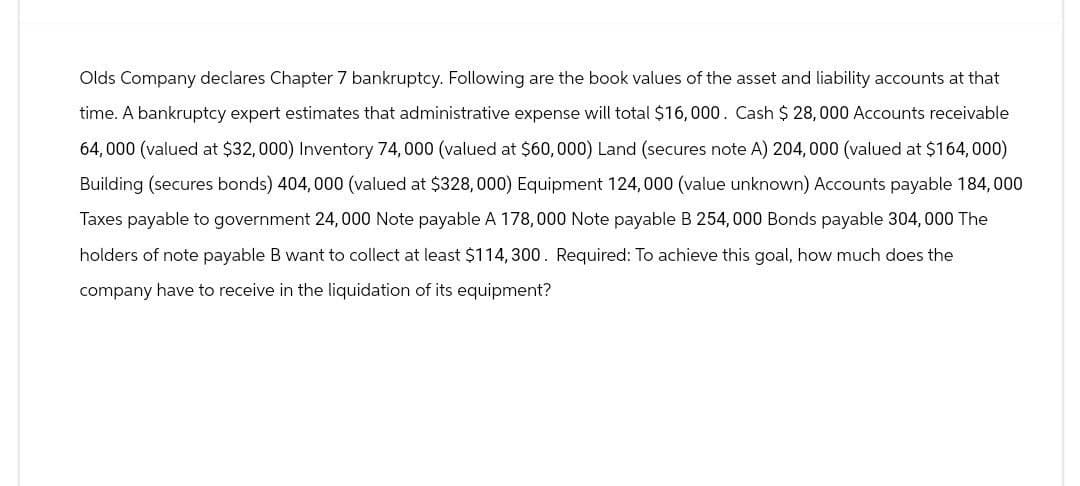

Olds Company declares Chapter 7 bankruptcy. Following are the book values of the asset and liability accounts at that time. A bankruptcy expert estimates that administrative expense will total $16,000. Cash $ 28,000 Accounts receivable 64,000 (valued at $32,000) Inventory 74,000 (valued at $60,000) Land (secures note A) 204, 000 (valued at $164,000) Building (secures bonds) 404, 000 (valued at $328,000) Equipment 124,000 (value unknown) Accounts payable 184,000 Taxes payable to government 24,000 Note payable A 178,000 Note payable B 254,000 Bonds payable 304,000 The holders of note payable B want to collect at least $114,300. Required: To achieve this goal, how much does the company have to receive in the liquidation of its equipment?

Olds Company declares Chapter 7 bankruptcy. Following are the book values of the asset and liability accounts at that time. A bankruptcy expert estimates that administrative expense will total $16,000. Cash $ 28,000 Accounts receivable 64,000 (valued at $32,000) Inventory 74,000 (valued at $60,000) Land (secures note A) 204, 000 (valued at $164,000) Building (secures bonds) 404, 000 (valued at $328,000) Equipment 124,000 (value unknown) Accounts payable 184,000 Taxes payable to government 24,000 Note payable A 178,000 Note payable B 254,000 Bonds payable 304,000 The holders of note payable B want to collect at least $114,300. Required: To achieve this goal, how much does the company have to receive in the liquidation of its equipment?

Chapter23: Corporate Restructuring

Section: Chapter Questions

Problem 6P

Related questions

Question

None

Transcribed Image Text:Olds Company declares Chapter 7 bankruptcy. Following are the book values of the asset and liability accounts at that

time. A bankruptcy expert estimates that administrative expense will total $16,000. Cash $28,000 Accounts receivable

64,000 (valued at $32,000) Inventory 74,000 (valued at $60,000) Land (secures note A) 204, 000 (valued at $164,000)

Building (secures bonds) 404,000 (valued at $328,000) Equipment 124,000 (value unknown) Accounts payable 184,000

Taxes payable to government 24,000 Note payable A 178,000 Note payable B 254,000 Bonds payable 304,000 The

holders of note payable B want to collect at least $114,300. Required: To achieve this goal, how much does the

company have to receive in the liquidation of its equipment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT