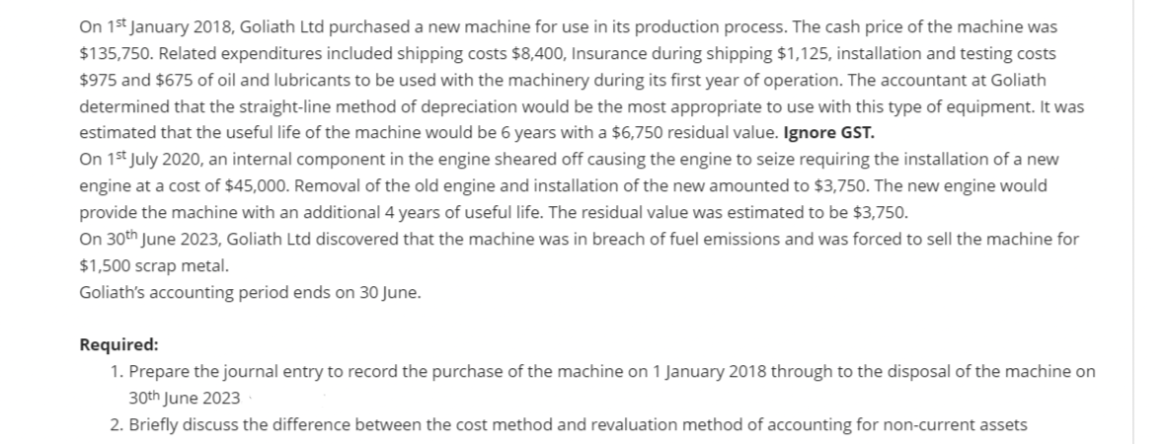

On 1st January 2018, Goliath Ltd purchased a new machine for use in its production process. The cash price of the machine was $135,750. Related expenditures included shipping costs $8,400, Insurance during shipping $1,125, installation and testing costs $975 and $675 of oil and lubricants to be used with the machinery during its first year of operation. The accountant at Goliath determined that the straight-line method of depreciation would be the most appropriate to use with this type of equipment. It was estimated that the useful life of the machine would be 6 years with a $6,750 residual value. Ignore GST. On 1st July 2020, an internal component in the engine sheared off causing the engine to seize requiring the installation of a new engine at a cost of $45,000. Removal of the old engine and installation of the new amounted to $3,750. The new engine would provide the machine with an additional 4 years of useful life. The residual value was estimated to be $3,750. On 30th June 2023, Goliath Ltd discovered that the machine was in breach of fuel emissions and was forced to sell the machine for $1,500 scrap metal. Goliath's accounting period ends on 30 June. Required: 1. Prepare the journal entry to record the purchase of the machine on 1 January 2018 through to the disposal of the machine on 30th June 2023 2. Briefly discuss the difference between the cost method and revaluation method of accounting for non-current assets

On 1st January 2018, Goliath Ltd purchased a new machine for use in its production process. The cash price of the machine was $135,750. Related expenditures included shipping costs $8,400, Insurance during shipping $1,125, installation and testing costs $975 and $675 of oil and lubricants to be used with the machinery during its first year of operation. The accountant at Goliath determined that the straight-line method of depreciation would be the most appropriate to use with this type of equipment. It was estimated that the useful life of the machine would be 6 years with a $6,750 residual value. Ignore GST. On 1st July 2020, an internal component in the engine sheared off causing the engine to seize requiring the installation of a new engine at a cost of $45,000. Removal of the old engine and installation of the new amounted to $3,750. The new engine would provide the machine with an additional 4 years of useful life. The residual value was estimated to be $3,750. On 30th June 2023, Goliath Ltd discovered that the machine was in breach of fuel emissions and was forced to sell the machine for $1,500 scrap metal. Goliath's accounting period ends on 30 June. Required: 1. Prepare the journal entry to record the purchase of the machine on 1 January 2018 through to the disposal of the machine on 30th June 2023 2. Briefly discuss the difference between the cost method and revaluation method of accounting for non-current assets

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 13PA: Colquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value...

Related questions

Question

Please help me

Transcribed Image Text:On 15t January 2018, Goliath Ltd purchased a new machine for use in its production process. The cash price of the machine was

$135,750. Related expenditures included shipping costs $8,400, Insurance during shipping $1,125, installation and testing costs

$975 and $675 of oil and lubricants to be used with the machinery during its first year of operation. The accountant at Goliath

determined that the straight-line method of depreciation would be the most appropriate to use with this type of equipment. It was

estimated that the useful life of the machine would be 6 years with a $6,750 residual value. Ignore GST.

On 1st July 2020, an internal component in the engine sheared off causing the engine to seize requiring the installation of a new

engine at a cost of $45,000. Removal of the old engine and installation of the new amounted to $3,750. The new engine would

provide the machine with an additional 4 years of useful life. The residual value was estimated to be $3,750.

On 30th June 2023, Goliath Ltd discovered that the machine was in breach of fuel emissions and was forced to sell the machine for

$1,500 scrap metal.

Goliath's accounting period ends on 30 June.

Required:

1. Prepare the journal entry to record the purchase of the machine on 1 January 2018 through to the disposal of the machine on

30th June 2023

2. Briefly discuss the difference between the cost method and revaluation method of accounting for non-current assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning