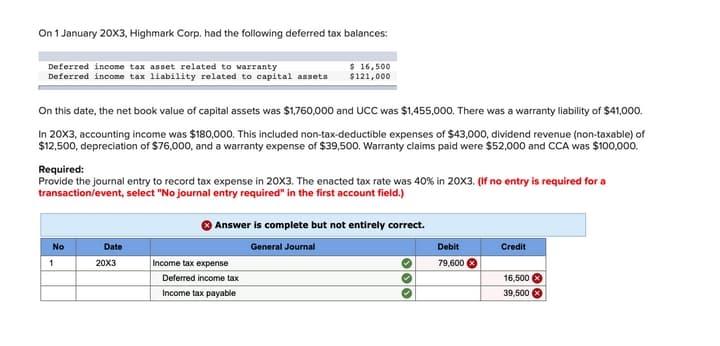

On 1 January 20X3, Highmark Corp. had the following deferred tax balances: Deferred income tax anset related to warranty Deferred income tax liability related to capital asseta $ 16,500 $121,000 On this date, the net book value of capital assets was $1,760,000 and UCC was $1,455,000. There was a warranty liability of $41,000. In 20X3, accounting income was $180,000. This included non-tax-deductible expenses of $43,000, dividend revenue (non-taxable) of $12,500, depreciation of $76,000, and a warranty expense of $39,500, Warranty claims paid were $52,000 and CCA was $100,000. Required: Provide the journal entry to record tax expense in 20X3. The enacted tax rate was 40% in 20X3. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete but not entirely correct. No Date General Journal Debit Credit 20X3 Income tax expense 79,600 Deferred income tax 16,500 O Income tax payable 39,500

On 1 January 20X3, Highmark Corp. had the following deferred tax balances: Deferred income tax anset related to warranty Deferred income tax liability related to capital asseta $ 16,500 $121,000 On this date, the net book value of capital assets was $1,760,000 and UCC was $1,455,000. There was a warranty liability of $41,000. In 20X3, accounting income was $180,000. This included non-tax-deductible expenses of $43,000, dividend revenue (non-taxable) of $12,500, depreciation of $76,000, and a warranty expense of $39,500, Warranty claims paid were $52,000 and CCA was $100,000. Required: Provide the journal entry to record tax expense in 20X3. The enacted tax rate was 40% in 20X3. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete but not entirely correct. No Date General Journal Debit Credit 20X3 Income tax expense 79,600 Deferred income tax 16,500 O Income tax payable 39,500

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 3RE: In the current year, Madison Corporation had 50,000 of taxable income at a tax rate of 25%. During...

Related questions

Question

Transcribed Image Text:On 1 January 20X3, Highmark Corp. had the following deferred tax balances:

Deferred income tax asset related to warranty

Deferred income tax liability related to capital assets

$ 16,500

$121,000

On this date, the net book value of capital assets was $1,760,000 and UCC was $1,455,000. There was a warranty liability of $41,000.

In 20X3, accounting income was $180,000. This included non-tax-deductible expenses of $43,000, dividend revenue (non-taxable) of

$12,500, depreciation of $76,000, and a warranty expense of $39,500. Warranty claims paid were $52,000 and CCA was $100,000.

Required:

Provide the journal entry to record tax expense in 20X3. The enacted tax rate was 40% in 20X3. (If no entry is required for a

transaction/event, select "No journal entry required" in the first account field.)

Answer is complete but not entirely correct.

No

Date

General Journal

Debit

Credit

1

20X3

Income tax expense

79,600 8

Deferred income tax

16,500 O

Income tax payable

39,500 8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning