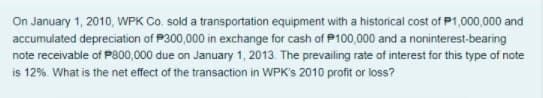

On January 1, 2010, WPK Co. sold a transportation equipment with a historical cost of P1,000,000 and accumulated depreciation of P300,000 in exchange for cash of P100,000 and a noninterest-bearing note receivable of P800,000 due on January 1, 2013. The prevailing rate of interest for this type of note is 12%. What is the net effect of the transaction in WPK's 2010 profit or loss?

Q: There was an explosion at the plant on December 23, 2021 with damages estimated at $1,385,000. The c...

A: As investigated from the given details, the loss appears to have happened due to company's error.

Q: QUESTION THREE MDAR Retailer Trial Balance as at 31 December 2011 Dr. Cr. $ $ Discount ...

A: Income statement is one of the financial statement which shows all incomes and all expenses of the b...

Q: On September 1, 2019, Jordan, Inc. acquired a patent for $600,000. The patent has 16 years remaining...

A: Date Account Titles and Explanation Debit Credit Sep'1 Patent $6,00,000 Cash $6,00,0...

Q: Redlands Inc. sells one product for $5. The variable cost per item is $3, and the fixed costs for th...

A: Hi student Since there are multiple questions, we will answer only first question. Since first quest...

Q: Record adjusting journal entries for each separate case below for year ended December 31. Assume no ...

A: Adjusting Entry – These entries make the cash transaction the accrual one. Adjusting entries do not ...

Q: FIFO and LIFO costs under perpetual inventory system The following units of an item were available ...

A: Total cost = number of units * cost per unit In LIFO method , the last purchase is sold first. So ,...

Q: What is the journal entry Declan's Designs recorded to recognize the declaration of dividends in 202...

A: >Dividends are the payments made to the stockholders for the amount invested by them in form of c...

Q: 2020 2021 Share capital (P100 par value) 5,000,000 5,850,000 Share premium 1,000,000 1,600,000 Retai...

A: The dividend is declared to the shareholders from the retained earnings of the business.

Q: Bulgasal Company provided the following data: 2020 2021 Share capital (P100 par value) 5,000,000 5,8...

A: Retained earnings is the amount of earnings which is accumulated and collected over the period of ti...

Q: In your own words, Explain the accounting cycle. 5 sentences only. No google and plagiarism.

A: Accounting Cycle - Accounting Cycles is the process of recording a transaction through different sta...

Q: On January 1, 20x1, Entity A acquires 25% interest in Entity B for P800,000. Entity B reports profit...

A: The carrying amount, also recognized as the carrying value, is indeed the asset's cost less deprecia...

Q: Casper used the following assets in his Schedule C trade or business in the tax year 2021. Casper is...

A: MACRS Depreciation Modified Accelerated cost recovery system Depreciation which are implemented by t...

Q: Robinson Products Company has two service departments (S1 and S2) and two production departments (P1...

A: Calculation of missing information: S1 total cost allocation to P2 = 100% - 10% - 20% ...

Q: 4,500 per year for 5 years. Mutually Exclusive project LL costs 37,500, and its expected cash flows ...

A: Net present value = (Annual cash inflows x Present value of annuity factor at 14% for 5 years) - Ini...

Q: Computing Taxable Income: Ross Martin arrived at the following tax information… Gross salary: $56,1...

A: 1) Taxable income: Gross income of person is calculated from all resources , thereafter deduction pr...

Q: The generally accepted accounting principle that supports recording the value of a property at the p...

A: Monetary principle says that a business should only record transaction if it is measured in monetary...

Q: a. Calculate the unit cost for each product using the appropriate cost drivers for each product. Not...

A: Solution Note : As per the Q&A guideline we are required to answer the first three subparts only...

Q: An analysis of the cash book and other records of Byle Corporation data:

A: Net credit purchases during the year = Closing accounts payable + Payments on accounts payable durin...

Q: The following items are reported on a company's balance sheet: Cash $550,800 Marketable securities 4...

A: Ratio analysis helps to analyze the financial statements of the company. The management can take dec...

Q: CCC Corp. has annual turnovers of inventory, receivables, and payables of 12, 18, 8 respectively. In...

A: Difference in cash conversion cycle = cash conversion cycle of CCC Corporation - Cash conversion cyc...

Q: Arrangement of the Statement of Earnings Kim Renovation Inc. renovates historical buildings for com...

A: Under single-step statement of earnings all revenues are grouped together and all expenses are toget...

Q: Pranks, Inc. is a manufacturer of joke and novelty products for perpetrators of practical jokes. The...

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for yo...

Q: Incorrect answer icon Your answer is incorrect. Martinez Corporation entered into a finance lease to...

A: GIVEN calculation of value of right- of use asset value of lease liability = $72,735 Commission...

Q: Seoli owned a 20% royalty interest in an oil well. Seoli received royalty payments on January 31 fo...

A: Royalty revenue is reported in the income statement of the company and the expenses would be deducte...

