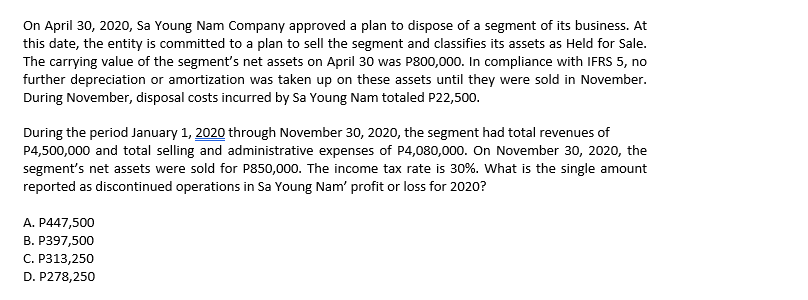

On April 30, 2020, Sa Young Nam Company approved a plan to dispose of a segment of its business. At this date, the entity is committed to a plan to sell the segment and classifies its assets as Held for Sale. The carrying value of the segment's net assets on April 30 was P800,000. In compliance with IFRS 5, no further depreciation or amortization was taken up on these assets until they were sold in November. During November, disposal costs incurred by Sa Young Nam totaled P22,500. During the period January 1, 2020 through November 30, 2020, the segment had total revenues of P4,500,000 and total selling and administrative expenses of P4,080,000. On November 30, 2020, the segment's net assets were sold for P850,000. The income tax rate is 30%. What is the single amount reported as discontinued onerations in Sa Voung Nam' profit or loss for 2020?

On April 30, 2020, Sa Young Nam Company approved a plan to dispose of a segment of its business. At this date, the entity is committed to a plan to sell the segment and classifies its assets as Held for Sale. The carrying value of the segment's net assets on April 30 was P800,000. In compliance with IFRS 5, no further depreciation or amortization was taken up on these assets until they were sold in November. During November, disposal costs incurred by Sa Young Nam totaled P22,500. During the period January 1, 2020 through November 30, 2020, the segment had total revenues of P4,500,000 and total selling and administrative expenses of P4,080,000. On November 30, 2020, the segment's net assets were sold for P850,000. The income tax rate is 30%. What is the single amount reported as discontinued onerations in Sa Voung Nam' profit or loss for 2020?

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 26P

Related questions

Question

Transcribed Image Text:On April 30, 2020, Sa Young Nam Company approved a plan to dispose of a segment of its business. At

this date, the entity is committed to a plan to sell the segment and classifies its assets as Held for Sale.

The carrying value of the segment's net assets on April 30 was P800,000. In compliance with IFRS 5, no

further depreciation or amortization was taken up on these assets until they were sold in November.

During November, disposal costs incurred by Sa Young Nam totaled P22,500.

During the period January 1, 2020 through November 30, 2020, the segment had total revenues of

P4,500,000 and total selling and administrative expenses of P4,080,00o. On November 30, 2020, the

segment's net assets were sold for P850,000. The income tax rate is 30%. What is the single amount

reported as discontinued operations in Sa Young Nam' profit or loss for 2020?

A. P447,500

B. P397,500

С. Р313,250

D. P278,250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT