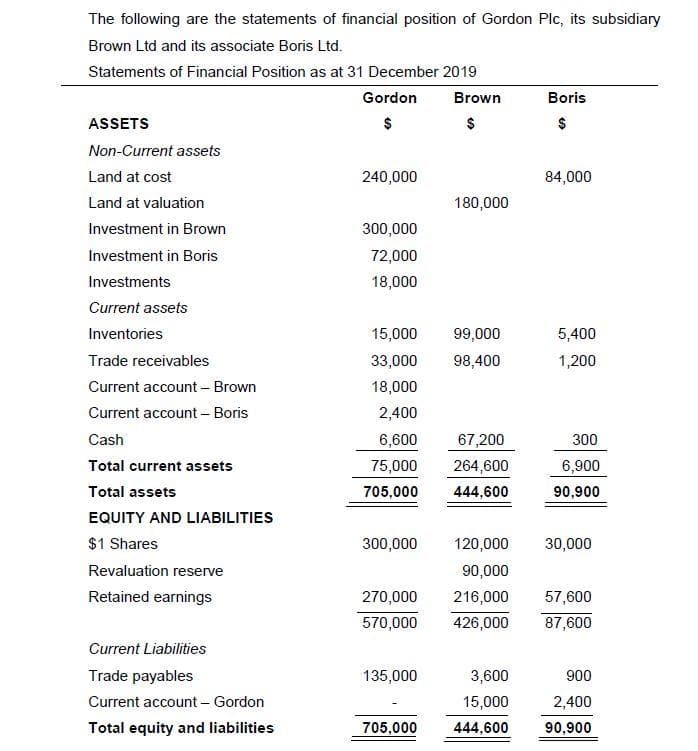

On 01 January 2013, Gordon Plc acquired 75% of Brown Ltd for $300,000 when Brown`s share capital and reserves were $252,000. Prior to the acquisition, the net book value of Brown`s non-current assets was $90,000. Brown revalued its non-current assets immediately prior to the acquisition to fair value and included the revaluation in its statement of financial position. (ii) On 01 January 2015, Gordon acquired 20% of Boris Ltd for $72,000 when the fair value of Boris`s net assets were $42,000. (iii) Goodwill has been impaired in Brown by $77,700 and in Boris by $31,800 (iv) At the year end, Gordon Plc has inventory acquired from Brown and Boris. Brown had invoiced the inventory to Garden for $6,000 – the cost to Brown had been $1,200 and Boris had invoiced Gordon for $3,000 – the cost to Boris had been $1,800. REQUIRED (a) Prepare Gordon Plc`s Consolidated Statement of Financial Position as at 31 December 2019.

(i) On 01 January 2013, Gordon Plc acquired 75% of Brown Ltd for $300,000 when Brown`s share capital and reserves were $252,000. Prior to the acquisition, the net book value of Brown`s non-current assets was $90,000. Brown revalued its non-current assets immediately prior to the acquisition to fair value and included the revaluation in its

(ii) On 01 January 2015, Gordon acquired 20% of Boris Ltd for $72,000 when the fair value of Boris`s net assets were $42,000.

(iii)

(iv) At the year end, Gordon Plc has inventory acquired from Brown and Boris. Brown had invoiced the inventory to Garden for $6,000 – the cost to Brown had been $1,200 and Boris had invoiced Gordon for $3,000 – the cost to Boris had been $1,800.

REQUIRED

(a) Prepare Gordon Plc`s Consolidated Statement of Financial Position as at 31

December 2019.

Step by step

Solved in 2 steps