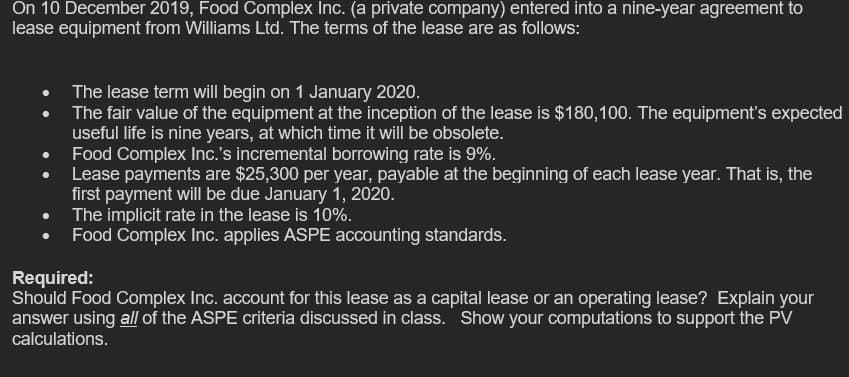

On 10 December 2019, Food Complex Inc. (a private company) entered into a nine-year agreement to lease equipment from Williams Ltd. The terms of the lease are as follows: The lease term will begin on 1 January 2020. The fair value of the equipment at the inception of the lease is $180,100. The equipment's expected useful life is nine years, at which time it will be obsolete. Food Complex Inc.'s incremental borrowing rate is 9%. Lease payments are $25,300 per year, payable at the beginning of each lease year. That is, the first payment will be due January 1, 2020. The implicit rate in the lease is 10%. Food Complex Inc. applies ASPE accounting standards. Required: Should Food Complex Inc. account for this lease as a capital lease or an operating lease? Explain your answer using all of the ASPE criteria discussed in class. Show your computations to support the PV calculations.

On 10 December 2019, Food Complex Inc. (a private company) entered into a nine-year agreement to lease equipment from Williams Ltd. The terms of the lease are as follows: The lease term will begin on 1 January 2020. The fair value of the equipment at the inception of the lease is $180,100. The equipment's expected useful life is nine years, at which time it will be obsolete. Food Complex Inc.'s incremental borrowing rate is 9%. Lease payments are $25,300 per year, payable at the beginning of each lease year. That is, the first payment will be due January 1, 2020. The implicit rate in the lease is 10%. Food Complex Inc. applies ASPE accounting standards. Required: Should Food Complex Inc. account for this lease as a capital lease or an operating lease? Explain your answer using all of the ASPE criteria discussed in class. Show your computations to support the PV calculations.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 1E: Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a...

Related questions

Question

100%

Transcribed Image Text:On 10 December 2019, Food Complex Inc. (a private company) entered into a nine-year agreement to

lease equipment from Williams Ltd. The terms of the lease are as follows:

The lease term will begin on 1 January 2020.

The fair value of the equipment at the inception of the lease is $180,100. The equipment's expected

useful life is nine years, at which time it will be obsolete.

Food Complex Inc.'s incremental borrowing rate is 9%.

Lease payments are $25,300 per year, payable at the beginning of each lease year. That is, the

first payment will be due January 1, 2020.

The implicit rate in the lease is 10%.

Food Complex Inc. applies ASPE accounting standards.

Required:

Should Food Complex Inc. account for this lease as a capital lease or an operating lease? Explain your

answer using all of the ASPE criteria discussed in class. Show your computations to support the PV

calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT