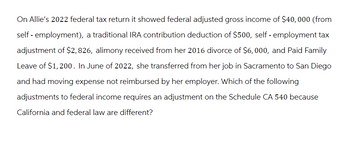

On Allie's 2022 federal tax return it showed federal adjusted gross income of $40,000 (from self-employment), a traditional IRA contribution deduction of $500, self-employment tax adjustment of $2,826, alimony received from her 2016 divorce of $6,000, and Paid Family Leave of $1,200. In June of 2022, she transferred from her job in Sacramento to San Diego and had moving expense not reimbursed by her employer. Which of the following adjustments to federal income requires an adjustment on the Schedule CA 540 because California and federal law are different?

On Allie's 2022 federal tax return it showed federal adjusted gross income of $40,000 (from self-employment), a traditional IRA contribution deduction of $500, self-employment tax adjustment of $2,826, alimony received from her 2016 divorce of $6,000, and Paid Family Leave of $1,200. In June of 2022, she transferred from her job in Sacramento to San Diego and had moving expense not reimbursed by her employer. Which of the following adjustments to federal income requires an adjustment on the Schedule CA 540 because California and federal law are different?

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. The following adjustment is missing Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Transcribed Image Text:On Allie's 2022 federal tax return it showed federal adjusted gross income of $40,000 (from

self-employment), a traditional IRA contribution deduction of $500, self-employment tax

adjustment of $2,826, alimony received from her 2016 divorce of $6,000, and Paid Family

Leave of $1,200. In June of 2022, she transferred from her job in Sacramento to San Diego

and had moving expense not reimbursed by her employer. Which of the following

adjustments to federal income requires an adjustment on the Schedule CA 540 because

California and federal law are different?

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT