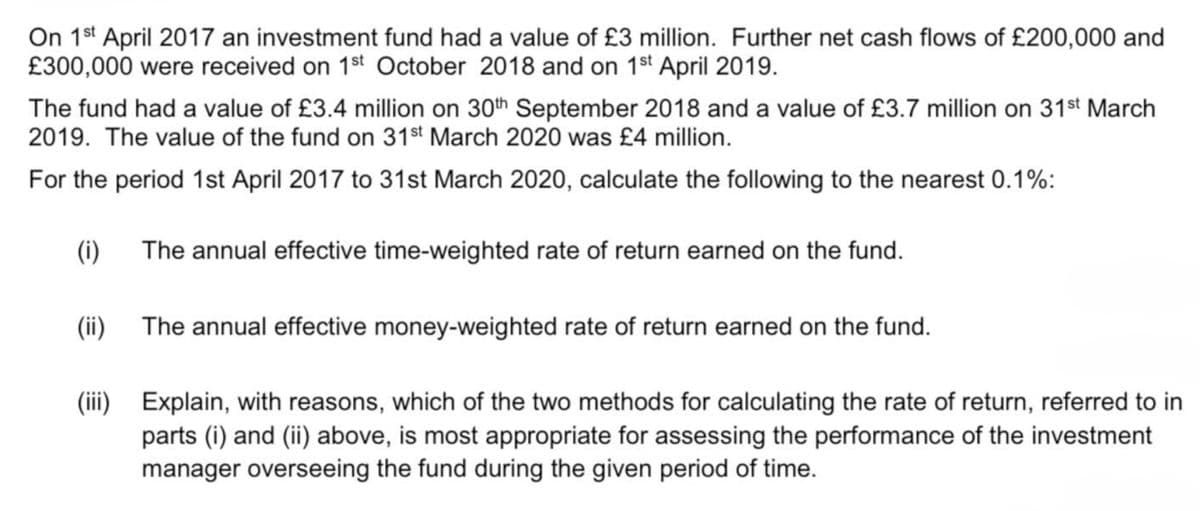

On 1st April 2017 an investment fund had a value of £3 million. Further net cash flows of £200,000 and £300,000 were received on 1st October 2018 and on 1st April 2019. The fund had a value of £3.4 million on 30th September 2018 and a value of £3.7 million on 31st March 2019. The value of the fund on 31st March 2020 was £4 million. For the period 1st April 2017 to 31st March 2020, calculate the following to the nearest 0.1%: The annual effective time-weighted rate of return earned on the fund. (i) The annual effective money-weighted rate of return earned on the fund. (iii) Explain, with reasons, which of the two methods for calculating the rate of return, referred to in parts (i) and (ii) above, is most appropriate for assessing the performance of the investment manager overseeing the fund during the given period of time. (ii)

On 1st April 2017 an investment fund had a value of £3 million. Further net cash flows of £200,000 and £300,000 were received on 1st October 2018 and on 1st April 2019. The fund had a value of £3.4 million on 30th September 2018 and a value of £3.7 million on 31st March 2019. The value of the fund on 31st March 2020 was £4 million. For the period 1st April 2017 to 31st March 2020, calculate the following to the nearest 0.1%: The annual effective time-weighted rate of return earned on the fund. (i) The annual effective money-weighted rate of return earned on the fund. (iii) Explain, with reasons, which of the two methods for calculating the rate of return, referred to in parts (i) and (ii) above, is most appropriate for assessing the performance of the investment manager overseeing the fund during the given period of time. (ii)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

ChapterM: Time Value Of Money Module

Section: Chapter Questions

Problem 10RE: If 90,000 is invested in a fund on December 31, 2019, and 5 equal annual withdrawals of 23,138.32...

Related questions

Question

Using formulas, no tables

correct answers:

i) 0.052169 pa

ii) let NFV(5%)= 0.003061 and let NFV(4%)= -0.101289, Then i = 0.0497 pa

Transcribed Image Text:On 1st April 2017 an investment fund had a value of £3 million. Further net cash flows of £200,000 and

£300,000 were received on 1st October 2018 and on 1st April 2019.

The fund had a value of £3.4 million on 30th September 2018 and a value of £3.7 million on 31st March

2019. The value of the fund on 31st March 2020 was £4 million.

For the period 1st April 2017 to 31st March 2020, calculate the following to the nearest 0.1%:

(i)

(ii)

The annual effective time-weighted rate of return earned on the fund.

The annual effective money-weighted rate of return earned on the fund.

(iii) Explain, with reasons, which of the two methods for calculating the rate of return, referred to in

parts (i) and (ii) above, is most appropriate for assessing the performance of the investment

manager overseeing the fund during the given period of time.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 7 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning