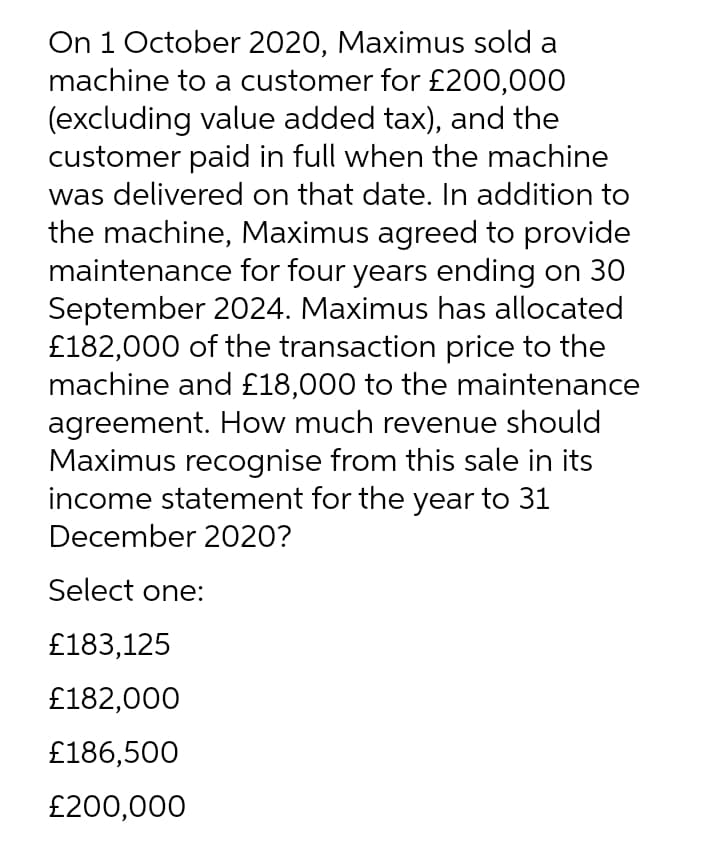

On 1 October 2020, Maximus sold a machine to a customer for £200,000 (excluding value added tax), and the customer paid in full when the machine was delivered on that date. In addition to the machine, Maximus agreed to provide maintenance for four years ending on 30 September 2024. Maximus has allocated £182,000 of the transaction price to the machine and £18,000 to the maintenance agreement. How much revenue should Maximus recognise from this sale in its income statement for the year to 31 December 2020? Select one: £183,125 £182,000 £186,500 £200.000

On 1 October 2020, Maximus sold a machine to a customer for £200,000 (excluding value added tax), and the customer paid in full when the machine was delivered on that date. In addition to the machine, Maximus agreed to provide maintenance for four years ending on 30 September 2024. Maximus has allocated £182,000 of the transaction price to the machine and £18,000 to the maintenance agreement. How much revenue should Maximus recognise from this sale in its income statement for the year to 31 December 2020? Select one: £183,125 £182,000 £186,500 £200.000

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 62P

Related questions

Question

Transcribed Image Text:On 1 October 2020, Maximus sold a

machine to a customer for £200,000

(excluding value added tax), and the

customer paid in full when the machine

was delivered on that date. In addition to

the machine, Maximus agreed to provide

maintenance for four years ending on 30

September 2024. Maximus has allocated

£182,000 of the transaction price to the

machine and £18,000 to the maintenance

agreement. How much revenue should

Maximus recognise from this sale in its

income statement for the year to 31

December 2020?

Select one:

£183,125

£182,000

£186,500

£200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT