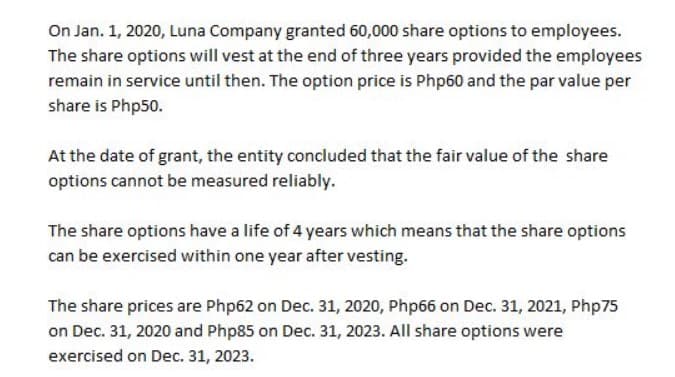

On Jan. 1, 2020, Luna Company granted 60,000 share options to employees. The share options will vest at the end of three years provided the employees remain in service until then. The option price is Php60 and the par value per share is Php50. At the date of grant, the entity concluded that the fair value of the share options cannot be measured reliably. The share options have a life of 4 years which means that the share options can be exercised within one year after vesting. The share prices are Php62 on Dec. 31, 2020, Php66 on Dec. 31, 2021, Php75 on Dec. 31, 2020 and Php85 on Dec. 31, 2023. All share options were exercised on Dec. 31, 2023.

On Jan. 1, 2020, Luna Company granted 60,000 share options to employees. The share options will vest at the end of three years provided the employees remain in service until then. The option price is Php60 and the par value per share is Php50. At the date of grant, the entity concluded that the fair value of the share options cannot be measured reliably. The share options have a life of 4 years which means that the share options can be exercised within one year after vesting. The share prices are Php62 on Dec. 31, 2020, Php66 on Dec. 31, 2021, Php75 on Dec. 31, 2020 and Php85 on Dec. 31, 2023. All share options were exercised on Dec. 31, 2023.

Chapter19: Deferred Compensation

Section: Chapter Questions

Problem 52P

Related questions

Question

*see attached problem

REQUIRED:

What is the compensation expense for 2023?

Transcribed Image Text:On Jan. 1, 2020, Luna Company granted 60,000 share options to employees.

The share options will vest at the end of three years provided the employees

remain in service until then. The option price is Php60 and the par value per

share is Php50.

At the date of grant, the entity concluded that the fair value of the share

options cannot be measured reliably.

The share options have a life of 4 years which means that the share options

can be exercised within one year after vesting.

The share prices are Php62 on Dec. 31, 2020, Php66 on Dec. 31, 2021, Php75

on Dec. 31, 2020 and Php85 on Dec. 31, 2023. All share options were

exercised on Dec. 31, 2023.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning