On December 31, 2023, Berclair Incorporated had 340 million shares of common stock and 3 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. On March 1, 2024, Berclair purchased 24 million shares of its common stock as treasury stock. Berclair issued a 5% common stock dividend on July 1, 2024. Four million treasury shares were sold on October 1. Net income for the year ended December 31, 2024, was $400 million. The income tax rate is 25%. Also outstanding at December 31 were incentive stock options granted to key executives on September 13, 2019. The options are exercisable as of September 13, 2023, for 30 million common shares at an exercise price of $56 per share. During 2024, the market price of the common shares averaged $70 per share. In 2020, $50.0 million of 8% bonds, convertible into 6 million common shares, were issued at face value. Required: Compute Berclair’s basic and diluted earnings per share for the year ended December 31, 2024. (Shares for stock options and conversion of convertible securities have been adjusted for any stock split or stock dividend.)

On December 31, 2023, Berclair Incorporated had 340 million shares of common stock and 3 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. On March 1, 2024, Berclair purchased 24 million shares of its common stock as treasury stock. Berclair issued a 5% common stock dividend on July 1, 2024. Four million treasury shares were sold on October 1. Net income for the year ended December 31, 2024, was $400 million. The income tax rate is 25%. Also outstanding at December 31 were incentive stock options granted to key executives on September 13, 2019. The options are exercisable as of September 13, 2023, for 30 million common shares at an exercise price of $56 per share. During 2024, the market price of the common shares averaged $70 per share. In 2020, $50.0 million of 8% bonds, convertible into 6 million common shares, were issued at face value. Required: Compute Berclair’s basic and diluted earnings per share for the year ended December 31, 2024. (Shares for stock options and conversion of convertible securities have been adjusted for any stock split or stock dividend.)

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 23MC: The correct formula for the calculation of earnings per share is ________. A. B. C. D.

Related questions

Question

On December 31, 2023, Berclair Incorporated had 340 million shares of common stock and 3 million shares of 9%, $100 par value cumulative

- On March 1, 2024, Berclair purchased 24 million shares of its common stock as

treasury stock . - Berclair issued a 5% common stock dividend on July 1, 2024.

- Four million treasury shares were sold on October 1.

- Net income for the year ended December 31, 2024, was $400 million.

- The income tax rate is 25%.

- Also outstanding at December 31 were incentive stock options granted to key executives on September 13, 2019.

- The options are exercisable as of September 13, 2023, for 30 million common shares at an exercise price of $56 per share.

- During 2024, the market price of the common shares averaged $70 per share.

- In 2020, $50.0 million of 8% bonds, convertible into 6 million common shares, were issued at face value.

Required:

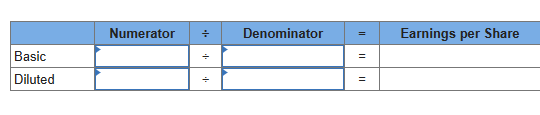

Compute Berclair’s basic and diluted earnings per share for the year ended December 31, 2024. (Shares for stock options and conversion of convertible securities have been adjusted for any stock split or stock dividend.)

Transcribed Image Text:Basic

Diluted

Numerator +

+

Denominator

=

=

=

Earnings per Share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

The computation of the Weighted average number of shares is not 321. And, the computation of diluted outstanding shares is not 351.

Solution

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College