On December 31, 2024, Windsor Corporation signed a 5-year, non-cancelable lease for a machine. The terms of the lease called for Windsor to make annual payments of $9,353 at the beginning of each year, starting December 31, 2024. The machine has an estimated useful life of 6 years and a $4,800 unguaranteed residual value. The machine reverts back to the lessor at the end of the lease term. Windsor uses the straight-line method of depreciation for all of its plant assets. Windsor's incremental borrowing rate is 9%, and the lessor's implicit rate is unknown. (c) Prepare all necessary journal entries for Windsor for this lease through December 31, 2025. (List all debit entries before credit entries. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places e.g. 5,275.) Date 1/24 Your answer is partially correct. 1/24 < Account Titles and Explanation Leased Equipment Lease Liability (To record the lease) Depreciation Expense Accumulated Depreciation-Leased Equipment Debit 36757.23 7351.45 Credit 36757.21 7351.45

On December 31, 2024, Windsor Corporation signed a 5-year, non-cancelable lease for a machine. The terms of the lease called for Windsor to make annual payments of $9,353 at the beginning of each year, starting December 31, 2024. The machine has an estimated useful life of 6 years and a $4,800 unguaranteed residual value. The machine reverts back to the lessor at the end of the lease term. Windsor uses the straight-line method of depreciation for all of its plant assets. Windsor's incremental borrowing rate is 9%, and the lessor's implicit rate is unknown. (c) Prepare all necessary journal entries for Windsor for this lease through December 31, 2025. (List all debit entries before credit entries. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places e.g. 5,275.) Date 1/24 Your answer is partially correct. 1/24 < Account Titles and Explanation Leased Equipment Lease Liability (To record the lease) Depreciation Expense Accumulated Depreciation-Leased Equipment Debit 36757.23 7351.45 Credit 36757.21 7351.45

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 1E: Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a...

Related questions

Question

A 94.

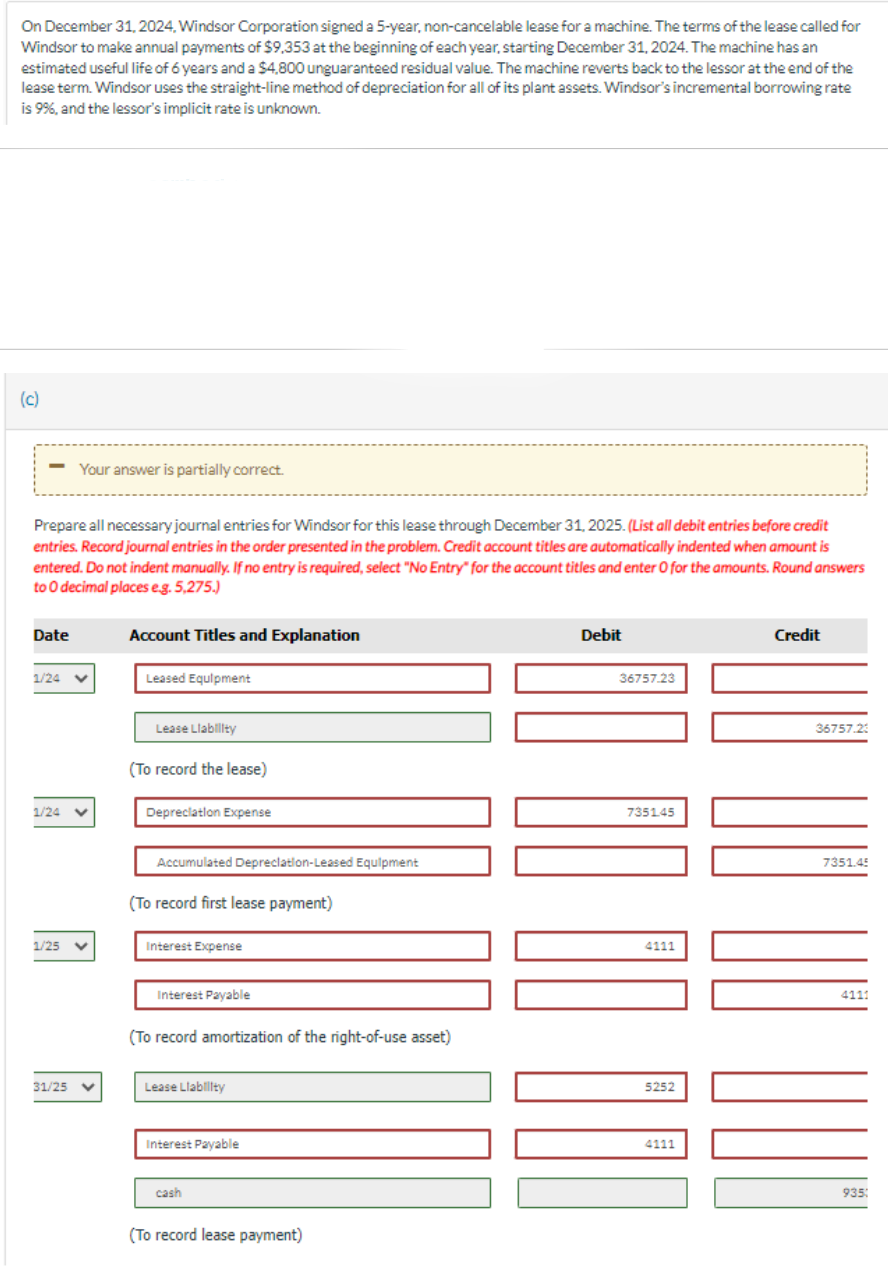

Transcribed Image Text:On December 31, 2024, Windsor Corporation signed a 5-year, non-cancelable lease for a machine. The terms of the lease called for

Windsor to make annual payments of $9,353 at the beginning of each year, starting December 31, 2024. The machine has an

estimated useful life of 6 years and a $4,800 unguaranteed residual value. The machine reverts back to the lessor at the end of the

lease term. Windsor uses the straight-line method of depreciation for all of its plant assets. Windsor's incremental borrowing rate

is 9%, and the lessor's implicit rate is unknown.

(c)

- Your answer is partially correct.

Prepare all necessary journal entries for Windsor for this lease through December 31, 2025. (List all debit entries before credit

entries. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers

to O decimal places e.g. 5,275.)

Date

1/24

1/24

1/25

31/25

Account Titles and Explanation

Leased Equipment

Lease Liability

(To record the lease)

Depreciation Expense

Accumulated Depreciation-Leased Equipment

(To record first lease payment)

Interest Expense

Interest Payable

(To record amortization of the right-of-use asset)

Lease Llability

Interest Payable

cash

(To record lease payment)

Debit

36757.23

7351.45

100 000

4111

5252

4111

Credit

36757.23

7351.45

4111

935:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning