On December 31, 2020, Naysayer Company has outstanding nurchase commitments for 10,000 gallons at P200 per gallon of raw material to be used in the manufacturing process. Required: Prepare journal entry under each of the following independent assumptions: a. The market price on December 31, 2020 is P210. b. It is expected that the market price will decline to P170 in early January 2021. C. The market price on December 31, 2020 is P170. d. The market price on December 31, 2020 is P170. On January 31, 2021 when the 10,000 gallon shipment is received, the market price is P150. e. The market price on December 31, 2020 is P170. On January 31, 2021 when the 10,000 gallon shipment is ulrot price is P210.

On December 31, 2020, Naysayer Company has outstanding nurchase commitments for 10,000 gallons at P200 per gallon of raw material to be used in the manufacturing process. Required: Prepare journal entry under each of the following independent assumptions: a. The market price on December 31, 2020 is P210. b. It is expected that the market price will decline to P170 in early January 2021. C. The market price on December 31, 2020 is P170. d. The market price on December 31, 2020 is P170. On January 31, 2021 when the 10,000 gallon shipment is received, the market price is P150. e. The market price on December 31, 2020 is P170. On January 31, 2021 when the 10,000 gallon shipment is ulrot price is P210.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 8E

Related questions

Question

Problem 12-2

Transcribed Image Text:purchase commitments for 10,000 gallons at P200 per gallon

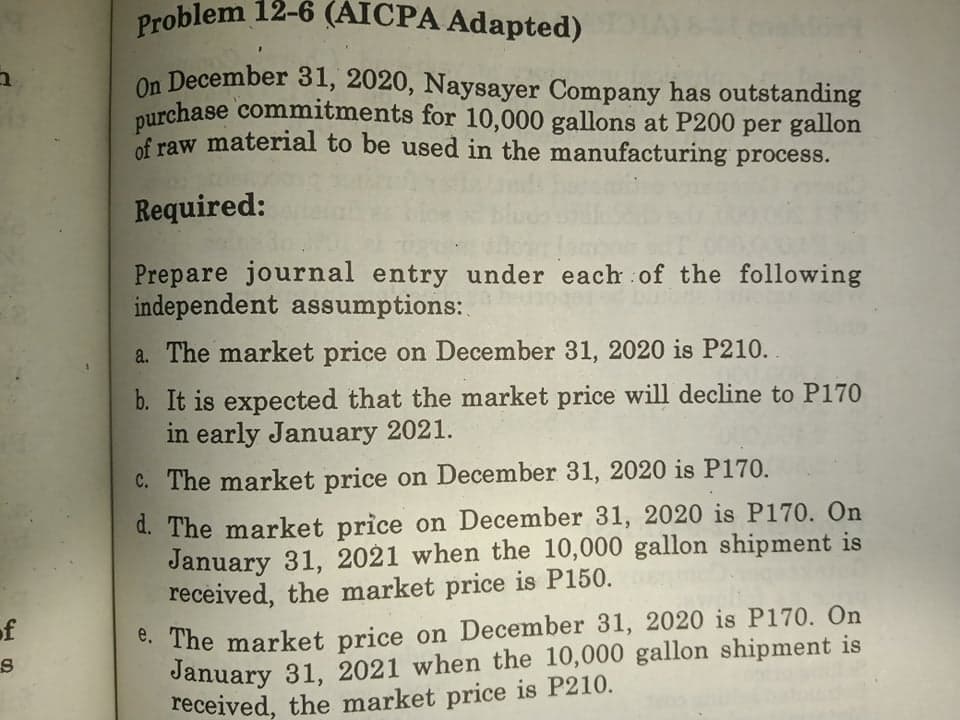

Problem 12-6 (AICPA Adapted)

On December 31, 2020, Naysayer Company has outstanding

f raw material to be used in the manufacturing process.

Required:

Prepare journal entry under each of the following

independent assumptions:

a. The market price on December 31, 2020 is P210.

b. It is expected that the market price will decline to P170

in early January 2021.

C. The market price on December 31, 2020 is P170.

d. The market price on December 31, 2020 is P170. On

January 31, 2021 when the 10,000 gallon shipment is

received, the market price is P150.

e. The market price on December 31, 2020 is P170. On

January 31, 2021 when the 10,000 gallon shipment is

received, the market price is P210.

of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT