On daay 1. 201 Engneers Cret Unon (ECU) ued , 20y bedi payl wih t valus 100.000. The bods pay intereet on e0 and Deceter 31 Had he ument Requirement t. f he martat interest when ECUe t bond, wi the bonde te ped e valu t e premm, ort a dscour Erplain The 7% bends ed when te market inerest rale i % will te piced al They ie in manet o invets py qure therm. Requrement , he maret rt r whe ECUe tond w thes bonde te end a e va a preu oral adaun aplan The P bonds ised when the martel interest ale iswite pnced al They are in the manet, o ta wl pay to sque them

On daay 1. 201 Engneers Cret Unon (ECU) ued , 20y bedi payl wih t valus 100.000. The bods pay intereet on e0 and Deceter 31 Had he ument Requirement t. f he martat interest when ECUe t bond, wi the bonde te ped e valu t e premm, ort a dscour Erplain The 7% bends ed when te market inerest rale i % will te piced al They ie in manet o invets py qure therm. Requrement , he maret rt r whe ECUe tond w thes bonde te end a e va a preu oral adaun aplan The P bonds ised when the martel interest ale iswite pnced al They are in the manet, o ta wl pay to sque them

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 12E: On October 1, 2019, Ball Company issued 9% bonds dated October 1, 2019, with a face amount of...

Related questions

Question

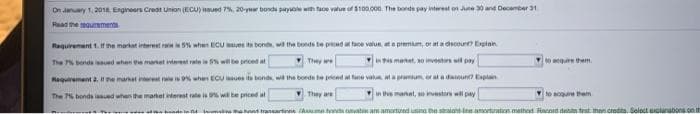

Transcribed Image Text:On danary 1.201 Engneers Creat Unon (ECU) ued 7%, 20-y bondi pyle with face value of 100.000. The bonde pay intereat on June 0 and Decamber 31

Raad he eaurement

Raquirement t.fhe martat interet rni% when ECUes t bond, wi the bonde be pried at tace valun, ate premium, or ata dscoun Erptan

The 7% bende ied when te martet ret rale i wbe piced at

They we

in metet, o investors il pay

to qure them.

Requirement a. he market rat rae % when ECU ues bonds w the borde te end e val a premum or aladaunEaplain

The bonds isued when the market interest rale is wil be priced al

V They are

in this manet, esti will pay

vto sogue them

n4 ms hnt tranartinne Ama tn atn am amartued usna he straianine anortuaten malhed Racnd deti tst men credta. Select aclanabona.on t

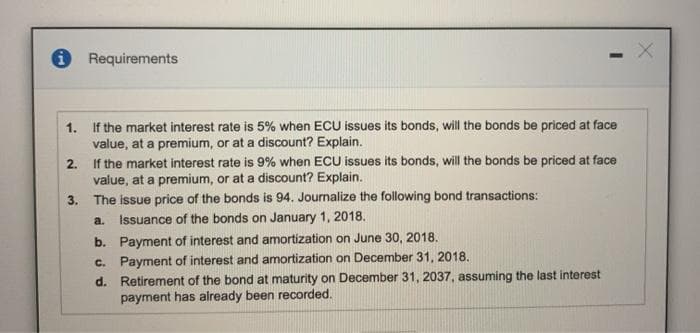

Transcribed Image Text:O Requirements

1. If the market interest rate is 5% when ECU issues its bonds, will the bonds be priced at face

value, at a premium, or at a discount? Explain.

If the market interest rate is 9% when ECU issues its bonds, will the bonds be priced at face

value, at a premium, or at a discount? Explain.

3. The issue price of the bonds is 94. Journalize the following bond transactions:

2.

a.

Issuance of the bonds on January 1, 2018.

b. Payment of interest and amortization on June 30, 2018.

c. Payment of interest and amortization on December 31, 2018.

d. Retirement of the bond at maturity on December 31, 2037, assuming the last interest

payment has already been recorded.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College