Q: Required information [The following information applies to the questions displayed below.] The follo...

A: Closing entries: All revenues are closed by crediting the income summary account and expenses are cl...

Q: Explain briefly : 1. Chartered Certified Accountant (ACCA) designation. 2. Certified Financial Plann...

A: 1. Chartered Certified Accountant designation (ACCA) is a designation awarded by the Association of ...

Q: A debit is not the normal balance for which of the following? O a) Asset account b) Dividends accoun...

A: Normal debit balance include assets expenses and losses Nature of Account Normal Balance In...

Q: ACCOUNTING CYCLE: Complete the illustration Problem: On January 1 of the current year Josef Cacdac o...

A: Date Particulars Amount Jan-01 Cash a/c Dr 8000 To Capital 8000 Ja...

Q: Perpetual inventory using FIFO The following units of a particular item were available for sale d...

A: FIFO is first in first out method of inventory valuation or costing, under which inventory which is ...

Q: y created a standard cost system to help control costs and has established the following standards f...

A: Material price variance = (Standard price - Actual price)*Actual quantity purchased Material quantit...

Q: Which of the following activities in not an element of a CPA firm's quality control system to be con...

A: The effectiveness of a company's quality control system is primarily reliant on its employees' abili...

Q: 5. Thad Morgan, a motorcycle enthusiast, has been exploring the possibility of relaunching the Weste...

A: Given sale units = 500 Sale price = $19,000 per unit Variable cost = $15,200 per unit Contribution m...

Q: Which of the following relationships held by your spousal equivalent may impact your independence? S...

A: Introduction:- Employment connections are contractual in nature and consist of an agreement between ...

Q: November 2 Purchase 100 units of inventory on account from Toad Inc. for $100 per unit, terms 3/10, ...

A: LIFO approach is used in to answer this question because sales made on November 16 only includes uni...

Q: 2. ABC Corporation issued P1,000,000 in 8% bonds, maturing in ten years and paying interest semi-ann...

A: Solution Concept When the coupon rate of bond = market rate of interest , bond is called a par valu...

Q: Lloyd’s Auto Specialist Ltd. journal entry for August 2021 Date Details DR CR 1-Aug Cash 150,000 ...

A: An income statement is a financial report that indicates the revenue and expenses of a business. It ...

Q: Preparation of Closing Entries and a Statement of Earnings Clayoquot Boat Repair Ltd. has entered a...

A: A journal entry is a form of accounting entry that is used to report a business transaction in a com...

Q: Declan's Designs Balance Sheet Declan's Designs Income Statement ASSETS 12/31/2021 12/31/2022 For th...

A: Accumulated Depreciation Debit Credit Particulars Amount (In $) Particulars Amount (In $) ...

Q: The following must be eliminated in the consolidation process except

A: Consolidation process means the merging of financial statements of parent and subsidiary entities an...

Q: Required information Problem 6-9B Record transactions and prepare a partial income statement using a...

A: Solution Concept Journal entry is a book where the business transactions are recorded It is recorde...

Q: What is Declan's Designs' 2022 total "Common Stock Issuance" to be reported on its Statement of Cash...

A: The cash flow statement is prepared to record the cash flow from various activities during the inclu...

Q: On October 1, Goodwell Company rented warehouse space to a tenant for $1,600 per month and received ...

A: Adjusting Entry – Adjusting entries do not include cash. This also ensures that the transactions inc...

Q: O E1-23 Groovy Limited is a recording studio used by musicians to record music. It began 2020 with $...

A: Cash Flow Statement - Under Cash Flow, there are three types of activities involved - Operating Acti...

Q: LeBron James (LBJ) Corporation agrees on January 1, 2020, to lease equipment from Cullumber, Inc. fo...

A: Lease is an agreement or arrangement between two parties, in which one party provides its asset for ...

Q: he company had a profit of 450,000. 4. Assuming that we have partners A and B which agree for a 80 %...

A: A capitalist partner is someone who contributes capital in a partnership firm bur generally is not i...

Q: Requires that 25% of the authorized shares be paid up.

A: The Philippines has earlier the corporation law and that amended with the Revised Corporation Code o...

Q: uds are sold in cases, with each case containing a pair of earbuds. SOUND CORE began the last quart...

A: The journal entries of the perpetual and periodic inventory system are as follows:

Q: In 2020, Mr. Marangley, a dealer of car, disposed a brand new sports utility vehicle (SUV) which cos...

A: Monthly installments to be paid for 7 month P50,000 * 7 P350,000 Immediate down payment P100,000 Sa...

Q: Required information Problem 6-9B Record transactions and prepare a partial income statement using a...

A: The multi-step Income Statement is a detailed vertical format income statement in which we can have ...

Q: Under the cash basis of accounting, revenue is recorded When earned When realized ...

A: Accrual basis: Under accrual basis accounting, revenue and expenses are recognized when they are inc...

