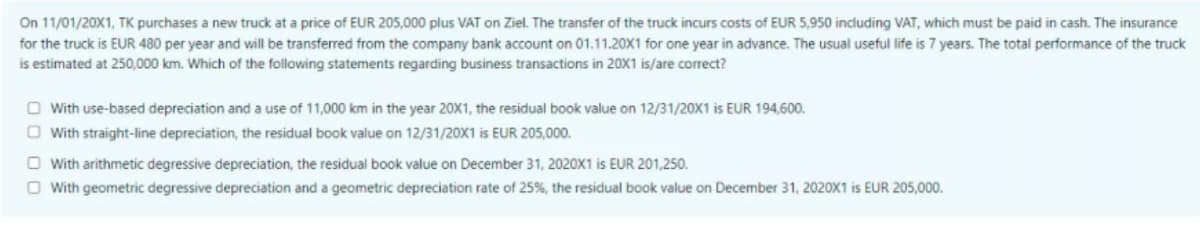

On 11/01/20X1, TK purchases a new truck at a price of EUR 205,000 plus VAT on Ziel. The transfer of the truck incurs costs of EUR 5,950 including VAT, which must be paid in cash. The insurance for the truck is EUR 480 per year and will be transferred from the company bank account on 01.11.20X1 for one year in advance. The usual useful life is 7 years. The total performance of the truck is estimated at 250,000 km. Which of the following statements regarding business transactions in 20X1 is/are correct?

On 11/01/20X1, TK purchases a new truck at a price of EUR 205,000 plus VAT on Ziel. The transfer of the truck incurs costs of EUR 5,950 including VAT, which must be paid in cash. The insurance for the truck is EUR 480 per year and will be transferred from the company bank account on 01.11.20X1 for one year in advance. The usual useful life is 7 years. The total performance of the truck is estimated at 250,000 km. Which of the following statements regarding business transactions in 20X1 is/are correct?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 10MC: On August 1, 2019, Kern Company leased a machine to Day Company for a 6-year period requiring...

Related questions

Question

Transcribed Image Text:On 11/01/20X1, TK purchases a new truck at a price of EUR 205,000 plus VAT on Ziel. The transfer of the truck incurs costs of EUR 5,950 including VAT, which must be paid in cash. The insurance

for the truck is EUR 480 per year and will be transferred from the company bank account on 01.11.20X1 for one year in advance. The usual useful life is 7 years. The total performance of the truck

is estimated at 250,000 km. Which of the following statements regarding business transactions in 20X1 is/are correct?

O With use-based depreciation and a use of 11,000 km in the year 20X1, the residual book value on 12/31/20X1 is EUR 194,600.

O With straight-line depreciation, the residual book value on 12/31/20X1 is EUR 205,000.

O With arithmetic degressive depreciation, the residual book value on December 31, 2020X1 is EUR 201,250.

O With geometric degressive depreciation and a geometric depreciation rate of 25%, the residual book value on December 31, 2020X1 is EUR 205,000.

Expert Solution

Step 1

All costs required to bring an asset to its present location and condition for its intended use should be capitalized. Therefore,Transfer cost (Exclusive of taxes) should be capitalized and initial insurance should not be capitalized.

Capitalized value of asset should be:

| Particulars | EURO |

| Cost of Truck | 2,05,000.00 |

| Transfer of truck (Excluding VAT) | 5,000.00 |

| Capitalization Value of the truck | 2,10,000.00 |

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College