on December 1 he purchased insurance for 2 years fro 2400 cash. I put 2400 and its wrong. What am I doing wrong?

on December 1 he purchased insurance for 2 years fro 2400 cash. I put 2400 and its wrong. What am I doing wrong?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 69E: Unearned Revenue Jennifers Landscaping Services signed a $400-per-month contract on November 1,...

Related questions

Question

on December 1 he purchased insurance for 2 years fro 2400 cash. I put 2400 and its wrong. What am I doing wrong?

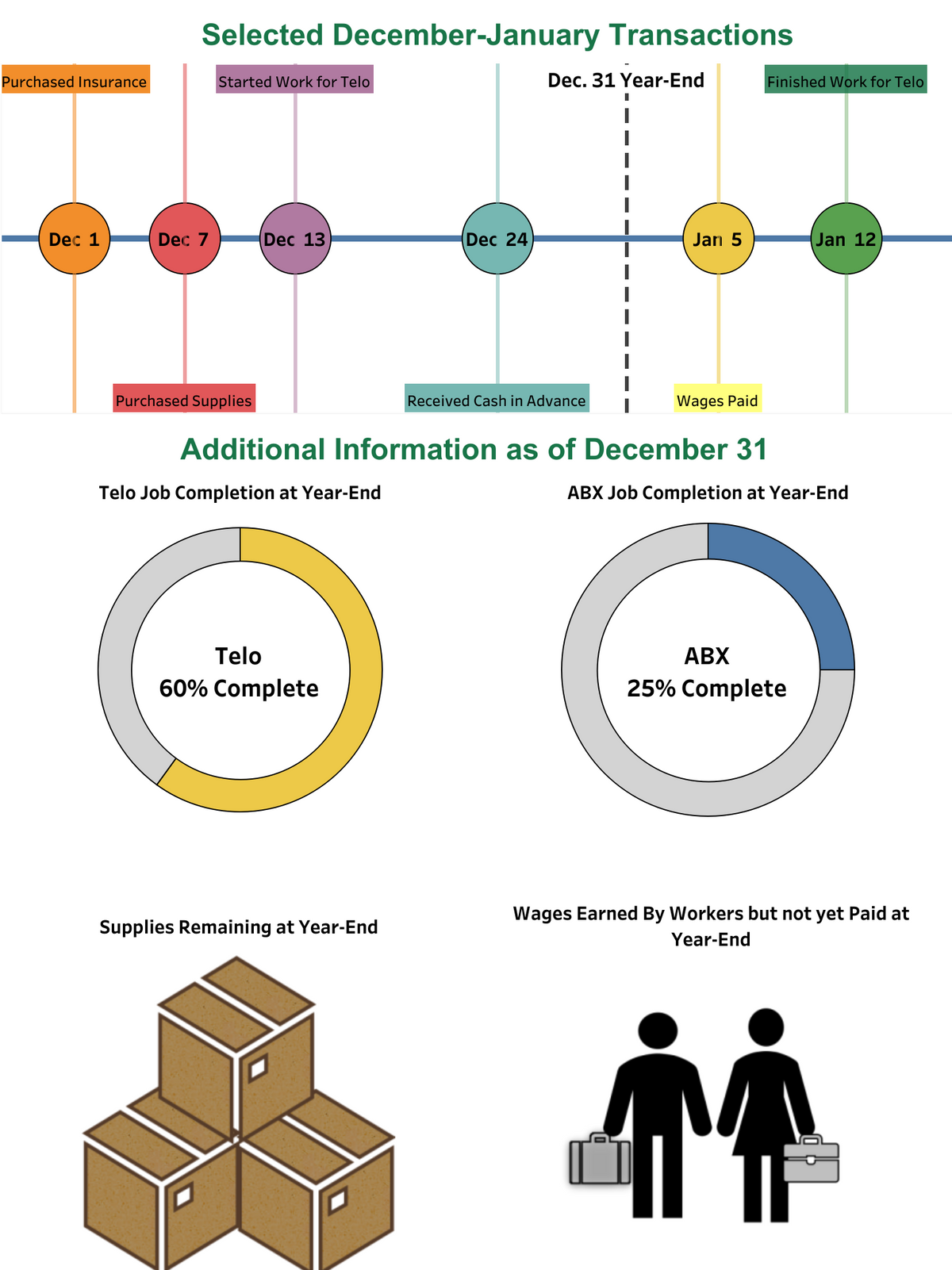

Transcribed Image Text:Selected December-January Transactions

Purchased Insurance

Started Work for Telo

Dec. 31 Year-End

Finished Work for Telo

Dec 1

Dec 7

Dec 13

(Dec 24

Jan 5

Jan 12

Purchased Supplies

Received Cash in Advance

Wages Paid

Additional Information as of December 31

Telo Job Completion at Year-End

ABX Job Completion at Year-End

Telo

ABX

60% Complete

25% Complete

Wages Earned By Workers but not yet Paid at

Supplies Remaining at Year-End

