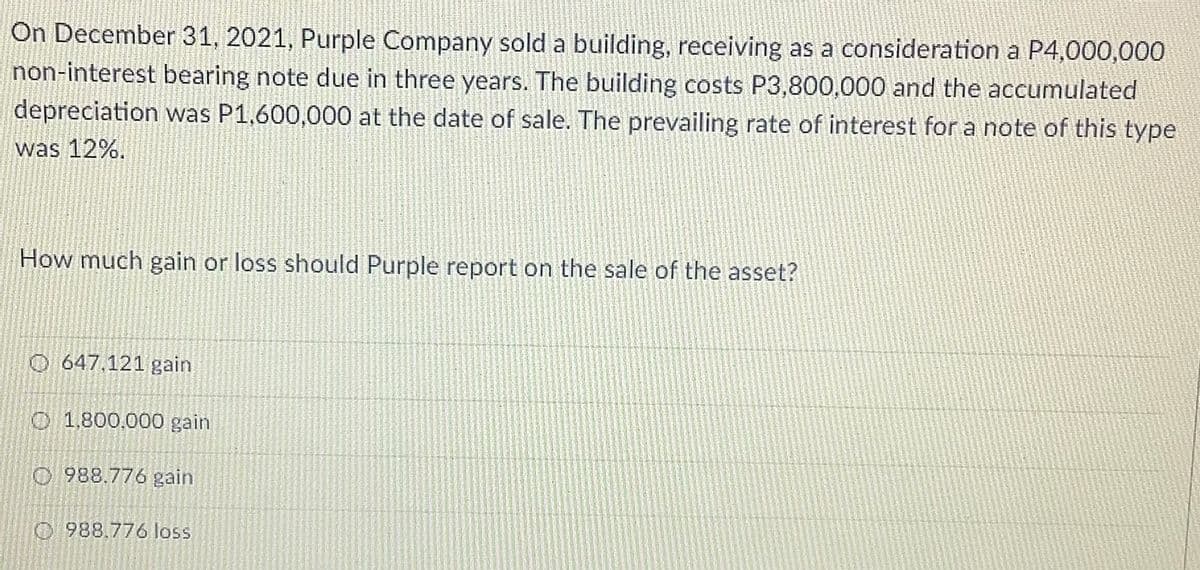

On December 31, 2021, Purple Company sold a building, receiving as a consideration a P4,000,000 non-interest bearing note due in three years. The building costs P3,800,000 and the accumulated depreciation was P1,600,000 at the date of sale. The prevailing rate of interest for a note of this type was 12%. How much gain or loss should Purple report on the sale of the asset?

On December 31, 2021, Purple Company sold a building, receiving as a consideration a P4,000,000 non-interest bearing note due in three years. The building costs P3,800,000 and the accumulated depreciation was P1,600,000 at the date of sale. The prevailing rate of interest for a note of this type was 12%. How much gain or loss should Purple report on the sale of the asset?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 11MCQ

Related questions

Question

Transcribed Image Text:On December 31, 2021, Purple Company sold a building, receiving as a consideration a P4,000,000

non-interest bearing note due in three years. The building costs P3,800,000 and the accumulated

depreciation was P1,600,000 at the date of sale. The prevailing rate of interest for a note of this type

was 12%.

How much gain or loss should Purple report on the sale of the asset?

O 647.121 gain

O 1,800,000 gain

O 988.776 gain

O 988.776 loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT