Olsen Outfitters Inc. believes that its optimal capital structure consists of 55% common equity and 45% debt, and its tax rate is 25%. Olsen must raise additional capital to fund its upcoming expansion. The firm will have $2 million of retained earnings with a cost of rs- 11%. lew common stock in an amount up to $6 million would have a cost of re- 13.0%. Furthermore, Olsen can raise up to $4 million of debt at an interest rate of ra - 9% and an additional $4 million of debt at ra- 11%. The CFO estimates that a proposed expansion would require n investment of $8.2 million. What is the WACC for the last dollar raised to complete the expansion? Round your answer to two decimal places. 9.71

Olsen Outfitters Inc. believes that its optimal capital structure consists of 55% common equity and 45% debt, and its tax rate is 25%. Olsen must raise additional capital to fund its upcoming expansion. The firm will have $2 million of retained earnings with a cost of rs- 11%. lew common stock in an amount up to $6 million would have a cost of re- 13.0%. Furthermore, Olsen can raise up to $4 million of debt at an interest rate of ra - 9% and an additional $4 million of debt at ra- 11%. The CFO estimates that a proposed expansion would require n investment of $8.2 million. What is the WACC for the last dollar raised to complete the expansion? Round your answer to two decimal places. 9.71

Chapter12: The Cost Of Capital

Section: Chapter Questions

Problem 12P

Related questions

Question

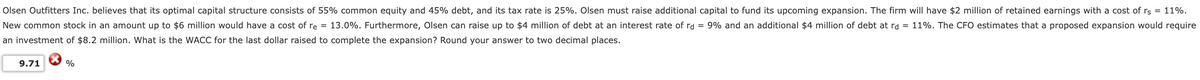

Transcribed Image Text:Olsen Outfitters Inc. believes that its optimal capital structure consists of 55% common equity and 45% debt, and its tax rate is 25%. Olsen must raise additional capital to fund its upcoming expansion. The firm will have $2 million of retained earnings with a cost of rs = 11%.

New common stock in an amount up to $6 million would have a cost of re = 13.0%. Furthermore, Olsen can raise up to $4 million of debt at an interest rate of rd = 9% and an additional $4 million of debt at rd = 11%. The CFO estimates that a proposed expansion would require

an investment of $8.2 million. What is the WACC for the last dollar raised to complete the expansion? Round your answer to two decimal places.

9.71

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning