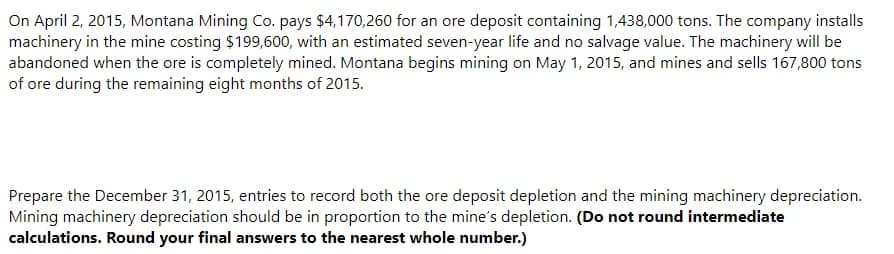

On April 2, 2015, Montana Mining Co. pays $4,170,260 for an ore deposit containing 1,438,000 tons. The company installs machinery in the mine costing $199,600, with an estimated seven-year life and no salvage value. The machinery will be abandoned when the ore is completely mined. Montana begins mining on May 1, 2015, and mines and sells 167,800 tons of ore during the remaining eight months of 2015. Prepare the December 31, 2015, entries to record both the ore deposit depletion and the mining machinery depreciation. Mining machinery depreciation should be in proportion to the mine's depletion. (Do not round intermediate calculations. Round your final answers to the nearest whole number.)

On April 2, 2015, Montana Mining Co. pays $4,170,260 for an ore deposit containing 1,438,000 tons. The company installs machinery in the mine costing $199,600, with an estimated seven-year life and no salvage value. The machinery will be abandoned when the ore is completely mined. Montana begins mining on May 1, 2015, and mines and sells 167,800 tons of ore during the remaining eight months of 2015. Prepare the December 31, 2015, entries to record both the ore deposit depletion and the mining machinery depreciation. Mining machinery depreciation should be in proportion to the mine's depletion. (Do not round intermediate calculations. Round your final answers to the nearest whole number.)

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 6PA: Gimli Miners recently purchased the rights to a diamond mine. It is estimated that there are one...

Related questions

Question

Transcribed Image Text:On April 2, 2015, Montana Mining Co. pays $4,170,260 for an ore deposit containing 1,438,000 tons. The company installs

machinery in the mine costing $199,600, with an estimated seven-year life and no salvage value. The machinery will be

abandoned when the ore is completely mined. Montana begins mining on May 1, 2015, and mines and sells 167,800 tons

of ore during the remaining eight months of 2015.

Prepare the December 31, 2015, entries to record both the ore deposit depletion and the mining machinery depreciation.

Mining machinery depreciation should be in proportion to the mine's depletion. (Do not round intermediate

calculations. Round your final answers to the nearest whole number.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,