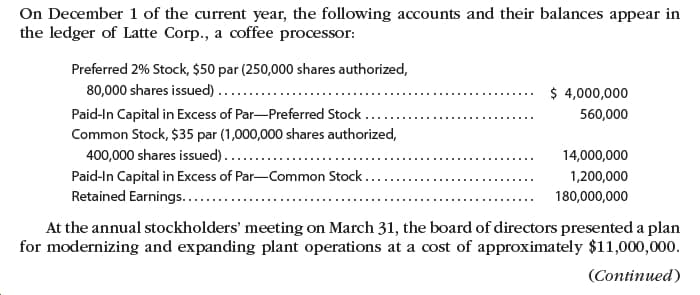

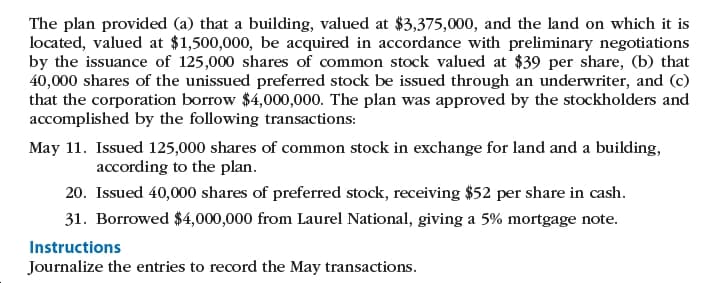

On December 1 of the current year, the following accounts and their balances appear in the ledger of Latte Corp., a coffee processor: Preferred 2% Stock, $50 par (250,000 shares authorized, 80,000 shares issued) .... Paid-In Capital in Excess of Par-Preferred Stock $ 4,000,000 560,000 Common Stock, $35 par (1,000,000 shares authorized, 400,000 shares issued)... 14,000,000 Paid-In Capital in Excess of Par-Common Stock. Retained Earnings..... 1,200,000 180,000,000 At the annual stockholders' meeting on March 31, the board of directors presented a plan for modernizing and expanding plant operations at a cost of approximately $11,000,000. (Continued) The plan provided (a) that a building, valued at $3,375,000, and the land on which it is located, valued at $1,500,000, be acquired in accordance with preliminary negotiations by the issuance of 125,000 shares of common stock valued at $39 per share, (b) that 40,000 shares of the unissued preferred stock be issued through an underwriter, and (c) that the corporation borrow $4,000,000. The plan was approved by the stockholders and accomplished by the following transactions: May 11. Issued 125,000 shares of common stock in exchange for land and a building, according to the plan. 20. Issued 40,000 shares of preferred stock, receiving $52 per share in cash. 31. Borrowed $4,000,000 from Laurel National, giving a 5% mortgage note. Instructions Journalize the entries to record the May transactions.

On December 1 of the current year, the following accounts and their balances appear in the ledger of Latte Corp., a coffee processor: Preferred 2% Stock, $50 par (250,000 shares authorized, 80,000 shares issued) .... Paid-In Capital in Excess of Par-Preferred Stock $ 4,000,000 560,000 Common Stock, $35 par (1,000,000 shares authorized, 400,000 shares issued)... 14,000,000 Paid-In Capital in Excess of Par-Common Stock. Retained Earnings..... 1,200,000 180,000,000 At the annual stockholders' meeting on March 31, the board of directors presented a plan for modernizing and expanding plant operations at a cost of approximately $11,000,000. (Continued) The plan provided (a) that a building, valued at $3,375,000, and the land on which it is located, valued at $1,500,000, be acquired in accordance with preliminary negotiations by the issuance of 125,000 shares of common stock valued at $39 per share, (b) that 40,000 shares of the unissued preferred stock be issued through an underwriter, and (c) that the corporation borrow $4,000,000. The plan was approved by the stockholders and accomplished by the following transactions: May 11. Issued 125,000 shares of common stock in exchange for land and a building, according to the plan. 20. Issued 40,000 shares of preferred stock, receiving $52 per share in cash. 31. Borrowed $4,000,000 from Laurel National, giving a 5% mortgage note. Instructions Journalize the entries to record the May transactions.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 3PA: Selected stock transactions The following selected accounts appear in the ledger of Parks...

Related questions

Question

Transcribed Image Text:On December 1 of the current year, the following accounts and their balances appear in

the ledger of Latte Corp., a coffee processor:

Preferred 2% Stock, $50 par (250,000 shares authorized,

80,000 shares issued) ....

Paid-In Capital in Excess of Par-Preferred Stock

$ 4,000,000

560,000

Common Stock, $35 par (1,000,000 shares authorized,

400,000 shares issued)...

14,000,000

Paid-In Capital in Excess of Par-Common Stock.

Retained Earnings.....

1,200,000

180,000,000

At the annual stockholders' meeting on March 31, the board of directors presented a plan

for modernizing and expanding plant operations at a cost of approximately $11,000,000.

(Continued)

Transcribed Image Text:The plan provided (a) that a building, valued at $3,375,000, and the land on which it is

located, valued at $1,500,000, be acquired in accordance with preliminary negotiations

by the issuance of 125,000 shares of common stock valued at $39 per share, (b) that

40,000 shares of the unissued preferred stock be issued through an underwriter, and (c)

that the corporation borrow $4,000,000. The plan was approved by the stockholders and

accomplished by the following transactions:

May 11. Issued 125,000 shares of common stock in exchange for land and a building,

according to the plan.

20. Issued 40,000 shares of preferred stock, receiving $52 per share in cash.

31. Borrowed $4,000,000 from Laurel National, giving a 5% mortgage note.

Instructions

Journalize the entries to record the May transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College