Step by step

Solved in 3 steps

- On January 1, 2019, Park Company accepted a 36,000, non-interest-bearing, 3-year note from a major customer in exchange for used equipment. The equipment had originally cost Park 200,000 and had a book value of 20,000 on the date of the sale. At the 12% imputed interest rate for this type of loan, the present value of the note is 25,500 on January 1, 2019. Park uses the effective interest rate. What is the carrying value of the note receivable on Parks December 31, 2019, balance sheet? a. 28,560 b. 29,000 c. 32,500 d. 36,000On July 1, 2019, Aldrich Company purchased as an available-for-sale security 200,000 face value, 9% U.S. Treasury notes for 194,000. The notes mature July 1, 2020, and pay interest semiannually on January 1 and July 1. The notes were sold on December 1, 2019, for 199,000. Aldrich normally uses straight-line amortization on all of its notes. In its income statement for the year ended December 31, 2019, what amount should Aldrich report as a gain on the sale of the available-for-sale security? a. 2,500 b. 3,500 c. 5,000 d. 6,000On January 1, Kilgore Inc. accepts a 20,000 non-interest-bearing, 5-year note from Dieland Company for equipment. Neither the fair value of the note nor the equipment is determinable. Kilgore had originally purchased the equipment for 18,000, and the equipment has a book value of 14,000 on January 1. Kilgore knows Dielands incremental borrowing rate of 9%. Prepare the journal entry for Kilgore to record the sale of the equipment on January 1.

- On January 01, 2022, Legit Company sold equipment costing P10,000,000 with accumulated depreciation of P5,500,000 in exchange for a P6,000,000 noninterest bearing note due in equal annual installments of P2,000,000 every December 31, 2022. There was no established exchange price for the equipment and the note had no ready market. The prevailing rate of interest for a note of this type at January 01, 2022 was 10%. What is the carrying amount of the note on December 31, 2022?On January 01, 2022, TGIF Company sold equipment costing P10,000,000 with accumulated depreciation of P5,500,000 in exchange for a P6,000,000 noninterest bearing note due in equal annual installments of P2,000,000 every December 31, 2022. There was no established exchange price for the equipment and the note had no ready market. The prevailing rate of interest for a note of this type at January 01, 2022 was 10%. What is the carrying amount of the note on December 31, 2022? (Round off the present value factors to 4 decimal places)On January 01, 2022, TGIF Company sold equipment costing 10,000,000 with accumulated depreciation of 5,500,000 in exchange for a 6,000,000 noninterest-bearing note due in equal annual installments of 2,000,000 every December 31, 2022. There was no established exchange price for the equipment and the note had no ready market. The prevailing rate of interest for a note of this type on January 01, 2022, was 10%. What is the carrying amount of the note on December 31, 2022?

- On January 1, 2021, ABC Co. sold a transportation equipment with a historical cost of ₱1,000,000 and accumulated depreciation of ₱300,000 in exchange for cash of ₱100,000 and a noninterest-bearing note receivable of ₱800,000 due on January 1, 2025. The prevailing rate of interest for this type of note is 12%. How much is the gain / (loss) on sale? How much is the unamortized interest on December 31, 2023?On January 1, 2017, Emme Company sold equipment with a carrying amount of P4,800,000 in exchange for a P6,000,000 noninterest bearing note due January 1, 2020. There was no established exchange price for the equipment.The prevailing rate of interest for a note of this type on January 1, 2017 was 10%. The present value of 1 at 10% for three periods is 0.75.What amount should be reported as gain or loss on sale of equipment?On January 01, 2021, Scottie Boo sold equipment costing P10,000,000 with accumulated depreciation of P5,500,000 in exchange for a P6,000,000 noninterest bearing note due in equal annual installments of P2,000,000 every December 31, 2021. There was no established exchange price for the equipment and the note had no ready market. The prevailing rate of interest for a note of this type at January 01, 2021 was 10%. What is the carrying amount of the note on December 31, 2021? (Round off the present value factors to 4 decimal places)

- Danica Corporation sold one of its buildings on January 1, 2007 for P20,000,000. Danica received a cash down payment of P5,000,000 and a 5-year, 10% note for the balance of P15,000,000. The note is payable in equal annual payments of principal and interest of P3,957,000 payable on December 31 of each year until the year 2011. What amount is to be reported as current notes receivable on December 31, 2008? A. 2,457,000 B. 2,702,700 C. 2,972,970 D. 3,000,000On January 01, 2021, The Company sold equipment costing P760,000 with accumulated depreciation of P320,000 on the date of sale. Company received as consideration for the sale, a P800,000 noninterest-bearing note due January 1, 2025. There was no established exchange price for the equipment and the note had no ready market. The prevailing rate of interest for a note of this type on January 01, 2021 was 5%. Using two decimal places for the present value (PV) factor, what is the note’s carrying amount on December 31, 2021?On January 01, 2021, VKS Company sold equipment costing P760,000 with accumulated depreciation of P320,000 on the date of sale. CPA received as consideration for the sale, a P800,000 noninterest-bearing note due January 1, 2025. There was no established exchange price for the equipment and the note had no ready market. The prevailing rate of interest for a note of this type on January 01, 2021 was 5%. Using two decimal places for the present value (PV) factor, what is the note’s carrying amount on December 31, 2021?