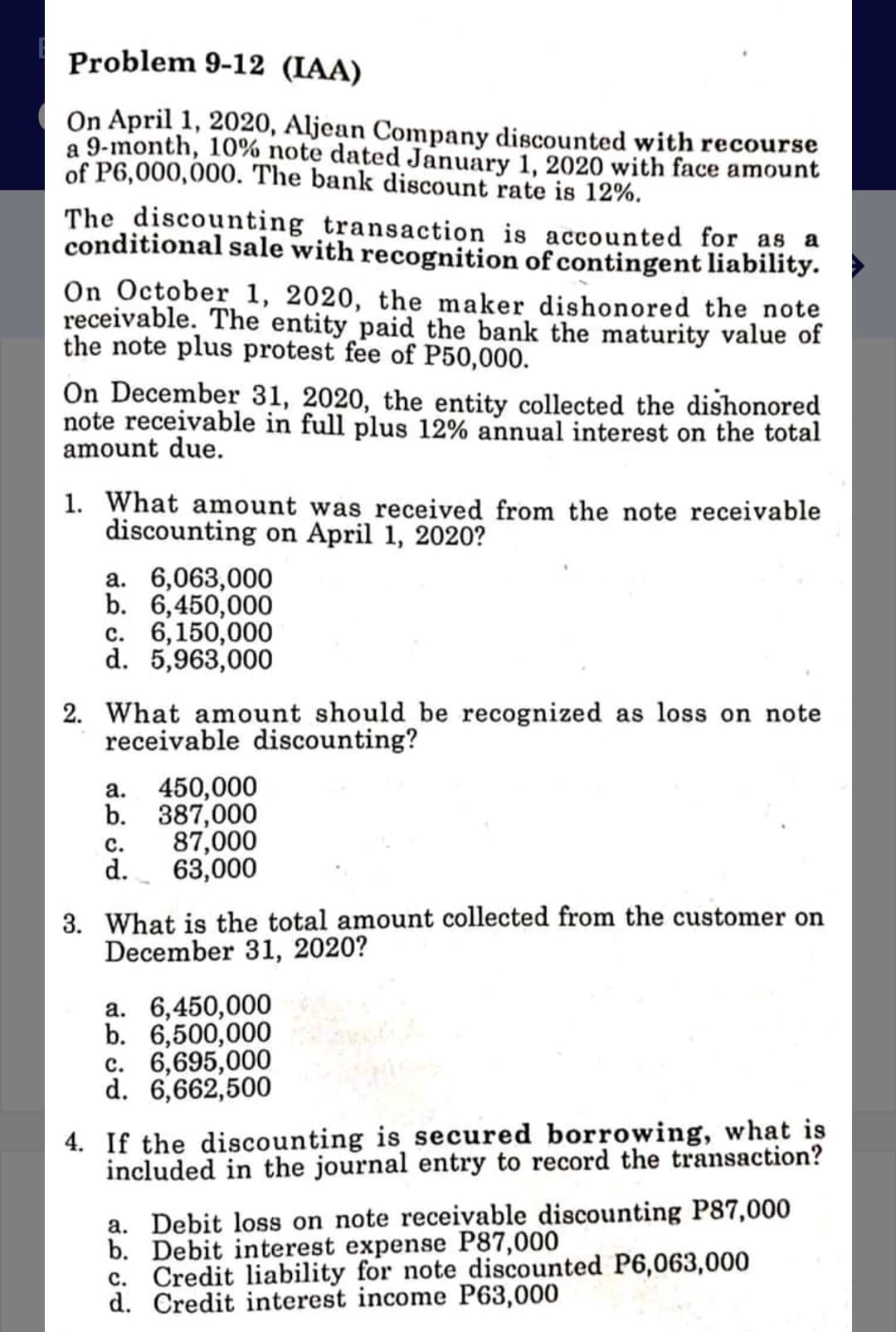

On April 1, 2020, Aljean Company discounted with recourse a 9-month, 10% note dated January 1, 2020 with face amount of P6,000,000. The bank discount rate is 12%. The discounting transaction is accounted for as a conditional sale with recognition of contingent liability. On October 1, 2020, the maker dishonored the note receivable. The entity paid the bank the maturity value of the note plus protest fee of P50,000. On December 31, 2020, the entity collected the dishonored note receivable in full plus 12% annual interest on the total amount due. 1. What amount was received from the note receivable discounting on April 1, 2020? a. 6,063,000 b. 6,450,000 c. 6,150,000 d. 5,963,000 2. What amount should be recognized as loss on note receivable discounting? 450,000 b. 387,000 87,000 а. с. d. 63,000 3. What is the total amount collected from the customer on December 31, 2020? a. 6,450,000 b. 6,500,000 c. 6,695,000 d. 6,662,500 4. If the discounting is secured borrowing, what is included in the journal entry to record the transaction? a. Debit loss on note receivable discounting P87,000 b. Debit interest expense P87,000 c. Credit liability for note discounted P6,063,000 d. Credit interest income P63,000

On April 1, 2020, Aljean Company discounted with recourse a 9-month, 10% note dated January 1, 2020 with face amount of P6,000,000. The bank discount rate is 12%. The discounting transaction is accounted for as a conditional sale with recognition of contingent liability. On October 1, 2020, the maker dishonored the note receivable. The entity paid the bank the maturity value of the note plus protest fee of P50,000. On December 31, 2020, the entity collected the dishonored note receivable in full plus 12% annual interest on the total amount due. 1. What amount was received from the note receivable discounting on April 1, 2020? a. 6,063,000 b. 6,450,000 c. 6,150,000 d. 5,963,000 2. What amount should be recognized as loss on note receivable discounting? 450,000 b. 387,000 87,000 а. с. d. 63,000 3. What is the total amount collected from the customer on December 31, 2020? a. 6,450,000 b. 6,500,000 c. 6,695,000 d. 6,662,500 4. If the discounting is secured borrowing, what is included in the journal entry to record the transaction? a. Debit loss on note receivable discounting P87,000 b. Debit interest expense P87,000 c. Credit liability for note discounted P6,063,000 d. Credit interest income P63,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 15P: Comprehensive Receivables Problem Blackmon Corporations December 31, 2018, balance sheet disclosed...

Related questions

Question

If the discounting is secured borrowing, what is included in the

record the transaction?

a. Debit loss on note receivable discounting Ᵽ87,000

b. Debit interest expense Ᵽ87,000

c. Credit liability for note discounted Ᵽ6,063,000

d. Credit interest income Ᵽ63,000

Transcribed Image Text:Problem 9-12 (IAA)

On April 1, 2020, Aljean Company discounted with recourse

a 9-month, 10% note dated January 1, 2020 with face amount

of P6,000,000. The bank discount rate is 12%.

The discounting transaction is accounted for as a

conditional sale with recognition of contingent liability.

On October 1, 2020, the maker dishonored the note

receivable. The entity paid the bank the maturity value of

the note plus protest fee of P50,000.

On December 31, 2020, the entity collected the dishonored

note receivable in full plus 12% annual interest on the total

amount due.

1. What amount was received from the note receivable

discounting on April 1, 2020?

a. 6,063,000

b. 6,450,000

c. 6,150,000

d. 5,963,000

2. What amount should be recognized as loss on note

receivable discounting?

a. 450,000

b. 387,000

с.

87,000

d.

63,000

3. What is the total amount collected from the customer on

December 31, 2020?

a. 6,450,000

b. 6,500,000

с. 6,695,000

d. 6,662,500

4. If the discounting is secured borrowing, what is

included in the journal entry to record the transaction?

a. Debit loss on note receivable discounting P87,000

b. Debit interest expense P87,000

c. Credit liability for note discounted P6,063,000

d. Credit interest income P63,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,