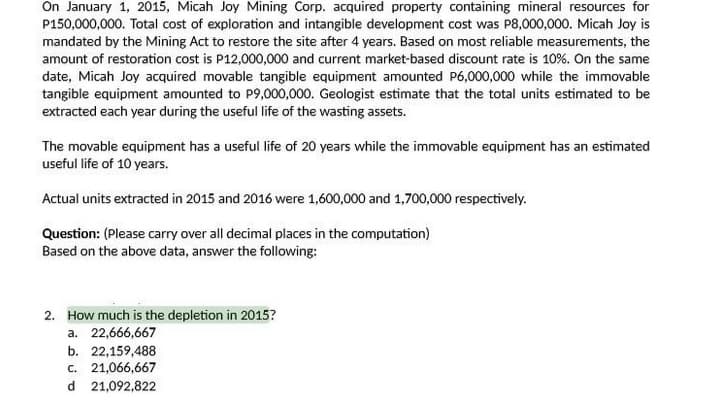

On January 1, 2015, Micah Joy Mining Corp. acquired property containing mineral resources for P150,000,000. Total cost of exploration and intangible development cost was P8,000,000. Micah Joy is mandated by the Mining Act to restore the site after 4 years. Based on most reliable measurements, the amount of restoration cost is P12,000,000 and current market-based discount rate is 10%. On the same date, Micah Joy acquired movable tangible equipment amounted P6,000,000 while the immovable tangible equipment amounted to P9,000,000. Geologist estimate that the total units estimated to be extracted each year during the useful life of the wasting assets. The movable equipment has a useful life of 20 years while the immovable equipment has an estimated useful life of 10 years. Actual units extracted in 2015 and 2016 were 1,600,000 and 1,700,000 respectively. Question: (Please carry over all decimal places in the computation) Based on the above data, answer the following: 2. How much is the depletion in 2015?

On January 1, 2015, Micah Joy Mining Corp. acquired property containing mineral resources for P150,000,000. Total cost of exploration and intangible development cost was P8,000,000. Micah Joy is mandated by the Mining Act to restore the site after 4 years. Based on most reliable measurements, the amount of restoration cost is P12,000,000 and current market-based discount rate is 10%. On the same date, Micah Joy acquired movable tangible equipment amounted P6,000,000 while the immovable tangible equipment amounted to P9,000,000. Geologist estimate that the total units estimated to be extracted each year during the useful life of the wasting assets. The movable equipment has a useful life of 20 years while the immovable equipment has an estimated useful life of 10 years. Actual units extracted in 2015 and 2016 were 1,600,000 and 1,700,000 respectively. Question: (Please carry over all decimal places in the computation) Based on the above data, answer the following: 2. How much is the depletion in 2015?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 6RE

Related questions

Question

Transcribed Image Text:On January 1, 2015, Micah Joy Mining Corp. acquired property containing mineral resources for

P150,000,000. Total cost of exploration and intangible development cost was P8,000,000. Micah Joy is

mandated by the Mining Act to restore the site after 4 years. Based on most reliable measurements, the

amount of restoration cost is P12,000,000 and current market-based discount rate is 10%. On the same

date, Micah Joy acquired movable tangible equipment amounted P6,000,000 while the immovable

tangible equipment amounted to P9,000,000. Geologist estimate that the total units estimated to be

extracted each year during the useful life of the wasting assets.

The movable equipment has a useful life of 20 years while the immovable equipment has an estimated

useful life of 10 years.

Actual units extracted in 2015 and 2016 were 1,600,000 and 1,700,000 respectively.

Question: (Please carry over all decimal places in the computation)

Based on the above data, answer the following:

2. How much is the depletion in 2015?

a. 22,666,667

b. 22,159,488

c. 21,066,667

d 21,092,822

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College