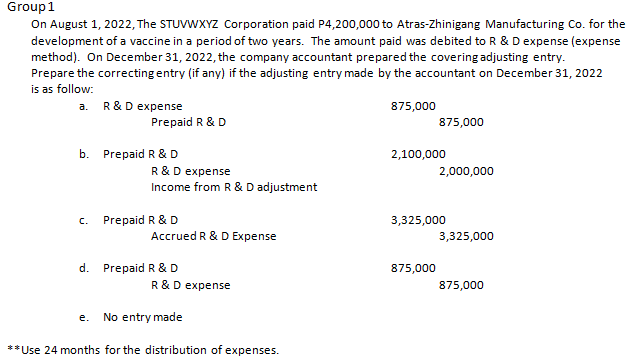

On August 1, 2022, The STUVWXYZ Corporation paid P4,200,000 to Atras-Zhinigang Manufacturing Co. for the development of a vaccine in a period of two years. The amount paid was debited to R & Dexpense (expense method). On December 31, 2022, the company accountant prepared the covering adjusting entry. Prepare the correcting entry (if any) if the adjusting entry made by the accountant on December 31, 2022 is as follow: a. R&D expense 875,000 Prepaid R & D 875,000 b. Prepaid R & D 2,100,000 R&D expense Income from R & D adjustment 2,000,000 c. Prepaid R & D 3,325,000 Accrued R & D Expense 3,325,000 d. Prepaid R & D 875,000 R&D expense 875,000 No entry made

On August 1, 2022, The STUVWXYZ Corporation paid P4,200,000 to Atras-Zhinigang Manufacturing Co. for the development of a vaccine in a period of two years. The amount paid was debited to R & Dexpense (expense method). On December 31, 2022, the company accountant prepared the covering adjusting entry. Prepare the correcting entry (if any) if the adjusting entry made by the accountant on December 31, 2022 is as follow: a. R&D expense 875,000 Prepaid R & D 875,000 b. Prepaid R & D 2,100,000 R&D expense Income from R & D adjustment 2,000,000 c. Prepaid R & D 3,325,000 Accrued R & D Expense 3,325,000 d. Prepaid R & D 875,000 R&D expense 875,000 No entry made

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter3: The Basics Of Record Keeping And Financial Statement Preparation: Income Statement

Section: Chapter Questions

Problem 14E

Related questions

Question

give solutions and explain it

Transcribed Image Text:Group1

On August 1, 2022, The STUVWXYZ Corporation paid P4,200,000 to Atras-Zhinigang Manufacturing Co. for the

development of a vaccine in a period of two years. The amount paid was debited to R & Dexpense (expense

method). On December 31, 2022, the company accountant prepared the covering adjusting entry.

Prepare the correcting entry (if any) if the adjusting entry made by the accountant on December 31, 2022

is as follow:

R&D expense

875,000

a.

Prepaid R & D

875,000

b. Prepaid R & D

2,100,000

R &D expense

Income from R & D adjustment

2,000,000

c. Prepaid R & D

3,325,000

Accrued R & DExpense

3,325,000

d. Prepaid R & D

875,000

R&D expense

875,000

е.

No entry made

** Use 24 months for the distribution of expenses.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

where is the correcting entry of the following?

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you