On January 1, 2011, Vallo, Tyler and Syria formed a joint operation for the sale of certain merchandise. Syria is to manage the joint operation. Vallo was to provide funds and Tyler was to supply merchandise to be sold by Syria. They agreed to divide profits and losses equally. The joint operation transactions from January to February are as follows: Jan 1: Tyler sent merchandise to Syria valued at P12,000. Freight of P500 paid by Syria. Vallo sent Syria, P10,000 cash. Syria purchased additional merchandise for cash worth P9,500. Syria sold merchandise on account for P16,000. Collection of account, P15,000. Syria sold merchandise for cash, P9,000. The joint operation was terminated and settlements to participants were made. Syria agreed to take the unsold merchandise at P3,000 and is to be charged for the uncollected accounts at face value. 7: 26: 31: Feb 20: 27: 28: How much would Syria receive (pay) during cash settlement?

On January 1, 2011, Vallo, Tyler and Syria formed a joint operation for the sale of certain merchandise. Syria is to manage the joint operation. Vallo was to provide funds and Tyler was to supply merchandise to be sold by Syria. They agreed to divide profits and losses equally. The joint operation transactions from January to February are as follows: Jan 1: Tyler sent merchandise to Syria valued at P12,000. Freight of P500 paid by Syria. Vallo sent Syria, P10,000 cash. Syria purchased additional merchandise for cash worth P9,500. Syria sold merchandise on account for P16,000. Collection of account, P15,000. Syria sold merchandise for cash, P9,000. The joint operation was terminated and settlements to participants were made. Syria agreed to take the unsold merchandise at P3,000 and is to be charged for the uncollected accounts at face value. 7: 26: 31: Feb 20: 27: 28: How much would Syria receive (pay) during cash settlement?

Chapter9: Taxation Of International Transactions

Section: Chapter Questions

Problem 27P

Related questions

Question

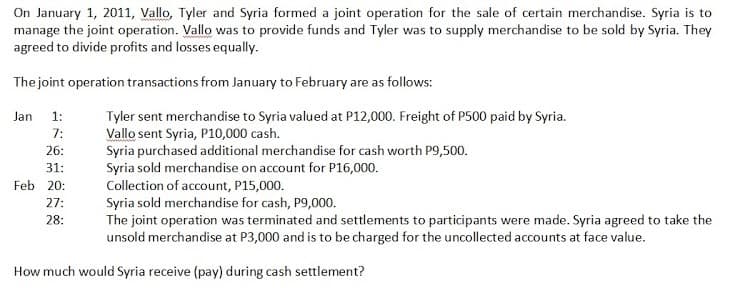

Transcribed Image Text:On January 1, 2011, Vallo, Tyler and Syria formed a joint operation for the sale of certain merchandise. Syria is to

manage the joint operation. Vallo was to provide funds and Tyler was to supply merchandise to be sold by Syria. They

agreed to divide profits and losses equally.

The joint operation transactions from January to February are as follows:

Jan

Tyler sent merchandise to Syria valued at P12,000. Freight of P500 paid by Syria.

Vallo sent Syria, P10,000 cash.

Syria purchased additional merchandise for cash worth P9,500.

Syria sold merchandise on account for P16,000.

Collection of account, P15,000.

Syria sold merchandise for cash, P9,000.

The joint operation was terminated and settlements to participants were made. Syria agreed to take the

unsold merchandise at P3,000 and is to be charged for the uncollected accounts at face value.

1:

7:

26:

31:

Feb 20:

27:

28:

How much would Syria receive (pay) during cash settlement?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning