On its December 31, 2020 balance sheet, Calhoun Company appropriately reported a 'debit balance in its Fair Value Adjustment account. There was no change during 2021 in the composition of Calhoun's portfolio of debt investments held as available-for-sale debt securities, The following information pertains to that portfollo Security Y Z Cost $130,000 100,000 175,000 $405.000 Fair value at 12/31/21 $160,000 90,000 125,000 $375,000 The amount of unrealized loss to appear as a component of comprehensive income for the year ending December 31, 2021 is a. $40,000. b. $30,000. c. $20,000. d. $0.

On its December 31, 2020 balance sheet, Calhoun Company appropriately reported a 'debit balance in its Fair Value Adjustment account. There was no change during 2021 in the composition of Calhoun's portfolio of debt investments held as available-for-sale debt securities, The following information pertains to that portfollo Security Y Z Cost $130,000 100,000 175,000 $405.000 Fair value at 12/31/21 $160,000 90,000 125,000 $375,000 The amount of unrealized loss to appear as a component of comprehensive income for the year ending December 31, 2021 is a. $40,000. b. $30,000. c. $20,000. d. $0.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 18E: Trading Securities Pear Investments began operations in 2020 and invests in securities classified as...

Related questions

Question

Transcribed Image Text:KNG 202

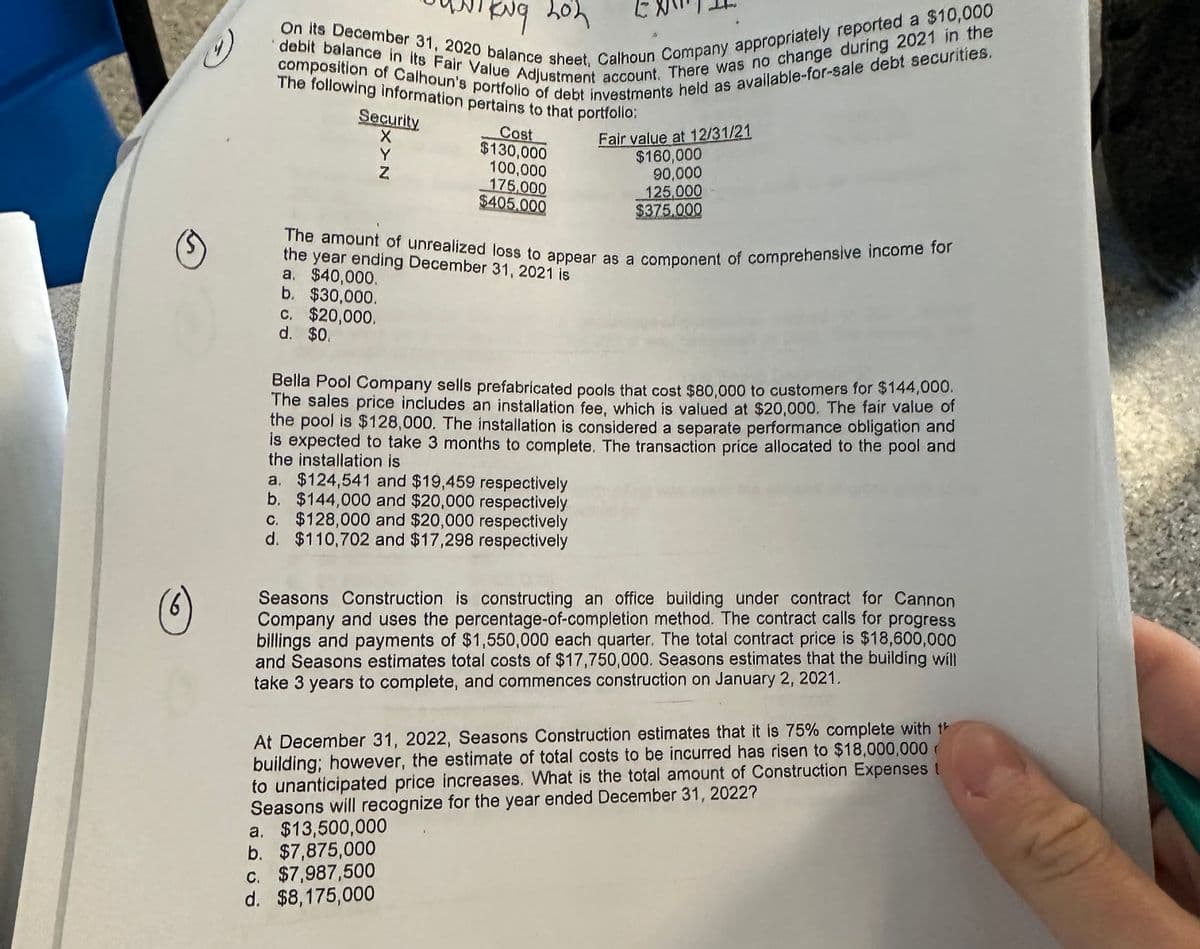

On its December 31, 2020 balance sheet, Calhoun Company appropriately reported a $10,000

composition of Calhoun's portfolio of debt investments held as available-for-sale debt securities.

debit balance in its Fair Value Adjustment account. There was no change during 2021 in the

The following information pertains to that portfollo:

Security

X

Y

N

Cost

$130,000

100,000

175,000

$405.000

Fair value at 12/31/21

$160,000

90,000

125,000

$375,000

The amount of unrealized loss to appear as a component of comprehensive income for

the year ending December 31, 2021 is

a. $40,000.

b. $30,000.

c.

$20,000,

d. $0.

Bella Pool Company sells prefabricated pools that cost $80,000 to customers for $144,000.

The sales price includes an installation fee, which is valued at $20,000. The fair value of

the pool is $128,000. The installation is considered a separate performance obligation and

is expected to take 3 months to complete. The transaction price allocated to the pool and

the installation is

a. $124,541 and $19,459 respectively

b. $144,000 and $20,000 respectively

c. $128,000 and $20,000 respectively

d. $110,702 and $17,298 respectively

Seasons Construction is constructing an office building under contract for Cannon

Company and uses the percentage-of-completion method. The contract calls for progress

billings and payments of $1,550,000 each quarter. The total contract price is $18,600,000

and Seasons estimates total costs of $17,750,000. Seasons estimates that the building will

take 3 years to complete, and commences construction on January 2, 2021.

At December 31, 2022, Seasons Construction estimates that it is 75% complete with th

building; however, the estimate of total costs to be incurred has risen to $18,000,000

to unanticipated price increases. What is the total amount of Construction Expenses

Seasons will recognize for the year ended December 31, 2022?

a. $13,500,000

b. $7,875,000

c. $7,987,500

d. $8,175,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning