On April 1, 2022, Wilson Corp. purchased a call option on shares of FVA stock. The contract was for 100 shares at a strike price of $130 per share, with an expiration date of June 30, 2022. The option contract premium (the amount paid to enter the contract at signing) was $70. Wilson settled the option on June 15, when a market appraisal estimated the time value of the option to be $50 (assume cash settlement). Prices of FVA stock during the option period are provided below. June 15 $135 Price of FVA stock: April 1 $130 June 30 $125 What amount of gain or loss on settlement is recorded in the journal entry to record the settlement of the option contract? (Loss amounts should be indicated with a minus sign.)

On April 1, 2022, Wilson Corp. purchased a call option on shares of FVA stock. The contract was for 100 shares at a strike price of $130 per share, with an expiration date of June 30, 2022. The option contract premium (the amount paid to enter the contract at signing) was $70. Wilson settled the option on June 15, when a market appraisal estimated the time value of the option to be $50 (assume cash settlement). Prices of FVA stock during the option period are provided below. June 15 $135 Price of FVA stock: April 1 $130 June 30 $125 What amount of gain or loss on settlement is recorded in the journal entry to record the settlement of the option contract? (Loss amounts should be indicated with a minus sign.)

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 6P

Related questions

Question

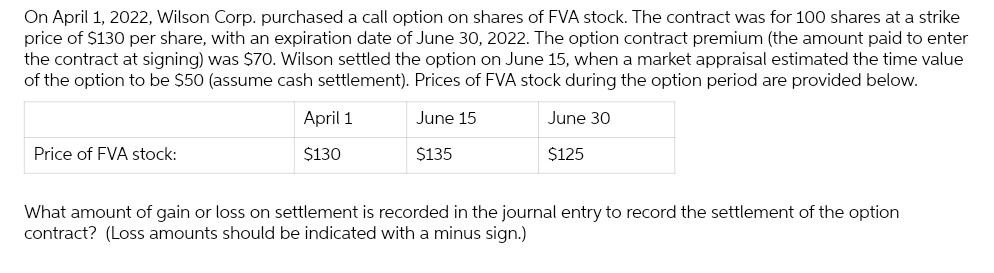

Transcribed Image Text:On April 1, 2022, Wilson Corp. purchased a call option on shares of FVA stock. The contract was for 100 shares at a strike

price of $130 per share, with an expiration date of June 30, 2022. The option contract premium (the amount paid to enter

the contract at signing) was $70. Wilson settled the option on June 15, when a market appraisal estimated the time value

of the option to be $50 (assume cash settlement). Prices of FVA stock during the option period are provided below.

June 15

June 30

$125

$135

Price of FVA stock:

April 1

$130

What amount of gain or loss on settlement is recorded in the journal entry to record the settlement of the option

contract? (Loss amounts should be indicated with a minus sign.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning