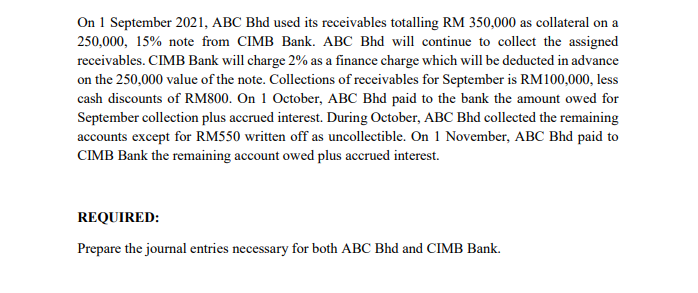

On 1 September 2021, ABC Bhd used its receivables totalling RM 350,000 as collateral on a 250,000, 15% note from CIMB Bank. ABC Bhd will continue to collect the assigned receivables. CIMB Bank will charge 2% as a finance charge which will be deducted in advance on the 250,000 value of the note. Collections of receivables for September is RM100,000, less cash discounts of RM800. On 1 October, ABC Bhd paid to the bank the amount owed for September collection plus accrued interest. During October, ABC Bhd collected the remaining accounts except for RM550 written off as uncollectible. On 1 November, ABC Bhd paid to CIMB Bank the remaining account owed plus accrued interest. REQUIRED: Prepare the journal entries necessary for both ABC Bhd and CIMB Bank.

On 1 September 2021, ABC Bhd used its receivables totalling RM 350,000 as collateral on a 250,000, 15% note from CIMB Bank. ABC Bhd will continue to collect the assigned receivables. CIMB Bank will charge 2% as a finance charge which will be deducted in advance on the 250,000 value of the note. Collections of receivables for September is RM100,000, less cash discounts of RM800. On 1 October, ABC Bhd paid to the bank the amount owed for September collection plus accrued interest. During October, ABC Bhd collected the remaining accounts except for RM550 written off as uncollectible. On 1 November, ABC Bhd paid to CIMB Bank the remaining account owed plus accrued interest. REQUIRED: Prepare the journal entries necessary for both ABC Bhd and CIMB Bank.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 11RE: On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to...

Related questions

Question

Transcribed Image Text:On 1 September 2021, ABC Bhd used its receivables totalling RM 350,000 as collateral on a

250,000, 15% note from CIMB Bank. ABC Bhd will continue to collect the assigned

receivables. CIMB Bank will charge 2% as a finance charge which will be deducted in advance

on the 250,000 value of the note. Collections of receivables for September is RM100,000, less

cash discounts of RM800. On 1 October, ABC Bhd paid to the bank the amount owed for

September collection plus accrued interest. During October, ABC Bhd collected the remaining

accounts except for RM550 written off as uncollectible. On 1 November, ABC Bhd paid to

CIMB Bank the remaining account owed plus accrued interest.

REQUIRED:

Prepare the journal entries necessary for both ABC Bhd and CIMB Bank.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub