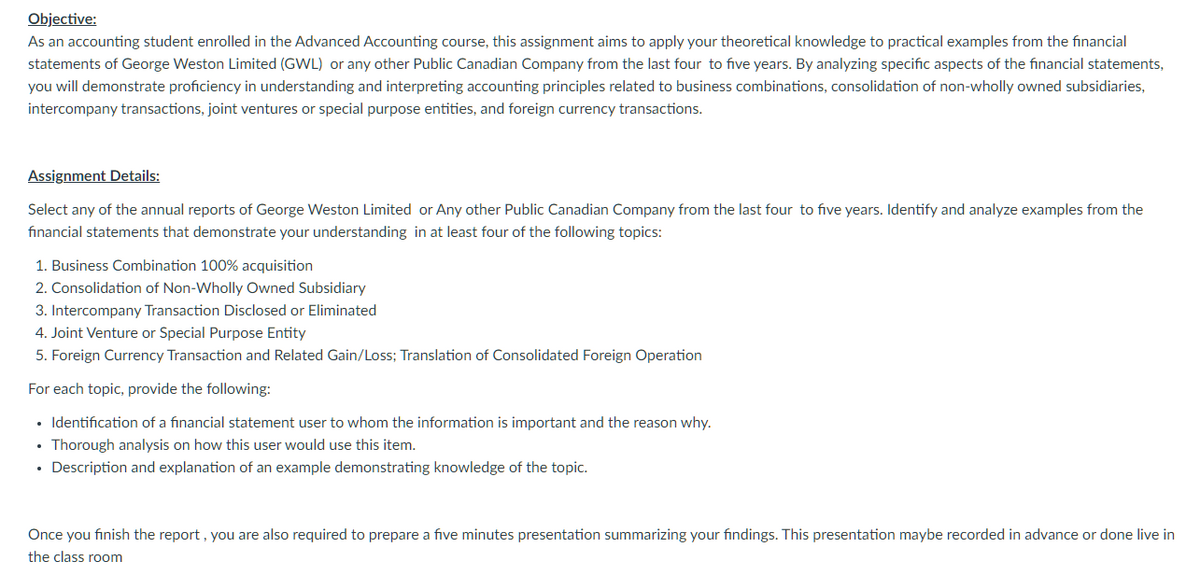

Objective: As an accounting student enrolled in the Advanced Accounting course, this assignment aims to apply your theoretical knowledge to practical examples from the financial statements of George Weston Limited (GWL) or any other Public Canadian Company from the last four to five years. By analyzing specific aspects of the financial statements, you will demonstrate proficiency in understanding and interpreting accounting principles related to business combinations, consolidation of non-wholly owned subsidiaries, intercompany transactions, joint ventures or special purpose entities, and foreign currency transactions. Assignment Details: Select any of the annual reports of George Weston Limited or Any other Public Canadian Company from the last four to five years. Identify and analyze examples from the financial statements that demonstrate your understanding in at least four of the following topics: 1. Business Combination 100% acquisition 2. Consolidation of Non-Wholly Owned Subsidiary 3. Intercompany Transaction Disclosed or Eliminated 4. Joint Venture or Special Purpose Entity 5. Foreign Currency Transaction and Related Gain/Loss; Translation of Consolidated Foreign Operation For each topic, provide the following: • Identification of a financial statement user to whom the information is important and the reason why. • Thorough analysis on how this user would use this item. Description and explanation of an example demonstrating knowledge of the topic. Once you finish the report, you are also required to prepare a five minutes presentation summarizing your findings. This presentation maybe recorded in advance or done live in the class room

Objective: As an accounting student enrolled in the Advanced Accounting course, this assignment aims to apply your theoretical knowledge to practical examples from the financial statements of George Weston Limited (GWL) or any other Public Canadian Company from the last four to five years. By analyzing specific aspects of the financial statements, you will demonstrate proficiency in understanding and interpreting accounting principles related to business combinations, consolidation of non-wholly owned subsidiaries, intercompany transactions, joint ventures or special purpose entities, and foreign currency transactions. Assignment Details: Select any of the annual reports of George Weston Limited or Any other Public Canadian Company from the last four to five years. Identify and analyze examples from the financial statements that demonstrate your understanding in at least four of the following topics: 1. Business Combination 100% acquisition 2. Consolidation of Non-Wholly Owned Subsidiary 3. Intercompany Transaction Disclosed or Eliminated 4. Joint Venture or Special Purpose Entity 5. Foreign Currency Transaction and Related Gain/Loss; Translation of Consolidated Foreign Operation For each topic, provide the following: • Identification of a financial statement user to whom the information is important and the reason why. • Thorough analysis on how this user would use this item. Description and explanation of an example demonstrating knowledge of the topic. Once you finish the report, you are also required to prepare a five minutes presentation summarizing your findings. This presentation maybe recorded in advance or done live in the class room

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter1: Accounting As A Form Of Communication

Section: Chapter Questions

Problem 1.9P

Related questions

Question

Transcribed Image Text:Objective:

As an accounting student enrolled in the Advanced Accounting course, this assignment aims to apply your theoretical knowledge to practical examples from the financial

statements of George Weston Limited (GWL) or any other Public Canadian Company from the last four to five years. By analyzing specific aspects of the financial statements,

you will demonstrate proficiency in understanding and interpreting accounting principles related to business combinations, consolidation of non-wholly owned subsidiaries,

intercompany transactions, joint ventures or special purpose entities, and foreign currency transactions.

Assignment Details:

Select any of the annual reports of George Weston Limited or Any other Public Canadian Company from the last four to five years. Identify and analyze examples from the

financial statements that demonstrate your understanding in at least four of the following topics:

1. Business Combination 100% acquisition

2. Consolidation of Non-Wholly Owned Subsidiary

3. Intercompany Transaction Disclosed or Eliminated

4. Joint Venture or Special Purpose Entity

5. Foreign Currency Transaction and Related Gain/Loss; Translation of Consolidated Foreign Operation

For each topic, provide the following:

• Identification of a financial statement user to whom the information is important and the reason why.

• Thorough analysis on how this user would use this item.

Description and explanation of an example demonstrating knowledge of the topic.

Once you finish the report, you are also required to prepare a five minutes presentation summarizing your findings. This presentation maybe recorded in advance or done live in

the class room

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage