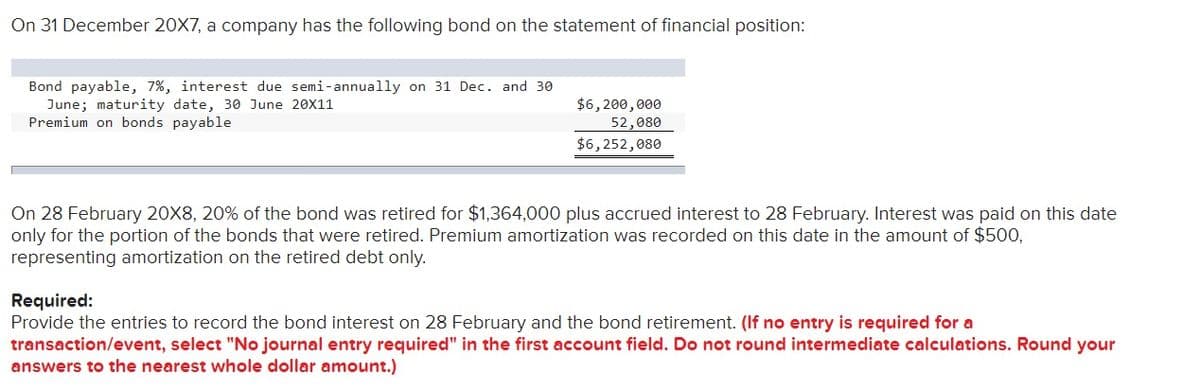

On 31 December 20X7, a company has the following bond on the statement of financial position: Bond payable, 7%, interest due semi-annually on 31 Dec. and 30 June; maturity date, 30 June 20X11 Premium on bonds payable $6, 200,000 52,080 $6,252,080 On 28 February 20X8, 20% of the bond was retired for $1,364,000 plus accrued interest to 28 February. Interest was paid on this date only for the portion of the bonds that were retired. Premium amortization was recorded on this date in the amount of $500, representing amortization on the retired debt only. Required: Provide the entries to record the bond interest on 28 February and the bond retirement. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.)

On 31 December 20X7, a company has the following bond on the statement of financial position: Bond payable, 7%, interest due semi-annually on 31 Dec. and 30 June; maturity date, 30 June 20X11 Premium on bonds payable $6, 200,000 52,080 $6,252,080 On 28 February 20X8, 20% of the bond was retired for $1,364,000 plus accrued interest to 28 February. Interest was paid on this date only for the portion of the bonds that were retired. Premium amortization was recorded on this date in the amount of $500, representing amortization on the retired debt only. Required: Provide the entries to record the bond interest on 28 February and the bond retirement. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 15MCQ

Related questions

Question

Transcribed Image Text:On 31 December 20X7, a company has the following bond on the statement of financial position:

Bond payable, 7%, interest due semi-annually on 31 Dec. and 30

June; maturity date, 30 June 20X11

Premium on bonds payable

$6, 200,000

52,080

$6,252,080

On 28 February 20X8, 20% of the bond was retired for $1,364,000 plus accrued interest to 28 February. Interest was paid on this date

only for the portion of the bonds that were retired. Premium amortization was recorded on this date in the amount of $500,

representing amortization on the retired debt only.

Required:

Provide the entries to record the bond interest on 28 February and the bond retirement. (If no entry is required for a

transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your

answers to the nearest whole dollar amount.)

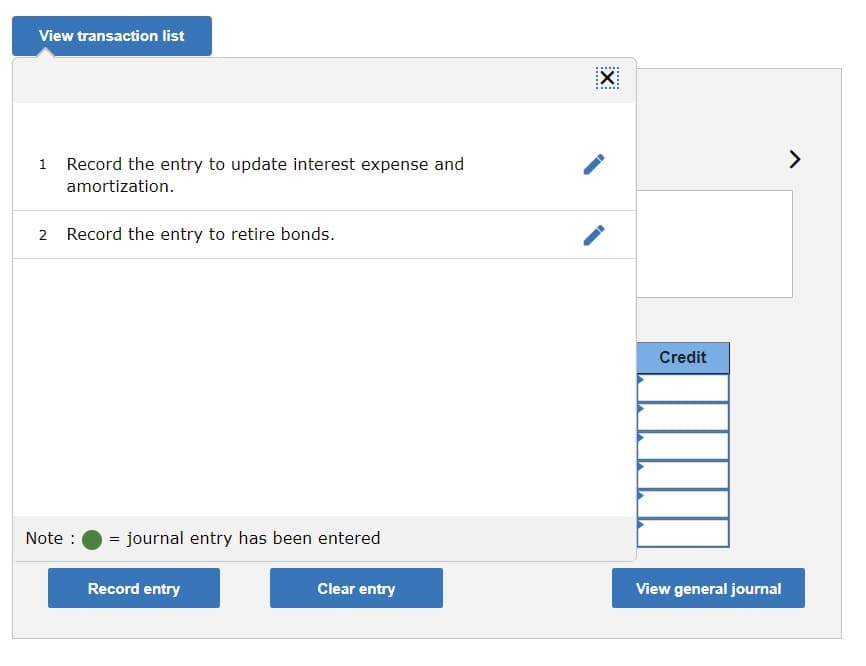

Transcribed Image Text:View transaction list

1 Record the entry to update interest expense and

>

amortization.

2 Record the entry to retire bonds.

Credit

Note :

= journal entry has been entered

Record entry

Clear entry

View general journal

......

:X:

....

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,