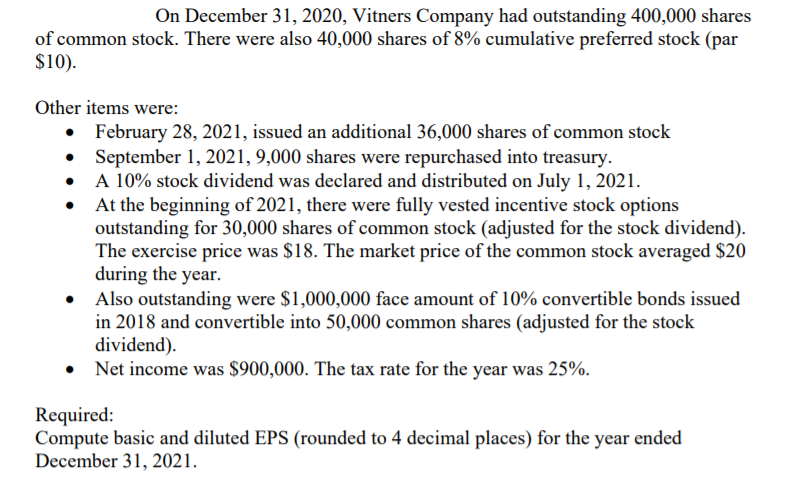

On December 31, 2020, Vitners Company had outstanding 400,000 shares of common stock. There were also 40,000 shares of 8% cumulative preferred stock (par $10). $10). Other items were: • February 28, 2021, issued an additional 36,000 shares of common stock September 1, 2021, 9,000 shares were repurchased into treasury. • A 10% stock dividend was declared and distributed on July 1, 2021. • At the beginning of 2021, there were fully vested incentive stock options outstanding for 30,000 shares of common stock (adjusted for the stock dividend). The exercise price was $18. The market price of the common stock averaged $20 during the year. • Also outstanding were $1,000,000 face amount of 10% convertible bonds issued in 2018 and convertible into 50,000 common shares (adjusted for the stock dividend). • Net income was $900,000. The tax rate for the year was 25%. Required: Compute basic and diluted EPS (rounded to 4 decimal places) for the year ended December 31, 2021.

On December 31, 2020, Vitners Company had outstanding 400,000 shares of common stock. There were also 40,000 shares of 8% cumulative preferred stock (par $10). $10). Other items were: • February 28, 2021, issued an additional 36,000 shares of common stock September 1, 2021, 9,000 shares were repurchased into treasury. • A 10% stock dividend was declared and distributed on July 1, 2021. • At the beginning of 2021, there were fully vested incentive stock options outstanding for 30,000 shares of common stock (adjusted for the stock dividend). The exercise price was $18. The market price of the common stock averaged $20 during the year. • Also outstanding were $1,000,000 face amount of 10% convertible bonds issued in 2018 and convertible into 50,000 common shares (adjusted for the stock dividend). • Net income was $900,000. The tax rate for the year was 25%. Required: Compute basic and diluted EPS (rounded to 4 decimal places) for the year ended December 31, 2021.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 10MC

Related questions

Question

Transcribed Image Text:On December 31, 2020, Vitners Company had outstanding 400,000 shares

of common stock. There were also 40,000 shares of 8% cumulative preferred stock (par

$10).

Other items were:

• February 28, 2021, issued an additional 36,000 shares of common stock

September 1, 2021, 9,000 shares were repurchased into treasury.

• A 10% stock dividend was declared and distributed on July 1, 2021.

At the beginning of 2021, there were fully vested incentive stock options

outstanding for 30,000 shares of common stock (adjusted for the stock dividend).

The exercise price was $18. The market price of the common stock averaged $20

during the year.

Also outstanding were $1,000,000 face amount of 10% convertible bonds issued

in 2018 and convertible into 50,000 common shares (adjusted for the stock

dividend).

• Net income was $900,000. The tax rate for the year was 25%.

Required:

Compute basic and diluted EPS (rounded to 4 decimal places) for the year ended

December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning