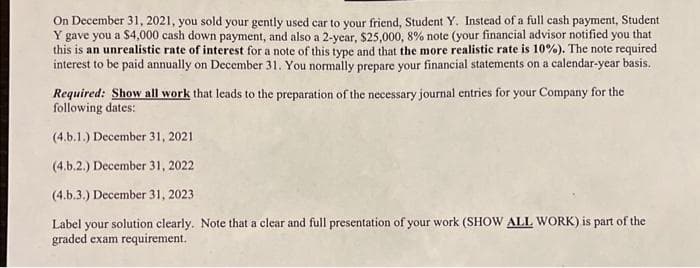

On December 31, 2021, you sold your gently used car to your friend, Student Y. Instead of a full cash payment, Student Y gave you a $4,000 cash down payment, and also a 2-year, $25,000, 8% note (your financial advisor notified you t that this is an unrealistic rate of interest for a note of this type and that the more realistic rate is 10%). The note required interest to be paid annually on December 31. You normally prepare your financial statements on a calendar-year basis. Required: Show all work that leads to the preparation of the necessary journal entries for your Company for the following dates: (4.b.1.) December 31, 2021 (4.b.2.) December 31, 2022 (4.b.3.) December 31, 2023 Label your solution clearly. Note that a clear and full presentation of your work (SHOW ALL WORK) is part of the graded exam requirement.

On December 31, 2021, you sold your gently used car to your friend, Student Y. Instead of a full cash payment, Student Y gave you a $4,000 cash down payment, and also a 2-year, $25,000, 8% note (your financial advisor notified you t that this is an unrealistic rate of interest for a note of this type and that the more realistic rate is 10%). The note required interest to be paid annually on December 31. You normally prepare your financial statements on a calendar-year basis. Required: Show all work that leads to the preparation of the necessary journal entries for your Company for the following dates: (4.b.1.) December 31, 2021 (4.b.2.) December 31, 2022 (4.b.3.) December 31, 2023 Label your solution clearly. Note that a clear and full presentation of your work (SHOW ALL WORK) is part of the graded exam requirement.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 28E: On January 1, 2019, Northfield Corporation becomes delinquent on a 100,000, 14% note to First...

Related questions

Question

100%

please help me

Transcribed Image Text:On December 31, 2021, you sold your gently used car to your friend, Student Y. Instead of a full cash payment, Student

Y gave you a $4,000 cash down payment, and also a 2-year, $25,000, 8% note (your financial advisor notified you that

this is an unrealistic rate of interest for a note of this type and that the more realistic rate is 10%). The note required

interest to be paid annually on December 31. You normally prepare your financial statements on a calendar-year basis.

Required: Show all work that leads to the preparation of the necessary journal entries for your Company for the

following dates:

(4.b.1.) December 31, 2021

(4.b.2.) December 31, 2022

(4.b.3.) December 31, 2023

Label your solution clearly. Note that a clear and full presentation of your work (SHOW ALL WORK) is part of the

graded exam requirement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,