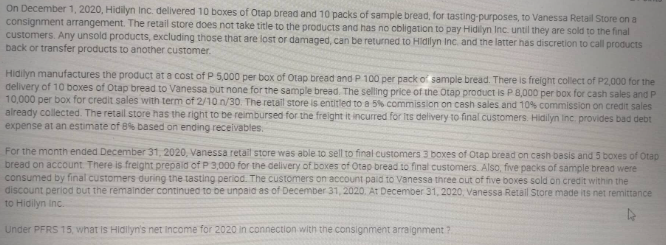

On December 1, 2020, Hidilyn Inc. delivered 10 boxes of Otap bread and 10 packs of sample bread, for tasting-purposes, to Vanessa Retail Store on a consignment arrangement. The retail store does not take title to the products and has no obligation to pay Hidilyn Inc. until they are sold to the final customers. Any unsold products, excluding those that are lost or damaged, can be returned to Hidilyn Inc. and the latter has discretion to call products back or transfer products to another customer. Hidilyn manufactures the product at a cost of P 5,000 per box of Otap bread and P 100 per pack of sample bread. There is freight collect of P2,000 for t delivery of 10 boxes of Otap bread to Vanessa but none for the sample bread. The selling price of the Otap product is P 8,000 per box for cash sales anc 10,000 per box for credit sales with term of 2/10 n/30. The retail store is entitled to a 5% commission on cash sales and 10% commission on credit sale already collected. The retail store has the right to be reimbursed for the freight it incurred for its delivery to final customers. Hidilyn Inc. provides bad det expense at an estimate of 8% based on ending receivables. For the month ended December 31, 2020, Vanessa retail store was able to sell to final customers 3 boxes of Otap bread on cash basis and 5 boxes of Or bread on account. There is freight prepaid of P 3,000 for the delivery of boxes of Otep bread to final customers. Also, five packs of sample bread were consumed by final customers during the tasting period. The customers on account paid to Vanessa three out of five boxes sold on credit within the discount period but the remainder continued to be unpaid as of December 31, 2020. At December 31, 2020, Vanessa Retail Store made its net remittand to Hidilyn Inc. Under PFRS 15, what is Hidilyn's net Income for 2020 in connection with the consignment arraignment ?

On December 1, 2020, Hidilyn Inc. delivered 10 boxes of Otap bread and 10 packs of sample bread, for tasting-purposes, to Vanessa Retail Store on a consignment arrangement. The retail store does not take title to the products and has no obligation to pay Hidilyn Inc. until they are sold to the final customers. Any unsold products, excluding those that are lost or damaged, can be returned to Hidilyn Inc. and the latter has discretion to call products back or transfer products to another customer. Hidilyn manufactures the product at a cost of P 5,000 per box of Otap bread and P 100 per pack of sample bread. There is freight collect of P2,000 for t delivery of 10 boxes of Otap bread to Vanessa but none for the sample bread. The selling price of the Otap product is P 8,000 per box for cash sales anc 10,000 per box for credit sales with term of 2/10 n/30. The retail store is entitled to a 5% commission on cash sales and 10% commission on credit sale already collected. The retail store has the right to be reimbursed for the freight it incurred for its delivery to final customers. Hidilyn Inc. provides bad det expense at an estimate of 8% based on ending receivables. For the month ended December 31, 2020, Vanessa retail store was able to sell to final customers 3 boxes of Otap bread on cash basis and 5 boxes of Or bread on account. There is freight prepaid of P 3,000 for the delivery of boxes of Otep bread to final customers. Also, five packs of sample bread were consumed by final customers during the tasting period. The customers on account paid to Vanessa three out of five boxes sold on credit within the discount period but the remainder continued to be unpaid as of December 31, 2020. At December 31, 2020, Vanessa Retail Store made its net remittand to Hidilyn Inc. Under PFRS 15, what is Hidilyn's net Income for 2020 in connection with the consignment arraignment ?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 15E: On January 1, 2019, Piper Company entered into an agreement with Save-Mart to sell its most popular...

Related questions

Question

Under PFRS15, What is Vanessa's net remittance to Hidilyn on December 31, 2020

Transcribed Image Text:On December 1, 2020, Hidilyn Inc. delivered 10 boxes of Otap bread and 10 packs of sample bread, for tasting-purposes, to Vanessa Retail Store on a

consignment arrangement. The retail store does not take title to the products and has no obligation to pay Hidilyn Inc. until they are sold to the final

customers. Any unsold products, excluding those that are lost or damaged, can be returned to Hidilyn Inc. and the latter has discretion to call products

back or transfer products to another customer.

Hidilyn manufactures the product at a cost of P 5,000 per box of Otap bread and P 100 per pack of sample bread. There is freight collect of P2,000 for the

delivery of 10 boxes of Otap bread to Vanessa but none for the sample bread. The selling price of the Otap product is P 8,000 per box for cash sales and P

10,000 per box for credit sales with term of 2/10 n/30. The retail store is entitled to a 5% commission on cash sales and 10% commission on credit sales

already collected. The retail store has the right to be reimbursed for the freight it incurred for its delivery to final customers. Hidilyn Inc. provides bad debt

expense at an estimate of 8% based on ending receivables.

For the month ended December 31, 2020, Vanessa retail store was able to sell to final customers 3 boxes of Otap bread on cash basis and 5 boxes of Otap

bread on account. There is freight prepaid of P 3,000 for the delivery of boxes of Otep bread to final customers. Also, five packs of sample bread were

consumed by final customers during the tasting period. The customers on account paid to Vanessa three out of five boxes sold on credit within the

discount period but the remainder continued to be unpaid as of December 31, 2020. At December 31, 2020, Vanessa Retail Store made its net remittance

to Hidilyn Inc.

Under PFRS 15, what is Hidilyn's net Income for 2020 in connection with the consignment arraignment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT