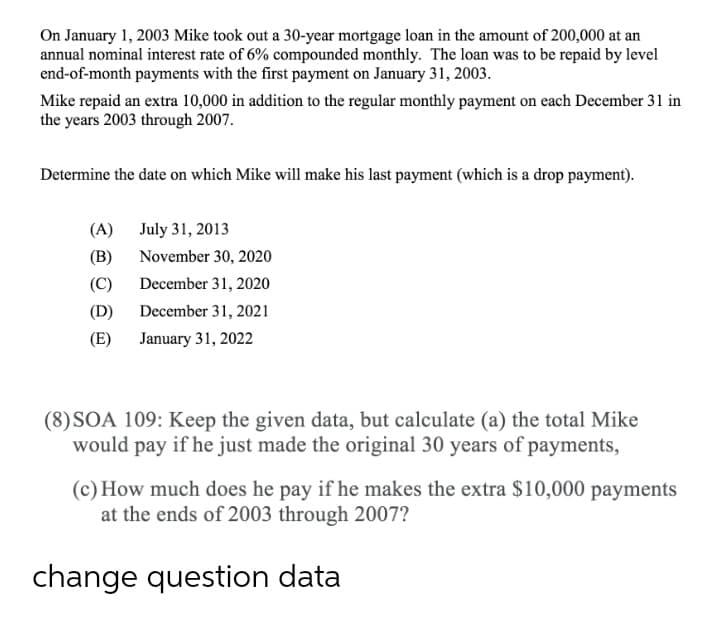

On January 1, 2003 Mike took out a 30-year mortgage loan in the amount of 200,000 at an annual nominal interest rate of 6% compounded monthly. The loan was to be repaid by level end-of-month payments with the first payment on January 31, 2003. Mike repaid an extra 10,000 in addition to the regular monthly payment on each December 31 in the years 2003 through 2007. Determine the date on which Mike will make his last payment (which is a drop payment). (A) July 31, 2013 (B) November 30, 2020 (C) December 31, 2020 (D) December 31, 2021 (E) January 31, 2022 (8)SOA 109: Keep the given data, but calculate (a) the total Mike would pay if he just made the original 30 years of payments, (c) How much does he pay if he makes the extra $10,000 payments at the ends of 2003 through 2007?

On January 1, 2003 Mike took out a 30-year mortgage loan in the amount of 200,000 at an annual nominal interest rate of 6% compounded monthly. The loan was to be repaid by level end-of-month payments with the first payment on January 31, 2003. Mike repaid an extra 10,000 in addition to the regular monthly payment on each December 31 in the years 2003 through 2007. Determine the date on which Mike will make his last payment (which is a drop payment). (A) July 31, 2013 (B) November 30, 2020 (C) December 31, 2020 (D) December 31, 2021 (E) January 31, 2022 (8)SOA 109: Keep the given data, but calculate (a) the total Mike would pay if he just made the original 30 years of payments, (c) How much does he pay if he makes the extra $10,000 payments at the ends of 2003 through 2007?

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:On January 1, 2003 Mike took out a 30-year mortgage loan in the amount of 200,000 at an

annual nominal interest rate of 6% compounded monthly. The loan was to be repaid by level

end-of-month payments with the first payment on January 31, 2003.

Mike repaid an extra 10,000 in addition to the regular monthly payment on each December 31 in

the years 2003 through 2007.

Determine the date on which Mike will make his last payment (which is a drop payment).

(A) July 31, 2013

(B)

November 30, 2020

(C)

December 31, 2020

(D)

December 31, 2021

(E) January 31, 2022

(8)SOA 109: Keep the given data, but calculate (a) the total Mike

would pay if he just made the original 30 years of payments,

(c) How much does he pay if he makes the extra $10,000 payments

at the ends of 2003 through 2007?

change question data

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning