problem 25P: LO.2 Oak Corporation has the following general business credit carryovers. If the general business...

Related questions

Question

Hi can someone help me with this question?

Transcribed Image Text:Problem 13-25 (Algorithmic) (LO. 2)

Oak Corporation has the following general business credit carryovers:

2016

$20,000

2017

60,000

2018

21,000

2019

64,000

Total carryovers

$165,000

The general business credit generated by activities during 2020 equals $132,000 and the total credit allowed during the current year is

$240,000 (based on tax liability).

а.

Enter the amount (if any) of each year's carryover utilized in 2020.

Amount of

Carryover

Year

Utilized

2016

2017

2018

2019

2020

b. What is the amount of any unused credits carried forward to 2021?

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning