On December 31, 2020, the statement of fi ollowing data with profit or loss sharing ra Cash P15,000,000 Dther non-cash asset 40,000,000 Liabilities to others P20,000,000

On December 31, 2020, the statement of fi ollowing data with profit or loss sharing ra Cash P15,000,000 Dther non-cash asset 40,000,000 Liabilities to others P20,000,000

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 39P

Related questions

Question

44

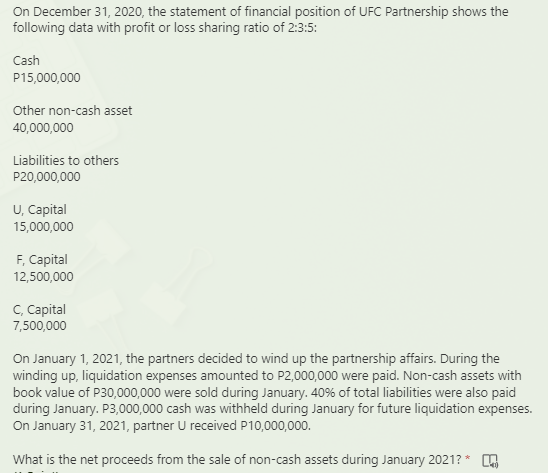

Transcribed Image Text:On December 31, 2020, the statement of financial position of UFC Partnership shows the

following data with profit or loss sharing ratio of 2:3:5:

Cash

P15,000,000

Other non-cash asset

40,000,000

Liabilities to others

P20,000,000

U, Capital

15,000,000

F, Сapital

12,500,000

С. Саpital

7,500,000

On January 1, 2021, the partners decided to wind up the partnership affairs. During the

winding up, liquidation expenses amounted to P2,000,000 were paid. Non-cash assets with

book value of P30,000,000 were sold during January. 40% of total liabilities were also paid

during January. P3,000,000 cash was withheld during January for future liquidation expenses.

On January 31, 2021, partner U received P10,000,000.

What is the net proceeds from the sale of non-cash assets during January 2021? * .

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT