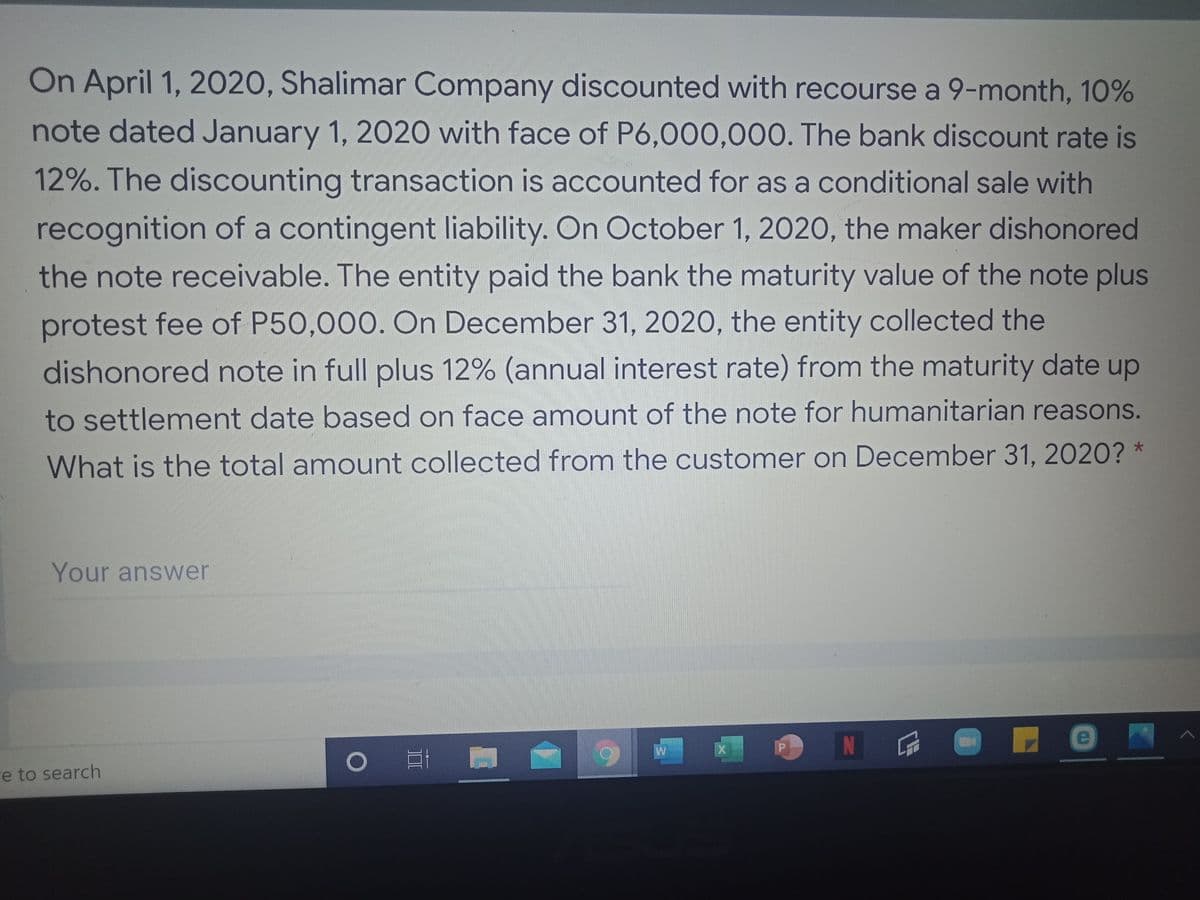

On April 1, 2020, Shalimar Company discounted with recourse a 9-month, 10% note dated January 1, 2020 with face of P6,000,000. The bank discount rate is 12%. The discounting transaction is accounted for as a conditional sale with recognition of a contingent liability. On October 1, 2020, the maker dishonored the note receivable. The entity paid the bank the maturity value of the note plus protest fee of P50,000. On December 31, 2020, the entity collected the dishonored note in full plus 12% (annual interest rate) from the maturity date up to settlement date based on face amount of the note for humanitarian reasons. What is the total amount collected from the customer on December 31, 2020?

On April 1, 2020, Shalimar Company discounted with recourse a 9-month, 10% note dated January 1, 2020 with face of P6,000,000. The bank discount rate is 12%. The discounting transaction is accounted for as a conditional sale with recognition of a

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images