Year-End

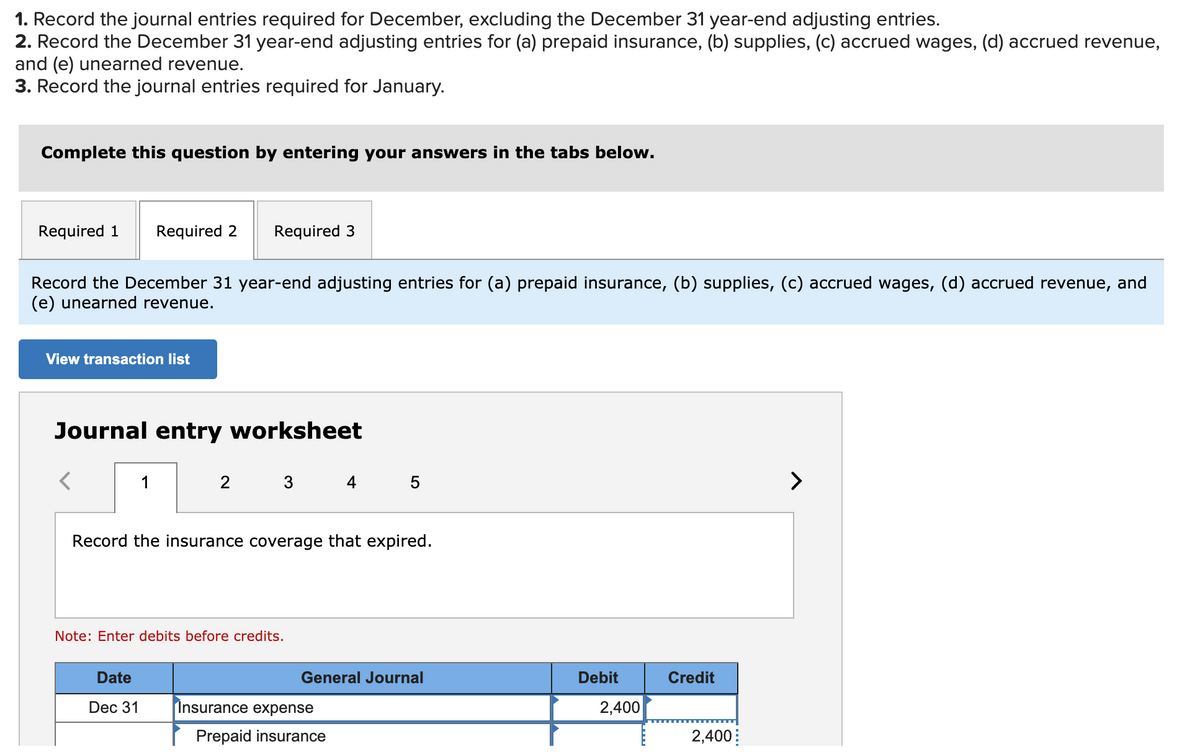

Transcribed Image Text:1. Record the journal entries required for December, excluding the December 31 year-end adjusting entries.

2. Record the December 31 year-end adjusting entries for (a) prepaid insurance, (b) supplies, (c) accrued wages, (d) accrued revenue,

and (e) unearned revenue.

3. Record the journal entries required for January.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Record the December 31 year-end adjusting entries for (a) prepaid insurance, (b) supplies, (c) accrued wages, (d) accrued revenue, and

(e) unearned revenue.

View transaction list

Journal entry worksheet

1

4 5

>

Record the insurance coverage that expired.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Dec 31

Insurance expense

2,400

Prepaid insurance

2,400:

Expert Solution

Step 1

As per the accrual method of accounting, we need to accrue the expenses which incur in a particular accounting period.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning